Table Of Contents

What Are Real-World Assets (RWAs)?

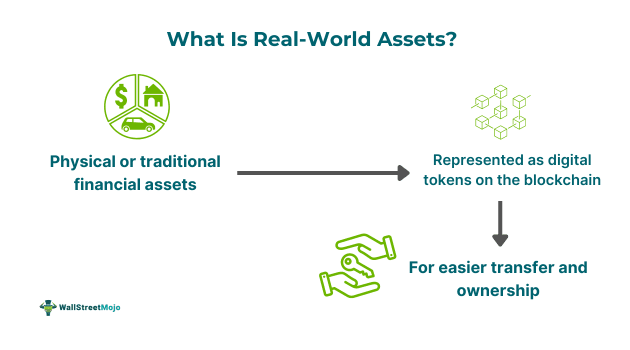

Real-world assets crypto refers to tangible (or physical) assets present in the crypto space but in token form. The sole objective of issuing RWAs is to provide users in the Web3 space with access to the financial assets present in the real world.

These assets help tackle volatility and other risk factors. They allow users to enable real-time investment in the digital format. Also, they increase the liquidity of these assets that is missing in the financial markets. Besides physical assets, even NFT real-world assets are available in the crypto ecosystem. However, it does bring regulatory compliance along with it.

Key Takeaways

- Real-world assets refer to the issuance of assets present in the physical world via tokenization. In short, a digital token is released that represents a small ownership stake in an asset.

- It enhances the liquidity of these assets in the crypto market, allows users to redeem easily, and reduces the associated volatility.

- The RWA-based platforms choose an asset and create a token as a security. Users can trade them on-chain and redeem them off-chain.

- It includes assets like real estate, bonds, stocks, artwork, loans, invoices, royalties, and similar others. The reports estimate the tokenized RWA market to reach $16 trillion by 2030.

Real-World Assets Explained

Real-world assets tokenization refers to the financial assets that are available on the crypto blockchain. It allows users to use a tokenized form of these assets for enhanced volatility and liquidity. Also, it enables better yield rates due to the absence of the influencing factors. They are present on the on-chain as security tokens to benefit from the blockchain technology. As a result, it becomes easy to trade and incentivize them. Some of the RWAs include real estate, loans, commodities, artwork, T-bills, short-term and long-term securities, stocks, bonds, and others.

The mechanism of real-world asset tokenization involves different components and stages. As various assets are present in the financial market, asset selection becomes crucial. The issuer can choose from a varied range and evaluate its existing trading position and worth. For example, a crypto firm may decide to issue tokenized bonds on-chain and let users hold them off-chain. As a result, with the help of blockchain technology, the bonds will work as assets, while the users can still redeem them in the physical world.

After selection, the tokenized asset gets a legal framework and set of compliances. It decides the blockchain technology and token infrastructure. Once finalized, the token gets minted on the chain and then distributed among the investors. It happens through the initial coin offering (ICO), which represents a share of the asset. Later, tokenized asset holders can trade in the secondary markets and book profits in return. Also, they can redeem or opt for buy-back if the crypto firm does so. A similar process is also possible for NFT real-world assets.

The main purpose of deploying RWAs is to eliminate the limitations of these assets in the physical world. It provides rights to assets by restricting access to only a few individuals. Thus, privacy and authenticity are maintained. For example, when someone sells a house, tokenizing the asset is beneficial.

Real-World Assets In DeFi

In contrast to the physical world, the application of real-world assets crypto is prevalent in the DeFi arena. Let us look at them:

- MakerDao real-world assets: Among all DeFi projects, remarkable progress is visible in the MakerDao real-world assets. It enables the minting of DAI stablecoin by holding physical assets off-chain, including real estate, intellectual property, and others. According to recent reports, in July 2023, MakerDao made 80% of its revenue from RWA-related fees.

- stUSDT: stUSDT is a Tether-based DeFi project that includes short-term treasury bills as RWAs. Users can stake a token and earn around 4.87% returns, with a total value locked (TVL) of over $507 million.

- Ondo Finance: It is the second largest RWA protocol after stUSDT, which allows the tokenization of highly liquid exchange-traded funds. Here, stablecoins are converted to USD to purchase assets that represent ownership of these funds. These assets also include US treasuries and money market funds.

- Polymath: This DeFi project includes the involvement of RWAs in commodities, fine arts, real estate, and similar industries.

- Unikura: This Japanese-based NFT RWA platform enables deposits of unique collections like manga books, vintage toys, and anime figures. It stores these valuables and gives minted NFTs in return. Users also receive royalties in return.

