Table Of Contents

Recapitalization Meaning

A recapitalization is a form of restructuring the ratio of various capital generating modes such as debt, equity, and preference shares depending upon WACC and other company requirements such as the desired level of control.

In this process, the company issues one form of capital to buy back another arrangement, for example, giving debt to buy back existing shares to benefit from a favorable interest rate environment. It also helps the company in defending itself from takeover and may give a boost to the financial condition and prevent it from further deterioration.

Key Takeaways

- A recapitalization means restructuring the various capital ratio-generating modes like debt, equity, and preference shares based on WACC, including the other company requirements, such as the desired level of control.

- In the recapitalization method, the company issues one capital form to buy another arrangement. For example, they provide debt to buy back existing shares to get benefits from a favorable interest rate.

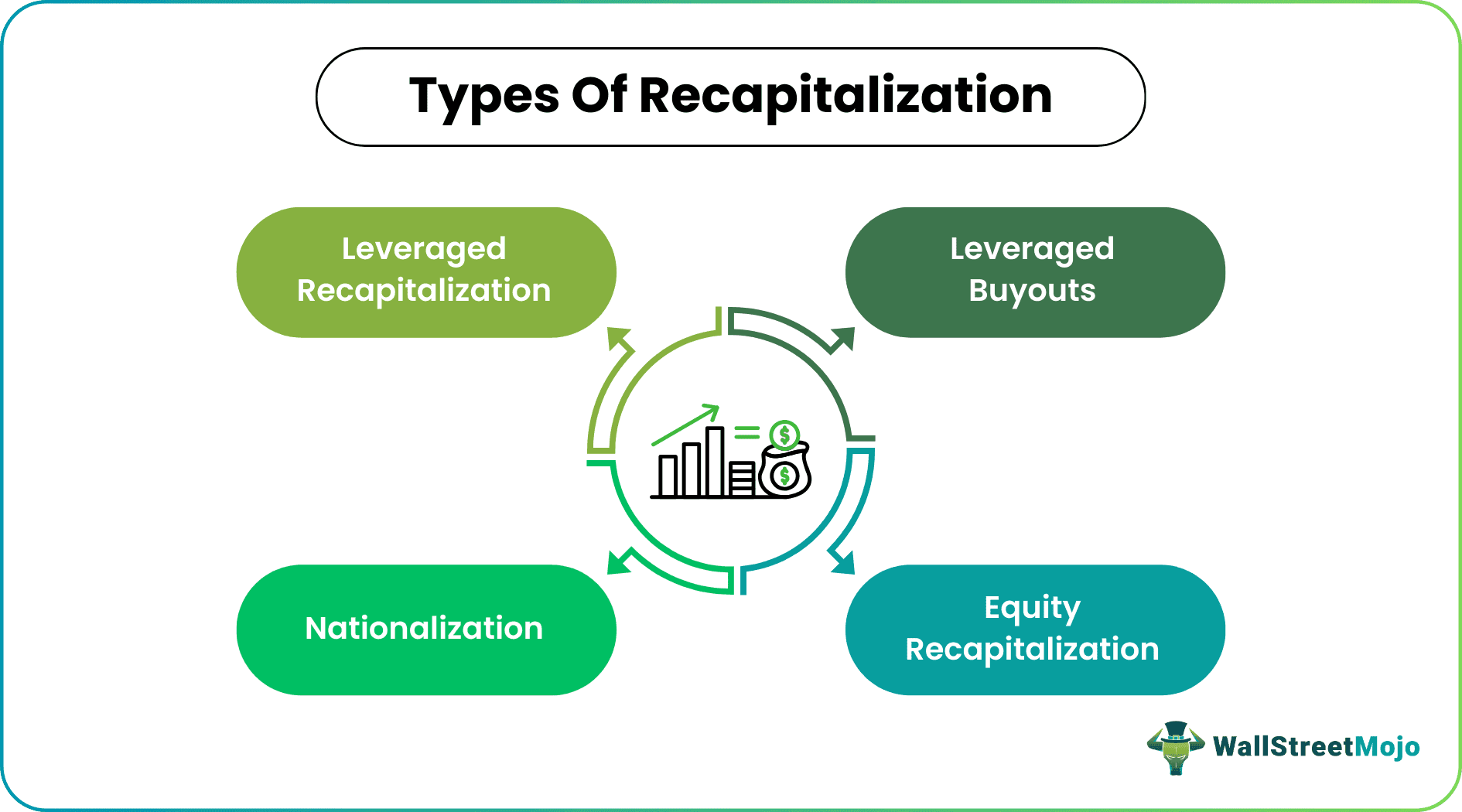

- Leveraged recapitalization, leveraged buyouts, nationalization, and equity recapitalization are various types of recapitalization.

