Table Of Contents

Reimbursement Meaning

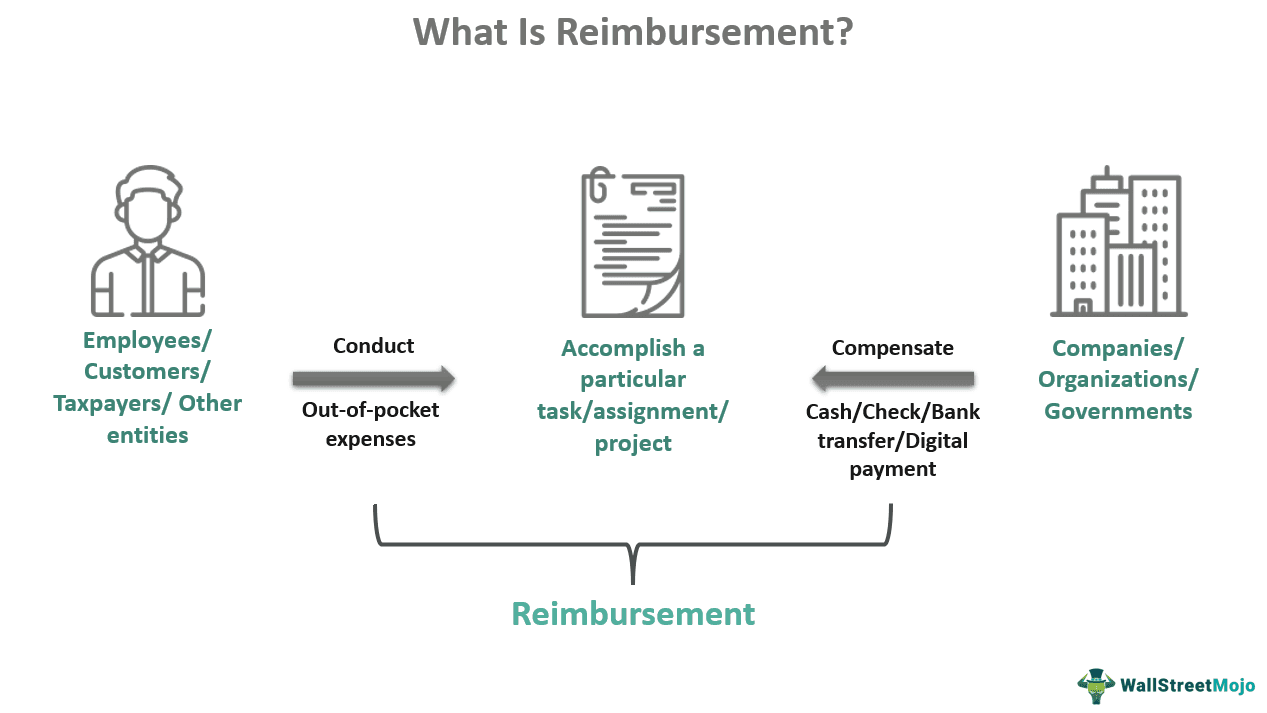

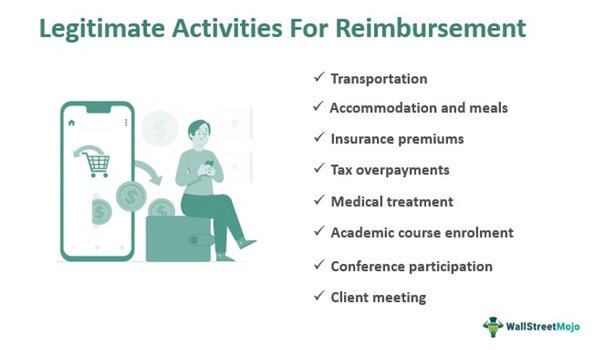

Reimbursement refers to the monetary compensation made by companies, organizations, or governments to employees, customers, taxpayers, or other entities for incurring expenses out of their pocket. It usually covers legitimate expenses, such as transportation, lodging, and meals, as well as insurance fees and tax overpayments.

Businesses and organizations sometimes require their employees or end-users to make an out-of-pocket payment for specific activities. These activities may include attending a conference or meeting, undergoing medical treatment, enrolling in an academic course, etc. It differs from a refund as the latter compensates the consumer for any losses or dissatisfaction caused by the goods or service.

Key Takeaways

- Reimbursement is the repayment of expenses incurred by employees, customers, taxpayers, or other entities while indulging in activities on behalf of their companies, organizations, or governments.

