Table Of Contents

What Is A Real Estate Loan?

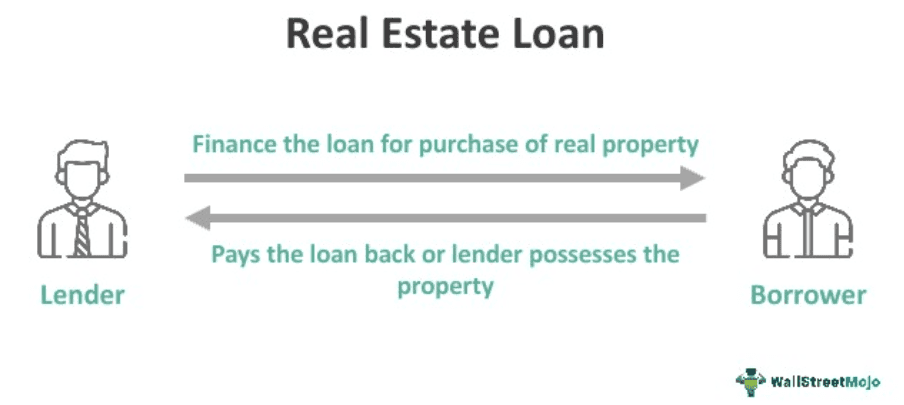

A real estate loan is used to finance the purchase of real property, including land and any buildings or structures on it. Hence, these loans aim to provide financial flexibility and support for individuals and businesses looking to participate in the real estate market.

These loans allow individuals to purchase property they may not afford outright. By spreading the cost of the property over the years, individuals can make homeownership more affordable. Additionally, it provides individuals with the opportunity to diversify their investment portfolio. Individuals can spread their risk across different asset classes by investing in real estate and earning higher returns.

Key Takeaways

- A real estate loan is a financial product utilized to fund the acquisition of real property, which may comprise the land and any physical structures.

- Real estate loans are often used to finance the purchase of a primary residence, an important goal for many individuals and families.

- Several types of real estate loans include conventional, FHA, and VA bridge loans.

- When applying for a loan, borrowers typically need to provide information about their financial situation, credit history, and details about the property.

Real Estate Loan Explained

Real estate loans are financial products that enable individuals and businesses to purchase and invest in real estate. They give borrowers money to purchase property, which is repaid over years with interest. Hence, if the borrower fails to repay the loan according to the agreed-upon terms, the lender has the right to take possession of the property through foreclosure.

Furthermore, commercial real estate loans are designed explicitly for non-residential real estate, which includes various property types such as office buildings, retail spaces, industrial facilities, hotels, and multifamily housing.

In the United States, real estate loans are a common way for individuals and businesses to finance real estate purchases or investments. Therefore, these loans are available from various lenders, including banks, credit unions, mortgage brokers, and online lenders.

Besides, the process of obtaining a real estate loan involves an application, pre-approval, underwriting, and closing. Borrowers will be required to provide detailed financial information and documentation to the lender, and the lender will review the application and determine whether to approve the loan.

Thus, if the loan is approved, the borrower will go through underwriting, a detailed review of the borrower's financial history and creditworthiness. Once underwriting is complete, the borrower will sign the loan documents to fund the loan. Therefore, real estate loan agreements are legally binding documents, and both parties should thoroughly review and understand the terms before signing.

Moreover, these loans are typically repaid over years, with each payment covering a portion of the principal and interest. To help borrowers make informed decisions, consulting reputable lending companies can provide guidance on the range of financing options available. Their expertise can assist in identifying loan terms that align with individual financial goals, ensuring flexibility in the repayment process.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

How To Get?

There are various steps involved in procuring a real estate loan:

- Determining eligibility: Real estate loans have different eligibility criteria, such as credit score, income, and debt-to-income ratio (DTI). An individual should check with various lenders to determine their specific criteria and whether they can meet them.

- Evaluate the type of loan: Different types have different requirements and features, so it's essential to understand what type of loan best meets an individual's needs.

- Finding a lender: Various lenders offer real estate loans, including banks, credit unions, mortgage brokers, and online lenders. Compare lenders and loan terms and choose the best to meet their needs.