- One may also use this process as an opening route in private equity.

Recapitalization Explained

Company recapitalization is the process in which a business changes its existing capital structure which normally consists of debt and equity. They do it by altering the capital structure that would better suit the company’s needs, and the motivation behind it may vary from one company to another. Therefore, it may or may not lead to the desired result or not and should think.

It is a common process in which the company recapitalization changes the proportion of its financing methods or replaces them with some other financing method. . There are several real-life examples of capitalization as most companies require this tool at some point in their life cycle. The motivation to do so may bind to a different objective from time to time. However, the main aim behind the entire idea is to make the financial condition more stable and use resources effectively.

Types

There are various types business recapitalization as below:

- Leveraged Recapitalization: Issue of new debt to buy back the company's existing shares. It leads to an increase in the debt component and a reduction in the equity component.

- Leveraged Buyouts: Same as leverage recapitalization but initiated by third parties to the company.

- Equity Recapitalization: More equity or preference shares are issued to buy back the debt and reduce the debt component.

- Nationalization: Government uses this mode. Capital infusion in the case of public sector units or by paying off compensation for a private company’s equity.

Thus, the above are the various types of equity and loan recapitalization.

Example

Let us look at an example of loan recapitalization to understand the process.

Around 2013, Dell went private. One of the main reasons for this was that Michael Dell wanted to grow faster and needed greater control over strategic decisions without gaining approval from several other stakeholders, and the Board of Directors.

Further, going private would reduce the filing requirements of the SEC, reducing the time and costs of paperwork. To undergo this change, Dell had to take a bank loan, and the costs saved from reduced paperwork and dividend payments would pay off the debt quickly compared to what it would have been able to. Thus, it would be able to reduce the debt burden too. Also, it would bring greater flexibility to invest in R&D because it does not need to pay out enough dividends and retain them; this may lead to faster growth.

However, this is not the only recapitalization case in Dell’s history. In 2018, i.e., five years later, Dell sought to go public again through a VMware, Inc. stock swap deal, an alternative to the traditional IPO process. But, again, the motivation was the growing ties with VMware, Inc. and the expected growth in the new product lines.

The above example of business recapitalization makes the concept clear.

