The distinctions between Regulation E training and Regulation Z are:

Table of Contents

What Is Regulation E?

Regulation E is a set of rules, procedures, and guidelines concerning Electronic Fund Transfers (EFTS) and electronic debit card issuers. It is proposed and administered by the Federal Reserve Board. The intention behind the Regulation E training is to safeguard customers using electronic modes of transferring and receiving funds.

These guidelines help customers and financial institutions understand the norms related to EFTs. They also provide insights into banking functions such as point-of-sale (POS) transactions, Automated Clearing Houses (ACH), and Automated Teller Machines (ATMs). The Feds implemented these guidelines as part of the Electronic Fund Transfer Act of 1978.

Key Takeaways

- Regulation E is a federal consumer protection law that was established in 1978 by the Federal Reserve Board. Its primary purpose is to protect consumers who use online modes of transacting.

- Transactions covered under Reg E include ATM transactions, POS purchases, ACH services, and direct withdrawal and deposit of funds.

- Consumers can raise disputes with banks through calls, in-person complaints, or emails.

- If the dispute is not investigated and settled within ten working days, the bank or financial institution is required to deposit a provisional credit in the customer’s account.

Regulation E In Electronic Fund Transfers Explained

Regulation E or Reg E is a federal law passed by Congress in 1978 as part of the Electronic Fund Transfer Act. Its primary intention is to protect all consumers who use electronic modes of paying and receiving funds. The Federal Reserve Board (Feds) oversees Regulation E.

These regulations help consumers by preventing incorrect EFTs and other fraudulent activities. They also give them the support to file for Regulation E disputes, such as unapproved withdrawals through debit cards, limited liability in case of a stolen or lost debit card, and unauthorized or wrong EFTs.

Reg E has two subparts: Parts A and B. Subpart A covers regulations relating to EFTs such as gift cards, gift certificates, and prepaid accounts. Subpart B provides guidelines regarding the remittance rule. These guidelines help with cancellation rights, error resolution, and disclosure.

It is important to note that while debit cards fall under Reg E guidelines, credit cards are not governed by this law. They are covered under the Truth in Lending Act, better known as Regulation Z.

The Reg E guidelines help consumers understand their rights in the event of a fraudulent or erroneous transaction or act. They also provide clear guidelines for banks to take corrective actions. Typically, if a consumer reports an error or fraudulent activity, the bank has ten working days to investigate and take corrective action.

However, the bank can extend the period up to 45 days, provided it credits the customer’s account with the apparently missing funds in a provisional manner. Once the investigation is over, the bank is required to inform both the consumer and the feds about its findings.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

History

To attain considerable Regulation E training, one must know a few critical happenings in its history. They are:

- In 1978, Congress enacted a federal consumer protection law enacted under Regulation E.

- The feds amended the law in 2009. The First Amendment restricts banks and other financial institutions from charging overdraft (OD) fees for POS and ATM transactions.

- One year later, in 2010, the Consumer Financial Protection Bureau took over rule-making responsibilities from the Federal Reserve. The change was due to the Dodd-Frank Wall Street Reform and Consumer Protection Act.

- In 2012, the CFPB amended the law governing consumers' transfers to businesses or individuals in a foreign country. The amendment provided consumers with newer protections and cancellation rights.

- Over the years, the CFPB has made minor to moderate changes to the act as and when the need arose.

- In April 2020, when the COVID-19 pandemic forced countries worldwide to declare lockdowns, the CFPB said that a few payment reliefs made to protect consumers were not government benefits as per Reg E and EFTA.

