Table of Contents

Regulation S Definition

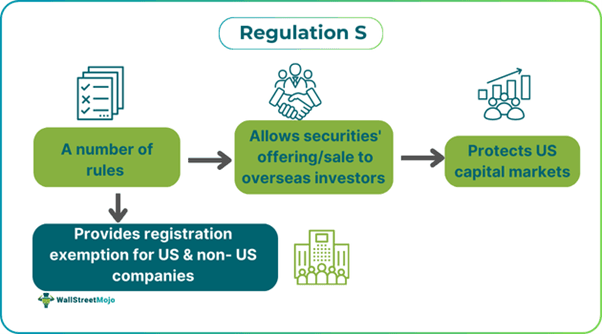

Regulation S is a set of rules allowing United States (US) as well as non-US companies to raise funds for an overseas organization while staying compliant with US securities law. It safeguards the nation’s capital markets and people investing in them, regardless of whether they are foreign or US nationals.

This regulation is applicable in the case of debt and equity securities. Even convertible securities can be involved in capital-raising transactions. The financial instruments purchased under this regulation are ‘restricted securities.’ One cannot sell them in the US until the end of the compliance period, which can be up to a year from the issuance date.

Key Takeaways

- The Regulation S definition refers to certain rules that make registration exemption available for offerings and sales to non-US companies. It provides protection to capital markets in the US. Moreover, it protects persons investing in them.

- Per a Regulation S requirement, any person acting on the issuer’s behalf or the issuer cannot engage in a directed selling effort.

- There can be different kinds of offerings per this regulation, for example, standalone and combined.

- A key difference between Regulation S and 144A is that the latter only gives exemption for offers made to qualified institutional buyers in the US.

Regulation S Explained

The Regulation S definition refers to a registration exemption that allows the sale of securities to any non-US investor exclusively outside the US, irrespective of whether they are unaccredited or accredited. This safe harbor provision exempts all international securities from registration under Section 5 of the Truth in Securities Act.

The Securities and Exchange Commission or SEC introduced it with the aim of protecting the capital markets in the US and safeguarding foreign nationals and US citizens who allocate funds to them. It ensures sufficient disclosure prior to the offering for the general public to make well-informed investment decisions.

The set of rules imposes specific restrictions to make sure they comply with the provisions. One of the key requirements is that the securities’ offer and sale must be carried out in offshore transactions, and it has to target investors who are natural person residents outside the United States. One must note that US investors must now see the terms that apply to non-US investors to steer clear of violating this regulation.

Another noteworthy Regulation S requirement is that issuers or persons acting on behalf of the former must not participate in any directed selling effort. This indicates that there must not be any activity that aims to condition the market for offered securities.

The SEC highlights the importance of executing reasonable procedures for ensuring sales and offers are in line with the regulation. Such procedures may include the employment of different customary practices for different international offerings, verifying the purchaser’s status as a non-United States person, and making sure that the resales are limited in line with the provisions of the regulation.

Offerings

Foreign and US issuers can carry out different types of offerings. Standalone offerings involve transactions performed exclusively in countries outside the United States. On the contrary, combined offerings include Rule 144A offerings in the US and offerings outside the United States. In addition, this regulation accommodates different continuous offering programs concerning debt securities.

The regulation also extends the provisions to foreign government securities offerings. Moreover, the provisions apply to offerings made under certain conditions under employee benefit plans administered per the laws of the relevant country. One must note that such offerings need to still be in line with the respective foreign rules and regulations to ensure compliance from an international standpoint.

Benefits

Let us look at some benefits of this regulation:

- It helps in raising funds beyond the United States borders. This allows for issuing dollar-denominated securities.

- This regulation acknowledges US persons’ presence and provides exemptions for specific categories, like accredited investors.

- It enables issuers and securities distributors to raise capital quicker and more discreetly. Moreover, it allows companies to raise funds at a lower cost compared to what they would have to pay for SEC registration.

Exemption

This regulation does not apply to offers or sales of financial instruments outside the US. Any security acquired outside the US, irrespective of whether they adhere to this regulation, will not be available for resale if their registration does not take place under the Truth in Securities Act introduced in 1933.

One must also note that it is unavailable for financial instruments offered and sold by any open-end investment company. Moreover, any unit investment trust (UIT) that requires registration under the US Investment Company Act or ICA or any UIT that is already registered., is not eligible for this exemption, .

Regulation S vs. 144a

Individuals new to SEC rules and regulations often confuse Regulation S and 144A. The table below highlights how they differ to eliminate confusion.

| Regulation S | 144A |

|---|---|

| This regulation offers registration exemptions to overseas investors. | This rule provides registration exemption to only large qualified institutional buyers or QIBs in the US. |

Regulation S vs. Regulation D

Understanding the main difference between regulations D and S is crucial to avoid confusion. So, let us find out how they differ.

| Regulation S | Regulation D |

|---|---|

| This regulation is for offerings to investors who are outside the United States. | Regulation D is a registration exemption for offerings generally restricted to accredited investors who fulfill certain financial thresholds, for example, high net-worth individuals, specific organizations, or institutional organizations. |