Table Of Contents

Rent To Own Home Meaning

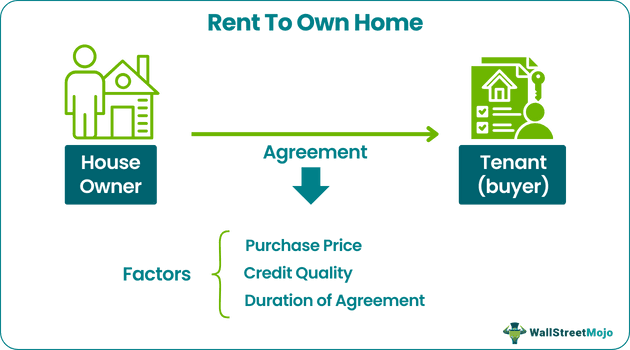

A rent-to-own home is an arrangement, through the form of an agreement, where the tenant has the option of buying the property, dwelling in this case, upon the expiration of the rental or lease agreement following which the home becomes tenant's property subject to clauses in the contract.

It is a common way by which the buyer can approach to purchase the house. Other names like lease-to-own or lease options are common. A lease agreement binds the buyer with the renting payments, while the option agreement offers the privilege to buy the house at his will. Both contracts may vary subject to the needs of the involved parties.

Key Takeaways

- A rent-to-own home agreement allows the tenant the option to purchase the property at the end of the rental or lease agreement, effectively transitioning from a tenant to a homeowner.

- This arrangement is also referred to as rent-to-buy or rent-to-purchase. Unlike a typical rental agreement where renting is the sole purpose, a rent-to-own agreement allows the tenant to buy the rental home after the agreement's expiration.

- Rent-to-own arrangements have existed for several decades, originating in the United Kingdom and later adopted in the United States.

How Does It Work?

Rent-to-own is also known as the rent-to-buy or rent-to-purchase option. In a typical rental agreement, the right to rent expires upon the termination of the contract. In the case of a rent-to-own agreement, the tenor extends to the tenant the option of buying the rental home after the agreement's expiration. It should be noted that such schemes may vary depending upon the type of agreement and the clauses involved.

This rent to own home programs of property ownership is as old as 70 years to 80 years, beginning first in the United Kingdom, followed by the United States.

The tenant has to pay rent to the owner. The agreement has the price and the timeframe written in the contract. A part of the rent is kept aside that will be used for downpayment of the loan. The tenant may sometimes need to pay a non-refundable option fee to buy the property later on.

The rent credit, which is gain a part of the rent, is kept aside also helps in reducing the buy price of the house. Later on the tenant may or may not buy the property. If they do not buy, then they have to forfeit the option fee and the rent credit.

The rent to own home contract is a mutual agreement between the tenant and the landlord. Thus, variables like purchase price and rents and agreements like leasing and owner-financing are subject to mutual understanding. However, such deals can fall apart if the creditworthiness and legal aspects are not fulfilled.

It is always advisable to take the help of a real estate expert who will be able to guide regarding the terms of the agreement.

Factors

The rent to own home programs comes with legal agreements of different sorts. However, there are two main agreements: lease and option agreement. The contract is between the house owner and the tenant (the buyer). The following are some of the factors that one can incorporate in the deed of the agreement: -

- Purchase price: This is the price for which the buyer is ready to purchase the house.

- Credit quality: Since the agreement is between two parties, the quality of credit can be important because of the features like down payment, rent credit, and rent payments

- Duration of agreement: The time for which the rent-to-own agreement stands legal. If the buyer fails to make payments, as prescribed in the agreement, the owner can claim termination. The buyer loses all rent credits, and related fees paid even if the option period expires.

Lease vs Rent - Explained in Video

Responsibilities

Let us understand the responsibilities of using such a rent to own home contract to buy a property.

- Responsibilities related to rent-to-own-home schemes are often explicitly mentioned in the deed that binds the buyer and the seller. Obligations such as transaction fees, maintenance fees, repair costs, community regulations, municipal facilities, and duties are only some of them.

