Table of Contents

What Are Renewable Energy Stocks?

Renewable Energy Stocks refer to shares listed by companies generating energy from renewable sources or those operating in the renewable energy sector. Such energy sources include geothermal, wind, and solar, among others. They encourage investment in companies producing green energy, thereby contributing to the efforts made to fight climate change.

They include operators, installers, developers, and investors of green energy firms that facilitate the growth of the renewable energy sector. These companies receive government incentives and have high consumer demand. They have performed well in the markets recently and can be suitable clean energy stock options to add to one's investment portfolio. They particularly appeal to investors who wish to curb the harmful effects of climate change.

Key Takeaways

- Renewable energy stocks are the stocks of companies operating in the renewable energy sector and generating energy via renewable resources,

- such as geothermal, wind, sun, and water, among others.

- Such stocks not only provide financial benefits but also help combat climate change through the development of green energy.

- Renewable energy stocks include solar energy, wind energy, hydropower, geothermal energy, bioenergy, and biomass, among others.

- They offer investors strong potential returns and enable portfolio diversification while promoting environmental conservation and prompting innovations to save the earth.

- They also help create jobs.

Renewable Energy Stocks Explained

Renewable energy stocks are the stocks of companies that are directly or indirectly involved in power generation and distribution from renewable sources like wind, solar, hydropower, etc. They are crucial to combating climate change and ushering in a new era of green energy.

These companies make good use of government policies and incentives for green energy to set up their factories, manufacture renewable technologies, provide installation services, and offer maintenance support. They also leverage the steadily growing public demand for green energy by initiating green energy projects. To raise funds for such activities, they are listed on stock exchanges.

Raising funds facilitates the research and development of new green energy technologies while creating jobs in various fields. Hence, their stocks are called renewable energy stocks. Also, the shares of these companies have seen significant growth from time to time, offering investors worthwhile options for investment.

Investors can use these stocks to diversify their portfolios and earn significant profits in the long run. This is especially true as the renewable energy industry is expected to see exponential growth in the future. These stocks are categorized by the type of renewable energy they focus on—solar, hydroelectric, biomass, or wind stocks.

Such efforts present multiple positive implications, such as a cleaner and greener environment than before, helping combat climate change and its adverse effects, and decreasing reliance on fossil fuels. On the financial front, they have led to the establishment of new companies, introduced new avenues for capital growth, and offered worthy opportunities for portfolio diversification. Above all, investors can earn significant return on investments through these stocks.

These stocks can be accessed via investment vehicles like exchange-traded funds (ETFs), green loans and bonds, community-supported energy projects, and direct investments in renewable energy projects. They have increased investment opportunities in the renewable sector for common investors.

These stocks can help transition the world economy to a low-carbon economy. Through such efforts, technological innovation is expected, which can boost employment numbers. They can enable entities to meet increased energy demands while decreasing greenhouse gasses and carbon emissions.

Types

Investors will find various types of stocks, with each focusing on a specific sector. Let us discuss them.

- Solar energy stocks: These stocks invest in companies engaged in financing, manufacturing, designing, and installing solar energy technologies like First Solar (FSLR).

- Wind energy stocks: They are based on companies that install, manufacture, and develop wind turbines for electricity generation, like Vestas Wind Systems (VWS).

- Hydropower stocks: These stocks comprise companies engaged in power generation through the use of flowing water, like Brookfield Renewable Partners (BEP).

- Geothermal energy stocks: They pertain to companies utilizing heat from the earth's interior/core to produce electricity, like Calpine Corporation (CPE) and Ormat Technologies (ORA).

- Bioenergy stocks: They generate power from biomass sources like waste, excreta, or crops. An example is Renewable Energy Group, Inc. (REGI).

- Nuclear power stocks (clean energy): They comprise stocks of companies developing, generating, and supplying power using nuclear technology to mine and refine nuclear fuel, produce reactor parts, and operate nuclear power plants. Cameco Corporation (CCJ) is one such nuclear energy stock.

Examples

In this section, let us study examples to understand the topic.

Example #1

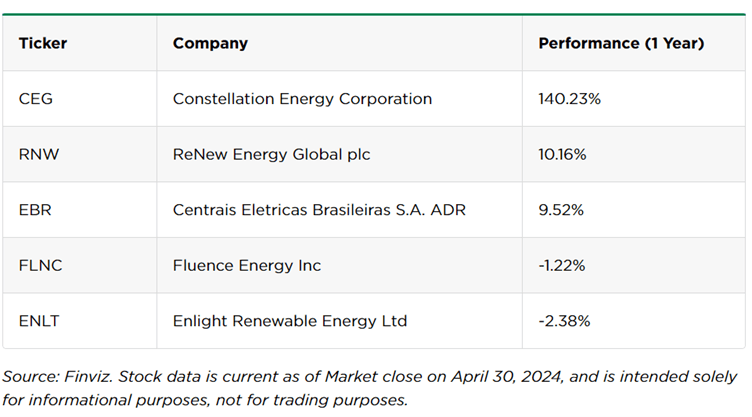

A Nerdwallet article recently published a list of the top 5 renewable energy stocks to consider in 2024. The article states that these stocks will enable investors to invest in a greener and cleaner future while enjoying good returns.

It also states that there have been some noteworthy advancements in the field of renewable energy that will likely create new manufacturing sectors, new technology centers, new jobs, and new devices and vehicles. As a result, the demand for such stocks has soared in a short period as investors anticipate a green revolution.

However, the renewable energy stocks listed here carry considerable risks and do not guarantee year-on-year returns. Investors may invest in the stocks shown in the table below with full caution and under expert guidance, even though some of them have exhibited good performance.

Example #2

Suppose LEANAT Hydel Power generates electricity using hydropower in Old York. Their research and development wing created a revolutionary turbine that produces 40 times more power than traditional turbines at half the cost of making them.

For this, it needs funds to mass produce the turbines for self and commercial use worldwide. As a result, it decided to go public and get listed on the Old York Stock Exchange under the stocks of renewable energy category.

Investors supporting clean energy and wanting to profit from the increasing demand for renewable energy find its offering interesting and attractive. Hence, as soon as LEANAT Hydel Power’s stocks were listed on the exchange, all its stocks were bought. This resulted in exponential growth for the company.

Investment Benefits

These stocks offer investors many benefits in addition to supporting climate change and environmental protection goals. Let us discuss the benefits of investing in these stocks.

- Stock price appreciation: Global climate concerns, technological advancements, and government incentives have increased the demand for renewable and green energy sectors. Thus, investors will likely see a hike in the prices of these stocks.

- Growth potential: In the recent past, these stocks did better than fossil fuel stocks, posting returns of 192.3% compared to 97.2% registered earlier . Hence, the growth possibilities seem to be endless.

- Suitable investment options: These stocks contribute toward funding for green projects, helping keep the environment healthy, averting adverse climate change, and promoting the development of a cleaner future for generations to come. Hence, they are attractive investment choices for investors who believe in mitigating the negative effects of climate change.

- Portfolio diversification: They also facilitate portfolio diversification beyond conventional stocks.

- Innovation: Renewable energy stocks support technological innovations in the clean energy segment, which can create positive outcomes for other industries and sectors, too.

- Job creation: Investments in these stocks can create new jobs for people in green energy sectors.

- Sustainability: Such stocks promote sustainable practices, help fight climate change, reduce greenhouse emissions, and generate sustainable energy for a greener earth.