- RealT: RealT provides ownership of a real-estate property based on an ERC-20 token. It enables fractional ownership of land with a secured income.

- Centrifuge: The centrifuge project enables liquidity with assets like mortgages, royalties, and invoices. It has two types of tokens (Tin and Drop). The former provides safe returns, while the latter ensures a higher yield rate with similar risk.

- Creditcoin: Another DeFi-based RWA project allows users to lend and borrow any asset, like crypto, stocks, bonds, and fiat currency, with this platform.

Examples

Let us look at some examples of real-world assets tokenization to comprehend the concept better:

Example #1

Suppose Huston and Emily are two friends working at a corporate institute. The former works as a designer, and the latter as an account executive. Lately, they have been investing in the crypto market. However, they did wish to incorporate real-time assets like bonds and T-bills as tokens. Later on, they discovered real-world asset platforms like stUSDT and RealT. As a result, Huston was able to own a fractional ownership in the 36 months US Treasuries bills via staking USDT. Likewise, even Emily brought RealT tokens and further purchased property in San Francisco.

After some quarters, both started receiving passive income in the form of rent and interest payments. This income continued for the next three years until Huston redeemed his tokens after a 36-month maturity period.

Example #2

According to a report by Bank of America, the tokenized gold market surpassed a significant milestone of $1 billion in value last month. This growth highlights the increasing pace of real-world asset tokenization, allowing for the ownership of tangible assets like precious metals to be transferred on the blockchain. The report emphasizes the benefits of tokenized gold, including 24/7 real-time settlement, no management fees, and the absence of storage or insurance costs. Additionally, fractionalization enables a level of accessibility and liquidity in the gold market that traditional investment vehicles like ETFs and futures cannot match.

In parallel, the demand for tokenized assets in other markets, such as US Treasury bills, is also on the rise, with the tokenized money market reaching approximately $500 million. The advisory firm Boston Consulting Group (BCG) has predicted that the demand for real-world asset (RWA) tokenization could reach $16 trillion by 2030, reflecting the broader trend toward digital asset adoption. This expansion is expected to impact how investors manage portfolios significantly, especially those focused on ESG, as tokenization can offer verifiable proof of origin for assets like gold.

Benefits

Following are the benefits of the real-world assets in the blockchain ecosystem. Let us look at them:

- Secured ownership: The prime advantage of incorporating tangible assets in the DeFi space is the security provided. It allows users to have fractional ownership of these assets through a digital token. Thus, if a token holder wishes to sell the funds, it occurs in a secured manner, which means no third party is involved.

- Efficiency and reduced cost: Trades occur efficiently through the implementation of blockchain technology. The time taken is quicker than with traditional methods. Also, the mediator's cost is eliminated, leading to a reduced transaction fee.

- Transparency: As these RWA projects operate on a distributed ledger, the transactions and trades that occur are open to all. This means that users can track their investments and fund's progress anytime. Also, these projects are audited on a frequent basis to maintain privacy and authenticity. Thus, any malicious hacker or elements present are also detected.

- Enables liquidity and scalability: Unlike traditional finance, token holders can easily redeem their owned assets. As a result, the potential for liquidity rises since the blockchain eases the process. For instance, if a person wishes to sell 10% real estate, it happens in a few minutes. However, in the real world, it would take days to months.

- Creates potential for income: Another major benefit of real-world assets is that they allow users to earn passive income in addition to their investments. For example, users can lend or invest tokens in securities to earn interest payments in return.

Drawbacks

In contrast to the advantages provided to crypto holders, there are certain drawbacks to the concept. Let us look at them:

- Complex regulatory environment: The major drawback or issue faced by RWAs is the governance model. Although the asset provided is yielding, there needs to be a proper infrastructure and architecture to govern the network. As a result, the base remains unbaked, leading to the failure of such projects.

- Trust issues: Another problem still needs to be solved with such assets providing platforms itself. A good team must manage and maintain the data before the platforms can survive. As a result, the real-world assets kept with them also pose a threat of data theft. Thus, crypto users need to trust such products.

- Technological and security issues: The DeFi platforms must consider the technological analysis before proceeding with the updates. If the platform is outdated, it may cause technical issues within the interface. As a result, the trades conducted may face a serious threat. Hackers may discover it and exploit the platform to seize all the assets and stored funds.

- Lack of awareness: A lack of investor information on such assets restricts their expansion. As a result, the platform or RWAs cannot scale in the financial markets, and the associated market also plunges.

- Fragmentation of asset ownership: Apart from the above-listed benefits, segment ownership also limits RWAs. Since an asset has many owners around the world, getting a consensus on an upgrade becomes hard. Likewise, it may lead to conflict among the token holders.