Table Of Contents

Definition of Repurchase Agreement (Repo)

A repurchase agreement is also known as RP or repo is a type of a short-term borrowing which is generally used by individuals who deal in government securities and such an agreement can happen between multiple numbers of parties and it can be classified into three types- specialized delivery repo, held-in-custody repo, and third-party repo.

Key Takeaways

- A repurchase agreement, also known as a repo, is a short-term borrowing arrangement where one party sells securities to another party with an agreement to repurchase them at a specified future date and price.

- Repurchase agreements are commonly used in the financial markets to provide short-term liquidity and facilitate borrowing/lending of cash against securities as collateral.

- The party selling the securities (the borrower) receives cash and transfers the legal ownership of the securities to the other party (the lender) for the duration of the agreement.

- Repurchase agreements are typically structured as collateralized loans, where the securities serve as collateral to mitigate the lender's risk.

Explanation

The maturity for a repurchase agreement can be from overnight to a year. Repurchase agreements with longer maturity are commonly referred to as “open” repos; these types of repos usually do not have a set maturity date. The agreements with a specified short maturity are referred to as “term” repos.

The dealer sells securities to investors on an overnight basis, and the securities are bought back on the following day. The transaction allows the dealer to raise short term capital. It is a short term money market instrument in which two parties agree to buy or sell a security at a future date. It is essentially a forward contract. A forward contract is an agreement to transact in the future at a pre-agreed price.

It is simple terms, is a loan that is collateralized by underlying security, which has a value in the market. The buyer of a repurchase agreement is the lender, and the seller of the repurchase agreement is the borrower. The seller of the repurchase agreement needs to pay interest at the time of buying back the securities, which are called the Repo Rate.