- Apply for the loan: Once the person found a lender and loan type, fill out the loan application and provide any requested documentation, such as income statement, tax returns, and credit reports. Hence, the lender will review the application and determine whether to approve the loan.

- Close the loan: Once approved, the person will receive an estimate of the loan terms and costs. Review the estimate, ask any questions the person may have, and sign the loan documents at the closing.

- Payments: After closing, an individual will begin paying on the real estate loan. An individual should understand the payment schedule and amounts and make timely payments to avoid late fees or other penalties.

Types

Real estate loans come in various forms, each with features, advantages, and requirements. The most common real estate loan types are:

- Conventional Loans:: These loans are primarily provided by private lenders and are neither insured nor guaranteed by the government. Conventional loans generally require a good credit score and a down payment of at least 5-20% of the property value.

- FHA Loans: These loans are insured by the Federal Housing Administration (FHA) and are designed to help individuals who may not qualify for a conventional loan. Moreover, FHA loans require a lower down payment and have less stringent credit requirements.

- V.A. Loans: These are loans available to veterans and their families and guaranteed by the Department of Veterans Affairs. They generally offer lower interest rates and do not require a down payment.

- Bridge Loans: These are short-term loans used to bridge the gap between the purchase of a new property and the sale of an existing one.

- USDA Loans: Backed by the U.S. Department of Agriculture, USDA loans promote rural and suburban homeownership. They often have low or no down payment requirements.

- Adjustable-Rate Mortgages (ARMs): ARMs have an interest rate that may change periodically based on changes in a corrfdown payment requirementsesponding financial index. The initial interest rate is usually lower than that of fixed-rate mortgages.

- Construction Loans: A construction loan is designed to finance the construction of a new building or property. Once construction is complete, the loan may be converted into a permanent mortgage.

Examples

Let us look at real estate examples to understand the concept better:

Example #1

Let's say John is interested in investing in a rental property in the United States. After doing some research, he found a duplex that was priced at $400,000. He believes he can rent out each unit for $1,500 monthly, for $3,000 in monthly rental income.

To finance the purchase of the duplex, John decided to take out a real estate loan. After reviewing his financial situation, he found that he qualifies for a conventional loan with a 20% down payment and an interest rate of 4.5%. Therefore, he must put down $80,000 (20% of $400,000) and borrow $320,000.

He applies for the loan and goes through the underwriting process, which includes reviewing the credit history, income, and debt-to-income ratio. After the lender reviews the application, they approve the loan and proceed with the purchase.

John makes the down payment of $80,000 and takes out the $320,000 loan. The monthly mortgage payment is approximately $1,620, including principal and interest payments, property taxes, and insurance. Later, he finds tenants for both units and starts collecting monthly rental income of $3,000. Thus, after deducting mortgage payments, property taxes, insurance, and other expenses such as maintenance and repairs, John has a net monthly income of around $1,200.

Over time, John pays down the principal on the loan and builds equity in the property. If the value of the property increases, he may also be able to sell it for a profit. However, if property values decline, he may need help covering the expenses and making the loan payments.

Example #2

The average long-term U.S. mortgage rate increased in October 20223 to its highest level since December 2000, driving up the cost of purchasing a home and further lowering the affordability prospects for many prospective homebuyers.

According to mortgage buyer Freddie Mac, the average rate on the standard 30-year home loan increased to 7.49 percent from 7.31 percent in October 2023. The rate was 6.66 percent on average a year ago.

According to mortgage buyer Freddie Mac, the average rate on the standard 30-year home loan increased to 7.49 percent from 7.31 percent in October 2023. The rate was 6.66 percent on average a year ago.

The cost of borrowing on 15-year fixed-rate mortgages, popular among homeowners’ real estate loans, has also increased. From 6.72 percent, the average rate increased to 6.78 percent.

Borrowers' monthly costs may rise by hundreds of dollars as a result of elevated interest rates, which restricts their purchasing power in a market that is already out of reach for many Americans. Additionally, they discourage homeowners from selling who received rock-bottom rates two years before.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.