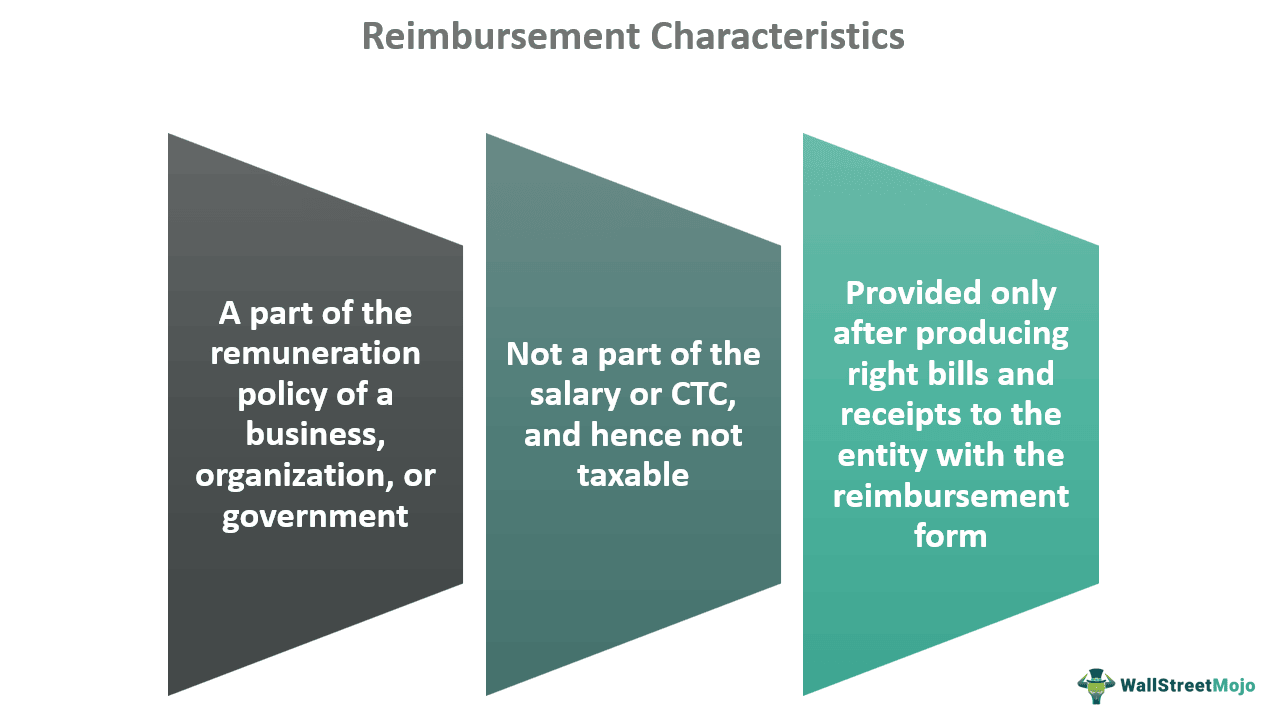

- It is not the same as a refund that pays the customer for any losses or dissatisfaction caused by the goods or service. Since it is not a part of the salary or CTC, it is not taxable.

- Activities eligible for this type of compensation include travel, accommodation, meal expenditures on business trips,

- medical care costs, academic fees, health insurance premiums, Medicare charges, mileage costs, tax refunds, etc.

- Before processing reimbursement of expenses, the organization double-checks all bills and receipts for accuracy.

How Does Reimbursement Work?

Reimbursement is a part of the remuneration policy of any entity, including business, organization, or government. It specifies conditions and justifications that qualify an out-of-pocket expense made by an employee or customer to accomplish a particular task for compensation. However, it is not a part of the basic salary, and hence it is not taxable. Not just in businesses but also in government, it is a standard procedure.

Typically, companies compensate their employees for conducting business-related transactions. It could be traveling for a meeting or conference, site or client visit, and it could also include paying for lodging and food. In a situation like this, employees often spend the money from their pocket, known as out-of-pocket expenses.

An individual or a party can receive compensation in cash, check, bank transfer, or digital payment. But first, they must produce documents proving their claim to have paid for something on behalf of the relevant body. Besides compensating employees, it is a common phenomenon with insurance and taxation processes. With that said, the reimbursing organization must utilize practices to detect and reject fraudulent reimbursement claims.

