Table Of Contents

Real Estate Investment Definition

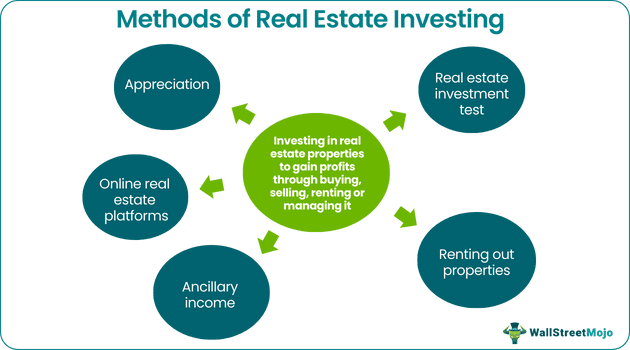

Real estate investing uses real estate properties as an investment vehicle and gains profit through a variety of methods. It can be as simple as owning real estate, collecting cash flow in rental income, and selling the asset for a higher price due to appreciation.

Investing in real estate can create generational wealth and far outperform the stock market if one does it right. There are four main ways to make money from owning real estate. These include rentals, appreciation, ancillary investment income, and dividends from owning real estate investment trust (REIT) shares. To support these strategies, many investors also use property data and market research tools. This PropStream Review breaks down how the platform can help identify and evaluate profitable opportunities.

Key Takeaways

- Real estate investors use real estate properties as an instrument of gaining profits through a variety of methods.

- Real estate investments can include flipping properties, renting out properties, owning REIT shares, ancillary incomes, online real estate platforms, etc.

- While it’s hard to measure the true average historical return for real estate investors, it is clear from anecdotal evidence that real estate can build generational wealth.

- A person can receive passive rental income, their property appreciates, leverage an investment, and receive great tax benefits through investing in real estate.

How to do Real Estate Investing?

Real estate investing can be done in many ways. First, a person can use capital to acquire a property. They can do this independently or create a fund with other people in their network to get started. It is just like finding and buying a house for dwelling, but instead, they rent the home and collect cash flow from tenants.

One can also invest your money in a real estate investment trust. These are public companies that own and operate real estate. So a person can buy and sell shares just like they would for any other stock. This is great if they do not have huge capital for the equity required in an investment property.

Additionally, a person can invest in an online real estate platform like Crowdstreet or Fundraise. Some of these platforms are only open to accredited investors. But they connect real estate developers and operators to investors looking to invest in real estate projects. One can even buy, renovate and flip real estate properties to turn a profit if they have the time and the handiwork to fix up an asset.

Another way to make money from real estate is through any ancillary income a person can create from their property. For example, maybe one put in a laundry unit that charges $1 per load or a vending machine at their duplex. They can also collect a management fee for managing the assets and make money this way.

Real Estate Investing for Beginners

The best way for beginners to get started with real estate investing would be to invest in REITs. One can purchase shares for a much smaller amount than the equity required for an entire property. They can also look at quarterly reporting to better understand the stock’s performance to increase the real estate investing acumen. A person can make some higher returns when they are ready and have enough capital to invest in rental properties.

For beginners, it is best to find assets that are in good condition and require very little work before renting to tenants. This is also called a turnkey. Renovations and capital projects should be left to seasoned investors who understand the risks of projects requiring this much work.

Historical Returns and Expectations

Investing in real estate does not create potential returns as high as investing in the same period in stock. Historically, housing prices have only increased by about 5% over the last 80 years. If one takes out the inflation, that drops to about 1.5% per year. On the other hand, stocks typically generate about 7% returns per year after inflation.

However, the housing market does not have the same dips and volatility as the stock market and can generate steady passive rental income while the owner holds the asset. As realtor Darren Robertson says, while real estate may not offer the same high returns as stocks, it provides stability and steady passive rental income, making it an excellent long-term investment.

Comparing the S&P 500 to a REIT stock is a more informed analysis because the REIT’s performance does encompass its rental income year over year. From May 1996 to July 2019, the S&P 500 total return was 621.8%, while the Vanguard Real Estate ETF Total Return was 865.3%. From this, we can conclude that huge growth can happen in real estate!

Why Invest in Real Estate?

Also, while holding an asset, one can generate a steady cash flow that can be a fantastic revenue stream and is not generated when only comparing sale prices. Another reason why real estate may outpace investing in the stock market is that a person can easily leverage their investment, whereas stocks are mainly limited by the amount of capital.

Some investment properties require as little as 3% down and allow an individual to rake in huge cash flow with only a few thousand dollars upfront. This is how one can generate wealth. It is impossible to quantify rental real estate investment returns because each case is unique, and no two pieces of real estate or markets or taxation policies are the same. Still, there are countless anecdotal stories of people building all their wealth through real estate.

According to the IRS, another huge real estate investing benefit is property depreciation for tax purposes. People can write off the purchase price for years on their tax returns and save themselves from paying higher taxes.

Frequently Asked Questions (FAQs)

Real estate is an excellent investment option for anyone seeking out huge profits. There are several ways a person can start earning money from real estate properties. House flipping, rental income, real estate investment trusts (REITs), real estate investment groups(REITs), online real estate platforms, etc. are some of these.

Real estate investing works through the buying, selling, managing, renting, and handling of real estate properties in a way that generates income. There are many methods through which a person can make money from real estate properties. Many people consider real estate a viable source of income that allows flexible investment.

Digital real estate involves the purchase, sales, and flipping of digital assets, like domain names, applications, social media accounts, etc. As the advancements in the virtual world progressed, digital real estate investment was on rise and, just like physical real estate, became a tool of easy money-making.