Benefits

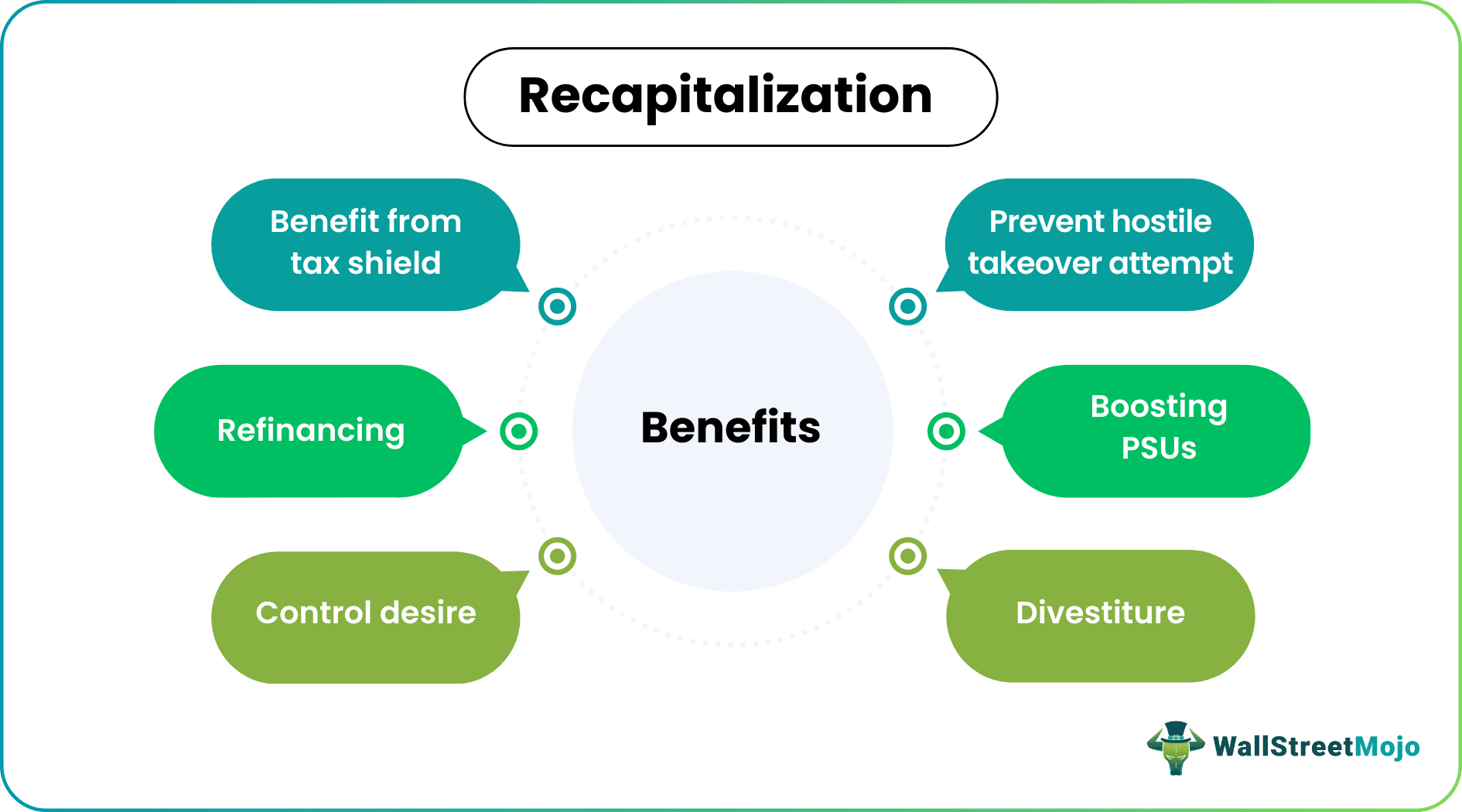

Let us look at the various benefits of the process.

Benefit From Tax Shield

Interest on debt is tax-deductible. Therefore, an increasing deficit in the capital structure leads to an increase in the interest burden and, in turn, lower taxes. That could only be a motivation when: -

- The company is sure of good sales to pay the interest because interest is an obligation one must pay even without the company earning enough profits.

- Interest cost is lower than the cost of equity of an all-equity company.

Reduce Interest Burden

Opposite to the previous motivation, when a company wants to reduce its interest burden, it goes for an equity recapitalization because it may not want to part with some of its profits or incur losses in paying the interest, which is an obligation independent of companies earning a profit. Even if the company makes a profit, it can retain it if it has growth opportunities to invest in. Therefore, under such circumstances, it has the freedom to payout any dividends.

Prevent Hostile Takeover Attempt

Several takeover defense mechanisms can lead to a recapitalization. The stock repurchase is when the target company buys back its shares from the market to reduce its availability for an acquiring company to buy such shares. In Greenmail, the target company buys back the shares held by the acquiring company, and if it extinguishes these shares, the capital structure gets affected. In white squire defense, it buys back the shares of the minority and allows them to be friendly partners.

Also, there may be a situation where the target goes for a rights issue at a highly discounted price to increase the number of shares and make it difficult for the acquirer to acquire. To take any of these defenses, the target company may issue debt or other forms of capital, leading to a recapitalization model. Otherwise, these result in a change in the capital structure.

Boosting Public Sector Units

When the government takes the nationalization route, it is mainly to help certain sick PSUs to overcome their deteriorating balance sheets. For example, when banks have very high levels of non-performing assets, the government infuses capital so that these banks don’t go bankrupt. At other times, when the economy is slowing, the government uses the capital infusion to boost lending activity by the bank. All these increase the government’s stake in the PSUs, a form of recapitalization.

Divestiture

The opposite of nationalization is Divestiture. The government sells its stake to private parties with the motivation to reduce the government’s expenditure or losses or make such PSUs more efficient through privatization.

Control Desire

At times companies or management require greater control over the company. For this reason, they may reduce the debt because debt-holders impose restrictive covenants on the risks that can be taken by the company or on the new capital issues.

Refinancing

At times when the interest rates become more favorable, companies may issue new debt to recall old debt issued at a higher interest rate; this helps in reducing its WACC.

Reducing Administrative Costs

There are several costs associated with being a publicly listed company related to disclosures and regulatory requirements. Such is not the case in private companies. Therefore, the companies may sometimes go private to reduce such costs when they become unbearable.

Recapitalization In Real Estate And Private Equity

In real estate development, several parties come together, landowners, development partners, investors, etc. However, each participant has different investment horizons and expectations regarding the market and returns. At times, those having a longer time horizon and hopeful expectations recapitalize the stake of other participants for mutual benefit.

One can use recapitalization as an exit route in private equity. The private owners sell a portion of their companies to take advantage of growth opportunities that require greater capital or reduce their stake or burden and retain some stake to benefit from prospective future growth.

Recapitalization Vs Refinancing

- Recapitalization model means changing the capital structure of the company for better operation and usage whereas refinancing means replacing the old debt with new debt where the terms and conditions may vary.

- Refinancing may also lead to combining many loans onto one to facilitate repayment, whereas the business may recapitalize by replacing the debt with equity or vice versa for better use of funds.

- The former deals with both debt and equity whereas the latter deals only with debt.