- It is noteworthy that the agreement's responsibilities are as important as the financial aspects. Even if the buyer duly pays rents and installments of the purchase price, the seller can sue him if the other parts of the agreement are grossly violated.

Owner Financing

Owner financing is a mechanism wherein the property owner (home) finances the property for the buyer. It means that the buyer agrees to pay a specified amount, made up of principal and interest through the loan, to the owner.

The owner and the tenant enters into an agreement for rent to own home financing which states the terms of the lease, the purchase option, the financing terms etc. Here, instead of taking a loan from the bank, the tenant get fund from the owner which they have to pay bank with interest within a fixed time period and as per the agreed terms.

Here too, a rent is paid and a part of it is kept aside towards purchase price. If the tenant decides to purchase the property, the term of purchase is executed.

This kind of rent to own home financing is an easy method in which the tenant can get funds to buy the property and is suitable for those who who cannot get finance through tradition way due to credit rating issues or any other reason. It also provides flexibility regarding the terms and conditions of the loan because the owner and the tenant directly deal with each other.

Example

Example #1

Alex wishes to purchase a home that is worth $500,000. He knows he can put down $100,000 upfront to secure the property. Unfortunately, he cannot raise a loan of the remaining $400,00. The homeowner agrees to do this for Alex and extends a loan. Thus, Alex pays the principal plus the interest on the loan raised by the owner, known as owner financing.

Example #2

John wants to purchase a home for his family in an uptown locality that will cost him $500,000 today. Suppose John uses the rent-to-own scheme provided by the new homeowner. In that case, he will have to make a down payment upfront as well as pay installments of money that comprise both rent and rent-to-own charges (Remember! He will have to pay more than just the rent to own the home after the rent-to-own is applied and his rent tenure expires).

Pros

- Rent-to-own is a good option for buyers who do not qualify for house loans due to financial or credit issues.

- Rent-to-own schemes allow buyers or, more specifically tenants, the downtime to arrange for finances upon which one can use the system after the rental agreement expires.

- Rent-to-own also allows a tenant to gauge the living experience during the rent period, loosely called the trial period.

Cons

- Some rent-to-own schemes can be a costly affair. That happens because rent-to-own systems come with payments that the renting party makes other than the usual rent.

- The rent-to-own scheme often binds the renting party to agree that the conditions become obligatory during the rental period. That can become burdensome sometimes.

- Rent-to-own schemes narrow down options for renting parties. If one signs the agreement upfront, any favorable variations in home loans or property prices become a missed opportunity for the tenant who has already signed a rent-to-own agreement.

Rent To Own Home Vs Mortgage

A mortgage is an arrangement by which the lender secures his loan or financing by legally binding the borrower to pledge real property as collateral. However, let us understand the difference between them in details.

- In case of the rent to own home process the buyer first enters into a lease agreement and rents the property and buys it later but in case of the latter, the buyer directly takes loan to buy the property.

- In case of the former, the tenant does not become owner till the time they pay rent but in case of the latter the buyer becomes owner as soon as they close the purchase deal with the owner.

- In case of the former, the tenant has the risk of losing a part of the rent as option fee and downpayment if they do not not buy the property, but such is not the case with the latter.

- For rent to own home process, the tenant can get easy financing from the owner and buy the property despite not having a good credit rating or high-value assets, but for a mortgage, that is not possible since the banks or financial institutions will give loan only is the borrower meets specific criteria.

Frequently Asked Questions (FAQs)

The ability of tenants to make improvements or modifications to the property during the rental period depends on the specific terms outlined in the rent-to-own agreement. Tenants must review the agreement carefully and consult with the landlord or seller to determine whether such modifications are allowed.

Yes, it is possible to negotiate the terms of a rent-to-own home agreement. Rent-to-own agreements are not standardized and can vary depending on the landlord or seller. However, both parties can engage in discussions and negotiations to establish mutually acceptable terms.

Regulations for rent-to-own homes can vary by jurisdiction, so it is essential to research and understand the specific regulations that apply in your area. In some regions, there may be consumer protection laws or regulations governing rent-to-own agreements, particularly concerning disclosure requirements, fair housing practices, and the rights and obligations of tenants and landlords.