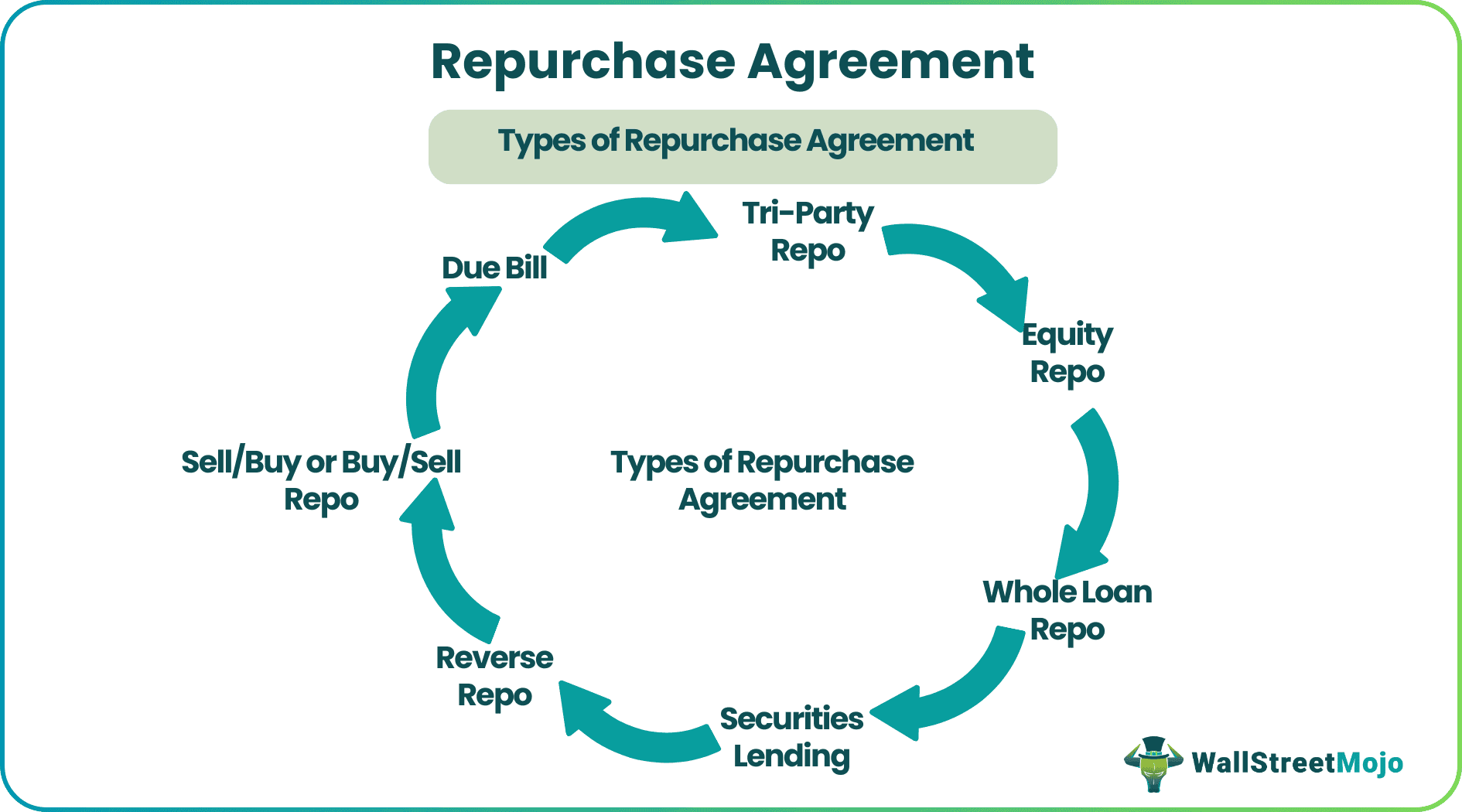

Types of Repurchase Agreement

Let us discuss each type of repurchase agreement in detail –

#1 - Tri-Party Repo

This type of repurchase agreement is the most common agreement in the market. A third party acts as an intermediary between the lender and the borrower. The collateral is handed over to the third party, and the third party will give substitution collateral. An example would be of a borrower handing over a certain amount of stock for which the lender can take bonds of equal value as collateral.

#2 - Equity Repo

As the name suggests, equity is the collateral in this type of repurchase agreements. A company’s stock will be the underlying security or collateral for the transaction. Such a transaction is also considered to be risky since the value of the stocks may fall if the company does not perform as expected.

#3 - Whole Loan Repo

A whole loan repo is a repurchase agreement in which a loan or a debt obligation is the collateral instead of a security.

#4 - Sell/Buy or Buy/Sell Repo

In a Sell/Buy repurchase agreement, the securities are sold and bought on a forward repurchase simultaneously. Buy/sell functions reverse of this; the security is bought and sold on a repurchase simultaneously. The difference in a Sell/Buy or Buy/Sell Repo from a traditional repurchase agreement is that it is transacted in the market.

#5 - Reverse Repo

A reverse repo is a transaction for the lender of a repurchase agreement. The lender buys the security from the borrower at a price with an agreement to sell it at a higher price at a pre-agreed future date.

#6 - Securities Lending

This type of repurchase agreement is entered into when an investor goes short on security. To complete the transaction, the investor would need to borrow the security. Once the transaction is complete, he will hand over the security to the lender.

#7 - Due Bill

A due bill repurchase agreement has an internal account in which the collateral for the lender is kept in. Typically, the borrower hands over possession of the collateral to the lender but in this case, it is placed in another bank account. This bank account is in the name of the borrower for the period of the agreement. This is not a common arrangement as it is a risky affair for the lender as they do not control the collateral.

Repurchase Agreement Example

You need $10,000 urgently, and your friend James has the surplus is his bank account. He is a good friend but would want a guarantee to make the payment to you. He sees your watch, which is a rare vintage watch given to you by your grandfather, which is valued at over $30,000; James asks for the watch as the collateral.

You agree to give him the watch and take back the watch from him after 6 months once you pay $10,000 plus the interest of say, $3,000. He transfers the amount into your account, and you give him the watch along with the bill. If you fail to pay the amount on the future date, you might lose the watch if not the friendship!!

This is a simple repurchase agreement. The interest of $3,000 is the repo rate for this transaction.

Pros

- A repo is a secured loan.

- They are safe investments because the underlying security has a value in the market, which serves as collateral for the transaction.

- The underlying security is being sold as collateral; hence it serves the purpose for both the lender and the borrower.

- If the borrower defaults to repay, the lender can sell the security.

- It is secured funding for the lender and easy liquidity for the borrower.

Cons

- Repos are subject to counterparty risk even though the collateral provides the protection.

- In the case of a counterparty default, the loss is uncertain. It can be determined only after the proceeds generated after the sale of the underlying security, along with its accrued interest, falls below the amount specified in the repurchase agreement.

- If the counterparty becomes bankrupt or insolvent, the lender may suffer a loss of principal and interest.

Conclusion

- In a repurchase agreement, the possession is temporarily transferred to the lender, whereas the ownership still remains with the borrower.

- They are short term transactions that facilitate short term capital.

- In most cases, the underlying security is the U.S Treasury Bonds.

- They are forward contracts entered into by parties that mutually agree to buy and sell a security at a future date.