Table Of Contents

What is the Real Rate of Return?

The real rate of return is the actual annual rate of return after taking into consideration the factors that affect the rate like inflation and it is calculated by one plus nominal rate divided by one plus inflation rate minus one and inflation rate can be taken from consumer price index or GDP deflator.

It helps an investor find out what actually he gets in return for investing a specific sum of money in an investment. For example, if Mr. Timothy invests $1000 into a bank and the bank promises to offer a 5% rate of return, Mr. Timothy may think that he is getting a good return on his investment. In financial terminology, we will call this 5% as the nominal rate.

However, the question remains, is 5% the actual return on Mr. Timothy’s investment? The answer is no. We also need to consider inflation and also tax (if the return on investment is not tax-deductible).

Real Rate of Return Formula

By considering the inflation rate, we can calculate it as follows

Real Rate of Return = (1+Nominal Rate)/(1+Inflation Rate) - 1

Example

Ms. Soul has kept $100,000 in a bank. The bank promises to pay a 6% rate of return at the end of the year. The inflation rate is 3% during the year. What would be the real rate of return?

- Real Rate of Return Formula = (1 + Nominal Rate) / (1 + Inflation Rate) – 1

- = (1 + 0.06) / (1 + 0.03) – 1

- = 1.06 / 1.03 – 1

- = 0.0291 = 2.91%.

Interpretation

In this formula, we’re first considering the nominal rate, and then we will consider the inflation rate.

As you already know – the rate of return on the investment or the bank offers is the nominal rate of return. However, to find out the inflation rate, we need to use the consumer price index. Alternatively, businesses can use a different consumer price index to calculate the inflation, or they can only take the goods and services into account that are related to their business.

Here’s the formula by using which we can find out the inflation rate –

Rate of Inflation = (CPI x+1 – CPI x) / CPI x

Here, CPI x means the initial consumer index.

If you have invested a good amount, it’s always prudent to use the real rate of return to see how much you’re actually earning on the investment.

However, if you just want to make sure how much you’re actually making in a casual sense, you can just use the following formula – (nominal rate – inflation rate).

Though this formula is not recommended, you can just check before going into detail.

Use and Relevance

If the investors want to know how much they are actually making (in some cases, it is actually negative), In this formula is a good one.

However, there are two things you need to consider before using this formula.

- The first thing is to deduct the inflation rate (or to divide the inflation rate); you need to make sure that you will purchase the same goods the CPI considers.

- The second thing is the rate of return is not always accurate. Yes, you can calculate the real rate of return by using the formula, but there can be more factors that you may need to consider, e.g., taxes, opportunity cost, etc.

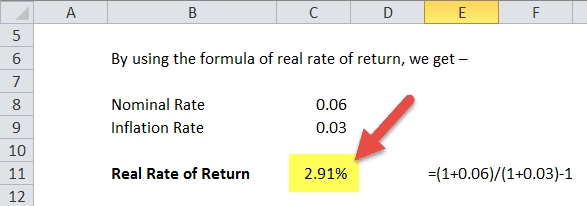

Real Rate of Return in Excel (with excel template)

Let us now do the same example above in Excel. This is very simple. You need to provide the two inputs of the Nominal Rate and Inflation Rate. You can easily calculate the real rate of return in the template provided.