Types Of Reimbursement

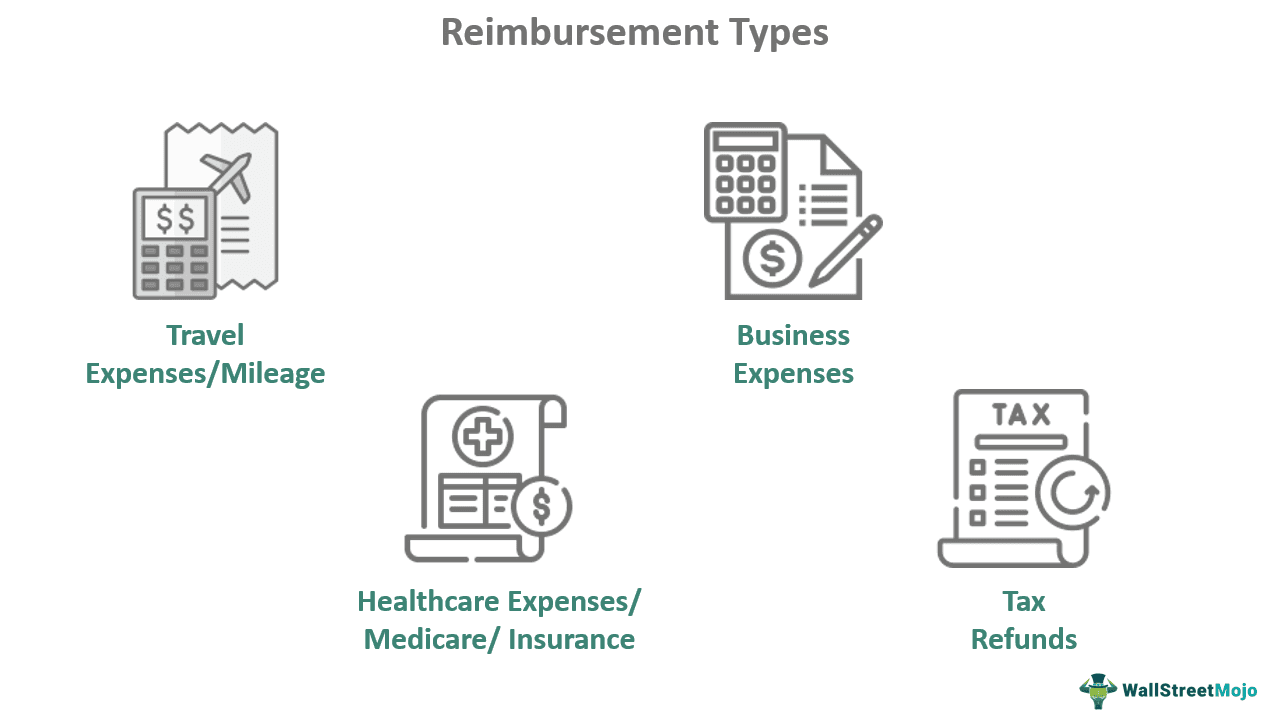

Companies, governments, and other organizations like to offer varied sets of reimbursement of expenses in line with the requirements and seriousness of business-related activities, including —

#1 - Travel Expenses

Employees occasionally travel outside the city to meet clients, attend business events, conduct site visits, or offer on-site services. So they take a variety of modes of transportation, including cabs, buses, trains, or aircraft. And for which their company reimburses them per diem rates, set by the United States General Services Administration or itself if they produce tickets. However, this method also applies within city limits. It means if an employee drives their car, they get reimbursement for mileage based on the cost of the trip.

#2 - Business Expenses

When an overseas business trip for purposes like role-specific training lasts more than a day, employees have to stay in hotels and eat food. Once they attach the hotel bills and receipts with the reimbursement form, their company reimburses the same.

If an employee meets a key client and has lunch or supper with them during the meeting, their company reimburses the same under business expenses. Besides, the company also compensates for any transactions made by the employee on making business calls, using the Internet, and buying office materials.

#3 - Healthcare Expenses

Reimbursement of medical expenses covers employee health insurance and medical bills. Rather than attributing the amount to employees, businesses usually pay these expenses straight to the insurer or hospital. Usually, the compensation for health insurance premiums is made under Health Reimbursement Accounts, Health Savings Accounts, and Flexible Spending Accounts.

#4 - Tax Refunds

Individuals and businesses who have overpaid taxes to the state and federal governments are eligible for repayment. Refunds may be available for various taxes, such as income tax, value-added tax, export tax, and property tax, among others.

Examples

Let us take an example to understand the concept of reimbursement of expenses -

Jessica works as a software solutions architect for a San Francisco, California-based IT company. Her employment demands her to see clients regularly. Meanwhile, a prestigious technology-oriented group announced hosting a national expo in Brooklyn, New York, inviting top IT organizations. Jessica's firm is also one of them. The board chooses to send her as the corporate representative because of her past on-site experience.

She travels to the event two days before it starts. During her four-day trip, she books a fancy hotel and pays for dining services. She meets other professionals and makes some new clients while on her tour. Her company has the policy of paying employees performing business-related activities outside the city. Because she successfully brought in new customers as well, the company's management authorizes the expenses she incurred in doing so.

She produces documentation of all out-of-pocket transactions done on behalf of the firm upon her return from the expo. The firm finds everything correct and compensates her immediately.

Other examples where reimbursement is applicable include:

#1 - Mileage

Reimbursement for mileage occurs when an employee uses their vehicle for company-related business meetings, site visits, and services. Their company then pays them for the fuel and gas expenses for qualified business travels as per the mileage cost incurred.

#2 - Medicare

Medicare pays the healthcare service provider or hospital directly for reimbursement of medical costs. It means the out-of-pocket expenses incurred by employees do not get credited to their bank accounts. However, before an employer can do so, the insured employee must submit a reimbursement claim for treatment costs or request their health care provider to do so on their behalf.

#3 - Insurance

Many organizations provide health insurance to all employees and, in specific cases, their family members, depending on their degree of employment and hierarchy. It may pay for some or all of the costs of hospitalization, physician consultations, ambulance and emergency services, medication, x-rays, etc. The insured can seek compensation from the insurance company for these out-of-pocket expenses under the policy terms.