Table Of Contents

What Is Recourse Debt?

Recourse Debt is one of the types of loans that are less risky for a lender for investment, as having this loan gives the lender a right to recover its investment using the collateral asset if the borrower is unable to make its promise payment or outstanding liability which is specified into a loan agreement.

Also, if the current market value of the borrower's collateral underlying assets is not enough to recover the outstanding loan, then as per the recourse agreement lender can claim for other assets of the borrower which were not initially used as collateral.

Key Takeaways

- Recourse debt is a loan that gives the lender the right to recover its investment by utilizing

- the collateral asset when the borrower fails to make payments or fulfill outstanding payment liabilities as specified in the loan agreement.

- It is considered less risky for the lender and is often favorable for investment purposes.

- Options to recover money for recourse debt may include issuing collections notices, taking and selling collateral, garnishing paychecks, and attaching other assets.

- The lender can take these actions to recoup the outstanding debt when the borrower defaults on the loan.

Recourse Debt Explained

Recourse debt or recourse loan is a for of funding in which the lender get certain facilities like in case the borrower defaults, then the lender can sieze the collateral used to back the loan and recover the pending amount. The lender also has the facility to ask for more collateral from the borrower in case the value of the collateral falls below the value of the loan amount.

These things should be clearly mentioned in the recourse debt factoring contract so that it does not create any kind of legal consequence later on and the lender is not at risk of losing the money.

However, it is important to understand that a recourse debt is in favour of the lender because they get the facility to cover their risk of default, whereas a non recourse debt is in favour of the borrower of loan. But since recourse loan decreases the risk of lender, they might be ready to lend money at a lower interest rate than the market.

Example

The loan agreement will specify whether the loan is recourse or non-recourse. Let us understand the topic with the help of some examples of recourse debt.

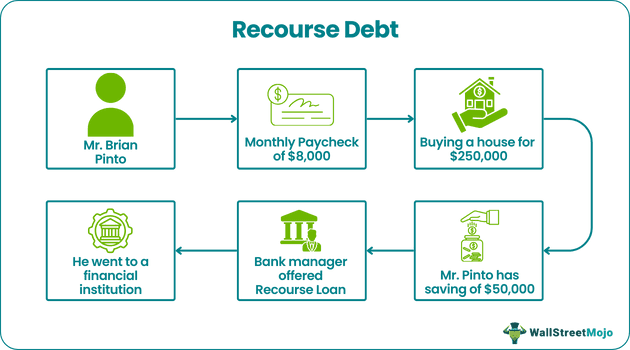

Mr. Brian Pinto is a United States resident and recently got a stable job in a pharmaceutical company which gets him a monthly paycheck of $8,000. Mr. Pinto plans to buy a house in New York City for $250,000. Mr. Pinto saved $50,000, So he went to a financial institution to look for options available for him to obtain the loan of the remaining amount of $200,000 for his house financing. His credit records are also not enough for this loan.

So after understating the scenario bank manager offered a recourse debt to Mr. Pinto, which specified that under the loan agreement, the financed home would be kept as collateral and taking some percentage of his paycheck directly as a monthly installment payment. Since he had no other option available to get a loan, he accepted the offer from the financial institution.

What if Mr Pinto Stop Making Payment?

As mentioned in the examples of recourse debt, home financing is a recourse debt specified in the loan agreement.

Thus, the above options explain using the recourse debt factoring contract.

How To Recover Money?

- Collections Notice: The lender might send a notice asking for money, or the lender may sell the debt to a collection agency that will try to collect.

- Take and Sell Collateral: Firstly, the financial institution will take the collateral property, which is mentioned in the loan agreement, and sell the property to recover its outstanding loan balance.

- Paycheck Garnishment: If the current market value of the collateral is not sufficient to recover the outstanding loan balance, then as per the loan agreement, the financial institution may get the right to increase the percentage of the paycheck or might contact the borrower's employer to take money out of his paycheck until all outstanding loan balance is recovered.

- Other Assets Attachment: In some cases, a lender might take and sell the borrower’s other assets, which are never pledged as collateral. For example, the lender may take money from the borrower's bank account, fixed deposits, etc.

Advantages

Some of the advantages of full recourse debt are as follows:

- Less Risky for Lenders: Recourse debt partnership is backed by collateral assets and a personal asset of the borrower, so the lender has less risk than a non-recourse.

- Low-Cost Loan for Borrower: High creditworthy borrowers can enjoy low-interest rates on recourse compared to a non-recourse loan.

- Leniency Loan in Process: Borrowers with poor credit history can also get a loan from financial institutions as under- recourse loan reduces perceived risk associated with less creditworthy investors.

Disadvantages

Some of the disadvantages of full recourse debt are as follows:

- Borrower’s Personal Income Garnishment: Under this type of debt, if the borrower defaults on the loan, the lender can claim on the personal income of the borrower such as wages, commission, bonuses, pension benefit, bank deposits, etc.

- Low-Interest Rate: The lender charges a low-interest rate for a recourse debt partnership compared to the non-recourse as this is more secure to the lender if the borrower defaults on the loan payment.

Recourse Debt Vs Non Recourse Debt

- The former gives the facility to the lender to seize the collateral of the borrower in case of not payment whereas the latter does not give any such facility.

- From the lender’s point of view, the former is more secured than the latter.

- Due to lesser risk, the former offers loan at the lower interest rate than the latter.

- The former is more suitable for borrowers who have a poor credit history and the latter is suitable for borrowers with strong credit history.