Table Of Contents

Real Estate Appraiser Definition

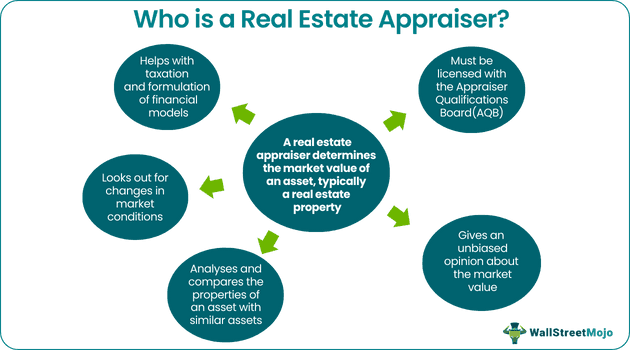

A real estate appraiser is a trained and certified person who provides an unbiased estimate of real estate value according to the detailed appraisal process. An appraisal is the appraiser’s opinion of value for a real estate based on the particular elements of the subject property and approved appraisal methods.

The appraiser visits and studies the specific piece of real estate property to compare them with other similar properties. The appraisal report will contain the estimated market value of the subject property with detailed and accurate information on the subject property and comparable properties used.

Key Takeaways

- Real estate appraisers are professionals hired to estimate the true market value of a specific piece of real estate property.

- Licensed real estate appraisers are essential for real estate valuations and transactions.

- They evaluate real estate using three different approaches, namely the income approach, cost approach, and sales comparison approach.

- All appraisers must adhere to standards put forth by the Appraiser Qualifications Board (AQB) and gain a real estate appraiser license.

Roles and Responsibilities

The appraiser is supposed to give an unbiased opinion about the value of a property without favoring either the buying or selling parties. The roles and responsibilities of a real estate appraiser include:

- Collecting and verifying all the necessary data regarding commercial and residential properties.

- Physical inspection and valuation of structures and properties and comparison with similar properties to understand the quality, characteristics, and differences.

- Studying the conditions of the neighborhood and their effect on the subject property

- Staying alert regarding all the events in the market and their effect on the change of the value of properties.

- Studying the previous appraisals about the property

- Documentation and data management

- Helping to formulate the best financial model

- Presenting an honest and fair appraisal report as and when needed by the clients

Real Estate Appraisal Approaches

There are three main approaches to evaluating a property:

#1 - Sales Approach

The value is calculated by comparing the subject property with other similar properties with recent sales (called comps). This approach is the most reliable for appraising residential real estate. Typically the appraiser will select at least three comps within a mile sold less than six months ago. Since no two pieces of real estate are identical, the appraiser must make adjustments for the differences and similarities in the comps based on the following:

- Property rights: If the subject property is sold outright and comp is only a land lease. Then the comp would have less value than the subject.

- Financing concessions: Owner financing versus a mortgage loan.

- Conditions of sale: Properties that are sold with certain motivations such as a foreclosure, a sale to family members, or part of a portfolio.

- Location: Similar properties in different locations, neighborhoods, or school districts.

- Physical features and amenities: The comps’ structure, age, size, condition, and amenity set.

- Market conditions: The interest rates, supply and demand, and other economic factors at the time of comps’ sale.

#2 - Cost Approach

This approach values a property based on the cost to construct it and is most helpful to appraise special purpose buildings or newer buildings where the cost to construct/replace the property is most relevant. There are five steps to this approach:

- 1: Estimate the value of the land as if it were vacant and available for its best use

- 2: Estimate the current cost of construction and all of its improvements

- 3: Estimate any accrued depreciation from the property’s current physical condition, deterioration, and obsolescence.

- 4: Subtract the accrued depreciation from the current construction cost.

- 5: Add the land value to the depreciated cost to find the total property value (i.e., Land+Construction Cost-Depreciation=Value).

#3 - Income Approach

The income approach values income-producing properties such as apartment buildings or office buildings through five steps:

- Estimate annual potential gross income which is based on market rates, not on in-place revenue.

- Deduct vacancy and other potential losses to arrive at effective gross income.

- Deduct operating expenses to arrive at the annual net operating income (NOI).

- Estimate the rate of return someone will pay for this type and class of property.

- Apply the market cap rate to the subject property.

How to Become a Real Estate Appraiser?

A person needs to be licensed in the state if they want to become an appraiser. Most states require appraisers to have a bachelor’s degree to receive their license. The Appraiser Qualifications Board (AQB) has a strict set of standards that all appraisers must adhere to. It includes education, experience, and examination guidelines that all states follow when issuing licenses.

Salary

According to Indeed, entry-level professionals usually start working as part-time appraisers and earn about $50-$150 per appraisal. After 1,000 hours as a trainee, appraisers may sit for the licensing exam. At that level, the average real estate appraiser salary ranges between $35,000 and $80,000. The next licensure level earns approximately $45,000-$95,000 as a real estate appraiser salary. And finally, the certified general appraisers will be making about $60,000-$105,000.

Real Estate Appraiser License

Appraisers have a year-long training before they become certified general real estate appraisers. First, they can be a trainee appraiser, which is an entry-level position. Then they can become a certified residential appraiser (qualified to evaluate only residential properties of 1-4 units). And finally, they reach the status of certified general appraiser who is qualified for all types of valuations.

Frequently Asked Questions (FAQs)

A real estate appraiser is a professional hired by buyers and sellers to make an accurate estimate of the market value of an asset, typically a real estate property.

Real estate appraisers are an integral part of real estate transactions, and all financial institutions and other entities highly regard their opinions. Therefore, these professionals are in high demand and hence make real estate appraising a good career to pursue.

The average salary of a licensed real estate appraiser ranges between $35,000 and $80,000. Certified general appraisers can earn as high as $105,000. Entry-level appraisers earn much less compared to experienced professionals. But appraisers in managerial positions and certified residential appraisers make a much bigger sum depending on their reputation.