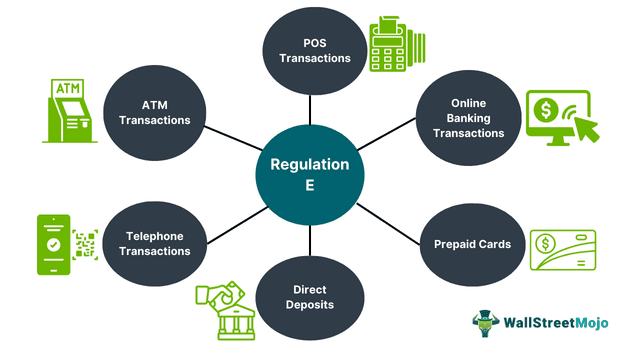

Types Of Transactions Covered by Regulation E

The different types of transactions under the act provide consumers with the opportunity to raise Regulation E disputes if any transaction takes an untoward turn, including:

- Remittance transfers

- Telephone bill payments (With recurring or periodic transfer requirement)

- Point of Sale (POS) transactions

- Remote banking

- Automated Clearing House (ACH) services; and

- Transfer and withdrawals through ATMs

- Gift cards

- P2P (Person-to-person) payments

- Direct withdrawals

- Direct deposits

What’s Not Covered Under Regulation E?

It is critical to understand that not all types of electronic transfers are covered by the act. Therefore, they shall also not be subject to Regulation E provisional credit in case of disputes. Such transactions include:

- Credit card transactions

- Fund transfers through check

- Fund transfer initiation through other paper instruments

- Wire transfers

How To File A Regulation E Dispute?

A Regulation E dispute must be reported immediately after finding such discrepancies. Customers must report such disputes in as much detail as possible to the bank or any other financial institutions through which the lapse has occurred. Consumers can file a dispute with their bank through different means, including:

- Bank’s online portal

- In-person complaint

- Phone

Once the bank files the complaint, it has ten working days to investigate and resolve these disputes. However, it can extend this period to 45 days provided it provisionally credits the customer’s account with the amount reported to have been incorrectly transferred or fraudulently acquired.

Examples

Now that the theoretical aspect of Regulation E provisional credit and the fundamental aspects of the concept are established, it is time to explore the practical aspect of the concept through the examples below.

Example #1

Justin is a model who purchases most of his outfits online. During a sale, he made a POS transaction of $200 on one of the major shopping sites. The transaction was approved, and the estimated delivery date was also revealed.

However, upon checking his account balance, Justin realized that $200 had been debited twice instead of once. Therefore, he immediately called his bank’s relationship manager and filed a dispute. The issue took more than ten days to investigate and solve, as the e-commerce company was backlogged trying to address multiple such complaints. Therefore, the bank deposited $200 in Justin’s account provisionally.

Example #2

In July 2024, the United States Prudential Bank Regulators issued a joint statement that clarified banks' arrangements with third parties for the delivery of bank deposit services and products. They also released a request to gain more information on the arrangements concerning FinTech and banks.

The statement also highlighted the fact that relying on third parties can raise compliance and operational risks. Therefore, Regulation E training and Regulation DD must be used to provide more prominent disclosures.

How Does It Protect?

Reg E protects consumers who transact through electronic modes. A few of the most prominent ways through which the act protects consumers are:

- Protects consumers against incorrect or fraudulent EFTs

- It gives consumers the right to dispute any erroneous or fraudulent activity through their account

- Consumers are awarded the right to demand a written statement of investigation

- If the investigation takes more than ten working days, they are eligible for Regulation E provisional credit until the matter is settled.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Regulation E vs Regulation Z

| Basis | Regulation E | Regulation Z |

|---|---|---|

| 1. Governing law | Electronic Fund Transfer Act (EFTA) | Truth in Lending Act (TILA) |

| 2. Applicability | It is applicable to savings and checking accounts | It provides guidelines to credit card issuers |

| 3. Purpose | It safeguards consumers using electronic modes of transacting | Reg Z protects all credit card-related disputes |

| 4. Merchandise | No merchandise protection | Protection is provided if merchandise is not received |

| 5. Provisional Credit | Provisional credit must be provided after ten working days | No provisional credit is required for these disputes |