Table Of Contents

Refinancing Meaning

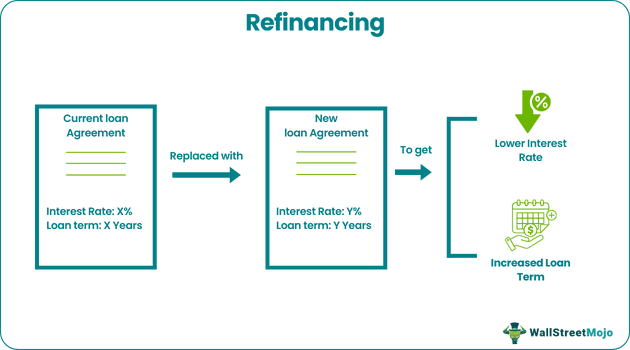

Refinancing refers to substituting the current loan contract with another credit agreement. It helps modify the loan terms, obtain better interest rates, and switch to an inexpensive loan type. So, several borrowers utilize rate-and-term or cash out refinancing to acquire greater mortgage costs and harness the house equity, respectively.

Please note that borrowers can also employ this procedure to attach or remove somebody from the credit arrangement. To clarify, it is categorized into four types: cash-out, rate-and-term, cash-in, and debt consolidation.

Key Takeaways

- Refinancing indicates the replacement of the current mortgage with a new debt obligation. It assists in adjusting the interest rates and repayment period per the borrower’s suitability.

- It has four crucial types: cash-in and cash-out, rate-and-term, and debt consolidation.

- The advantages include lower monthly payment interest rates, loan repayment period extension, switching to a more suitable loan type, and cancellation of private mortgage insurance installments.

- It also has disadvantages like possibly increased costs, a lengthy procedure, and a negative credit score (temporary) impact.

How Does Refinancing Work?

Refinancing is a new loan and can be with a different lender than the primary one. Like the initial credit application process, the moneylender analyses the debtor’s funds while refinancing mortgage. In addition, it assists in evaluating the danger level and ascertaining the eligibility for a befitting interest rate.

Please note that its terms and conditions could differ depending upon inherent risks, the country’s credit rating and political stabilization, creditworthiness, projected risks, and currency stability. Furthermore, in the case of a home loan, it is essential to comprehend the cost of refinancing concerning the expected period of stay in the house.

Borrowers must invest their capital and time to refinance their loans as they may,

- Choose a more suitable loan type

- Obtain a lesser interest rate

- Decrease the loan term

- Leverage the equity to lend more capital

Though temporarily at a minimum level, it may affect the credit score and is regarded as debt restructuring if debt replacement occurs under fiscal distress. This is certainly the best commercial step, provided that the borrower thoroughly considers its costs relative to the savings.

Refinancing Options

In other words, the following are four types of refinancing:

1. Cash-out Refinancing

The cash out refinancing method permits the borrowers to extract equity from the underlying asset. Thus, it denotes the collateralization of a new debt obligation and some money. Furthermore, they may use it as a low-priced business financing source to settle further high-interest dues.

2. Rate-and-term Refinancing

It alters either (or both) the interest rate or the term of the loan. Moreover, this can decrease the monthly installment or aid in saving money on profits. The payable amount won’t normally modify except if escrow fees are incorporated in the new loan.

3. Cash-in Refinancing

In other words, borrowers may make the lump sum settlement to lessen the loan-to-value ratio (LTV), thus lowering the total debt burden. It possibly diminishes the monthly payment and may help the borrower qualify for a reduced interest rate.

4. Debt Consolidation Refinancing

Like the cash-out structure, debtors get money from the equity but for other non-mortgage payments (such as credit card dues). Though mortgage debt soars, it is typically lesser than different debt types and thus, saves you money and may benefit from debt interest deduction.

Examples

Above all, the below-mentioned are examples to understand the mortgage refinancing costs.

Example #1

Say Chris (borrower) has a 20-year (loan term) fixed-rate mortgage and has been paying 7% interest for the last five years. Moreover, interest rates dramatically decline owing to market fluctuations. Consequently, he contacts the bank (lender) to refinance the existing mortgage at 5% interest for the remaining 15 years.

This allows Chris to decrease the interest rate and his monthly mortgage installment. Also, he may switch from fixed-rate to adjustable-rate mortgage (if preferred).

Example #2

The Oil and Gas Holding Company of Bahrain (Nogaholding) refinanced the current $1.6 billion loan, thereby enhancing the size to $2.2 billion. Furthermore, the dual-tranche loan is the first-sustainability linked loan of the company, to be matured in September 2026, and was oversubscribed twice.

Nogaholding recruited Mashreq and GIB for loan refinancing in February. To clarify, it will authorize the firm to cover the capital expenditure (CAPEX) arrangement for 2022 focused on boosting diversification and selling its gas and oil assets.

Refinancing Pros and Cons

To clarify, here are the pros and cons of refinancing mortgage.

Pros

- The cutback in loan payment and creating additional space in the rolling budget.

- Most importantly, repayment extension is feasible through loan period expansion.

- Borrowers may utilize the mortgage refinancing costs to diminish the interest rate.

- Above all, consolidating multiple loans into a single one may offer much-reduced interest rates than the current one.

- It is possible to exploit the house equity and obtain cash upon closing.

- Additionally, borrowers may switch from adjustable-rate to fixed-rate mortgage (or vice-versa) to soar monthly installments with varying interest rates.

- Debtors can call off private mortgage insurance installments and avoid nonessential fee payments.

Cons

- A probably extended loan term may increase the costs and postpone the payoff date.

- This procedure can take at least 15-45 days and may result in technical insolvency.

- To make use of refinancing rates, disbursement of closing costs is required.

- Please note that the borrower’s credit score will temporarily plummet.

- Taking the cash out will reduce equity in the house.

- In case of a major price cut after closing, the borrower’s remorsefulness is possible.