Table Of Contents

What is the Rate of Return?

The rate of return is the return that an investor expects from his investment and it is basically calculated as a percentage with a numerator of average returns (or profits) on an investment and denominator of the related investment on the same.

Examples

Example #1

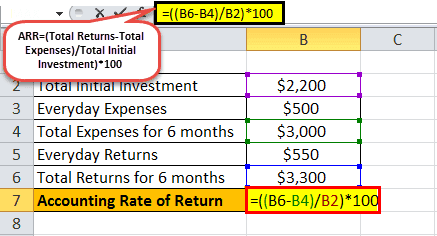

Anna owns a produce truck, invested $700 in purchasing the truck, some other initial admin related and insurance expenses of $1500 to get the business going, and has now a day to day expense of $500. Let’s consider hypothetically that her everyday profit is $550 (ideally, it will be based on sales). At the end of 6 months, Anna takes up her accounts and calculates her rate of return.

- Total Initial Investment: $2,200

- Everyday Expenses: $500

- Total Expenses for 6 months: $3,000

- Everyday Returns: $550

- Total Returns for 6 months: $3,300

So, we have the following data for the calculation of the Rate of Return:

Rate of Return =((Total Returns -Total Expenses )/Total Initial Investment )* 100

= ($3,300 - $3,000) /$2,200 X 100

Hence, the Rate of Return will be :

Example #2

Joe has invested equally in 2 securities A & B. He wishes to determine which security will promise higher returns after 2 years. Likewise, he wants to decide whether he should hold the other security or liquidate such a position.

Let us first find out returns from each security at the end of 1 year.

Return calculated for compounded interest is as below:

Below are the statistics related to his investment:

Security A:

Investment: $10,000

Interest Rate: 5% paid annually, compounded basis

Term to maturity: 10 years

A = PX ^(nT)

where:

- A = Amount (or Return) after a particular period of calculation

- P = Principal

- R = Rate of Interest

- n = Interest payment frequency

- T = Period of calculation

So, the calculation of Rate of Return for Security A(A1) will be as follows -

A = PX ^(nT)

Therefore, Return after 2 years for Security A (A1) = $10,000 X

So, Return after 2 years for Security A (A1) will be:

Return after 2 years for Security A(A1)=$11,025.

Security B:

Investment: $10,000

Interest Rate: 5% paid semi-annually, compounded basis

Term to maturity: 10 years

Therefore, calculation of Return after 2 years for Security B (A2) = $10,000 X

So,Return after 2 years for Security B(A2)= $11,038.13

Analysis:

It is determined that although the returns are similar, yet Security B gives a little return. However, it is not required to completely liquidate the other position, as the difference between the two returns is minimal; as such, Joe is not harmed by holding Security A.

Example #3

Joe wants to now calculate returns after the 10th year and wants to assess his investment.

Based on the returns calculated from the compound interest formula, we can calculate for 10 years as below:

So, the Calculation of Rate of Return for Security A(A1) for 10 years will be as follows -

A = PX ^(nT)

Therefore,Calculation of Return for 10 years for Security A (A1) = $10,000 X

So, Return for 10 years for Security A (A1) for 10 years will be:

Return for 10 years for Security A (A1)= $16,288.95.

Therefore,Return after 10 years for Security B (A2) = $10,000 X

Return after 10 years for Security B(A2)= $16,386.16

Relevance and Use

- Every investor is exposed to risk and returns. The returns offered by an avenue may or may not be the actual returns over a period of time on the riskiness of the asset in markets. Hence it is extremely important to understand the actual rate of return for the investment.

- It helps in capital budgeting decisions. It helps in identifying whether investing in a particular project is beneficial over a period of time and choose between options by comparing and identifying the best venture.

- It suggests the trends prevalent in the market and sometimes may even suggest futuristic views.

- A rate of Return is a simple calculation of suggestive investment for particular gains. One can make tweaks in their inputs and try to understand the amount to invest in order to earn particular returns.

- It is used to compare different investments and understand the background of such investment or benefits of the same.

- It gives the financial standing of the respective individual or firm as a whole.

Conclusion

The rate of return forms a pivotal terminology for all the analyses related to investments and their returns. It helps in various ways, as we have seen above, however, only when calculated right. Although it seems like a simple formula, it gives results that are required for making some major decisions – be it in finances or other return related decisions. Hence, it is very important to arrive at the accurate calculation, as it forms the basis of entire investments, future planning, and other economic-related decisions.