Table Of Contents

What is Random Walk Theory?

Random Walk Theory says that in an Efficient market, the stock price is random because you can't predict, as all information is already available to everyone. How they will react depends on their financial needs and choices. An efficient market, on the other hand, is a market with transparency and general information; future earnings are taught in the stock price.

In an inverse situation of the random walk theory economics is when a buyer is buying a stock, then they are buying it based on any information; that information is also available to the seller who is selling the stock. This is the efficient market, where everyone has got the information, and still, they do what is good for them according to their personal choice.

Key Takeaways

- Random Walk Theory states that stock prices in an efficient market are random due to unpredictability and financial needs. The reaction depends on financial requirements and choices.

- Random Walk Theory suggests investing in fund managers to manage random stock prices, as luck may not sustain and an alpha return may not be achieved in the next year.

- Passive investors believe in Random Walk Theory, as fund managers' performance fails to outperform the index, leading to a preference for passive ETF investments over fees.

Random Walk Theory Explained

Random Walk Theory is practical and has proven correct in most cases. The theory says that if Stock Prices are random, we need to waste money and hire fund managers to manage our money. It may happen that a fund manager has managed to provide an alpha return, but it may be due to luck, and luck may not sustain, and it may not provide an alpha return in the next year.

Alpha return is the extra return that a fund manager promises to pay over and above a benchmark return. Suppose all the other theories that provide ways to predict future stock prices were true. How can so many fund managers who apply both technical and fundamental analysis end up earning a negative or the same return as the benchmark? Well, according to random walk theory finance, after applying all theories, the stock prices can't be predicted, then obviously, it is random.

In a world where markets are efficient, the only way to earn a return is with the market itself. That is to invest in ETFs or mimic an Index by buying the same stocks in the same quantities. In this way, the cost of fund managers can be avoided, and you will end up earning the same return or maybe more because fund managers charge fees for funds they manage.

The belief has grown stronger that no fund manager can beat benchmark year on year, so instead of paying fees to managers, it's better to invest passively in ETFs.

Assumptions

The random walk theory economics assumes that stock prices follow a random and unpredictable pattern. It posits that future price movements cannot be reliably predicted based on past prices or any other information, as stock prices adjust instantaneously to new information, rendering past data irrelevant.

This theory contends that stock price changes are independent and identically distributed, meaning that each price change is unrelated to the previous change and has an equal likelihood of being up or down.

Furthermore, the theory assumes that all market participants have equal access to information and that prices fully reflect all available information. This notion leads to the concept of the Efficient Market Hypothesis, suggesting that it's impossible to consistently outperform the market by exploiting mispriced stocks.

Instead, investors should adopt a passive investment strategy, such as investing in index funds, as active trading strategies are unlikely to consistently yield higher returns due to the randomness of price movements.

This theory’s assumptions underscore the challenges of beating the market consistently through technical or fundamental analysis. It emphasizes the importance of diversification, long-term investing, and understanding the limitations of prediction in financial markets.

Examples

Let us understand the concept and its practicality through the examples below.

Example #1

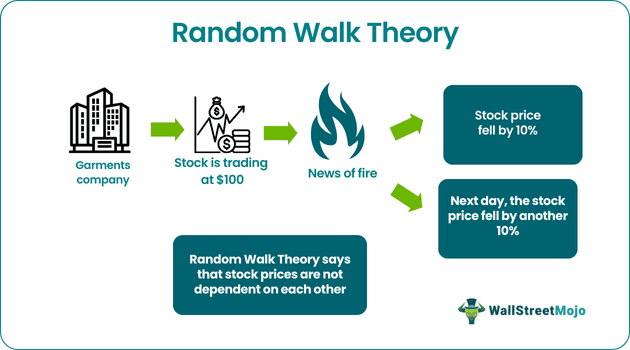

LMN garments company’s stock is trading at $100. Suddenly there was news of the fire in the factory, and Stock Price fell by 10%. The next day when the market started, the stock price fell by another 10%. Hence, what Random Walk Theory says is that they fell on the fire day was due to the news of the fire, but they fell on the next day was not on the news of the fire again. Due to any updated news on fire, say, an exact number of fabrics burned that caused the fall on the next day.

Therefore, Stock Prices are not dependent on each other. Each day stock reacts to various news and is independent of each other.

Example #2

The stock price of Apple Inc. opened at $190.02 on March 21, 2019. Its price rose to $195.09 during the closing bell. On March 22, the very next day, it lost all the value it gained the previous day and did not even gain the momentum back to $195 till April 3 2019.

Subsequently later in April 2019, the share price breached the $200 mark and lost all gained value in May and lost the value in June. This is a textbook example of this theory with one of the most prominent stocks in the U.S. market.

How Does It Apply to Stocks?

Let us understand in detail how this theory applies to the stock market and stocks through the explanation below.

- Stock movement, as described by random walk theory finance, is unpredictable. The easiest way to earn money in this world is to invest in stocks and wait for them to grow. Hence, this theory says that if the movement of stock price had been so easy to predict, then everyone would have made a fortune by now. Not all who invest in stocks end up winning. Then how are people losing money?

- Random Walk criticizes Technical Analysis. This theory heavily criticizes fundamental analysis and technical analysis. Technical analysis says that history repeats. Thereby, stock prices follow the trend that they have shown in the past. Random Walk believes that the stock price was as per the information available in the past. Each stock price is independent of the other.

- It means today's stock price is not dependent on what the stock price was yesterday. Yesterday's price was based on available information, and today, the stock price is based on available information. Everyone has access to all the information. Insider information is not included in this theory.

- Random Walk Theory is based on the weak-form efficient market hypothesis, which states that all the available information is already taught in the stock price. Suppose there is any prediction of future earnings, then that earning's present value is also taught in the stock price. The trading is between informed buyers and informed sellers, and it depends on what they would like to do. So ultimately, it is random.

Implications

Since we now understand the basics, assumptions, and examples of the random walk theory economics, let us now delve deeper into the implications of this theory through the discussion below.

- Stock Prices are random, so instead of spending money on Fund Managers, one should buy ETFs or spend on stocks in the exact quantity of an index.

- Technical analysis or fundamental analysis doesn’t work in predicting the stock price as it is impossible to predict it.

- Stock prices are independent; today’s stock price has no relation to yesterday’s stock price.

- Markets are efficient, information is readily available, and informed decisions are always taken.

Advantages

Let us understand the advantages of the random walk theory finance through the points below.

- Efficient Market Perspective: The Random Walk Theory asserts that stock prices rapidly adjust to new information, ensuring that market prices accurately reflect all available information. This viewpoint highlights the efficiency of financial markets in processing and incorporating information, aiding investors in making informed decisions.

- Balanced Investment Approach: By assuming that stock price movements are unpredictable, the theory encourages a diversified and balanced investment strategy. Investors are urged to focus on long-term goals rather than attempting to time the market, ultimately reducing the risk associated with trying to predict short-term price movements.

- Mitigated Illusion of Patterns: The theory dispels the illusion of discernible patterns in stock price movements. Recognizing that prices follow a random and independent trajectory helps investors avoid falling prey to misleading patterns that might lead to poor investment decisions, promoting a more rational approach to investing.

Disadvantages

Despite the advantages mentioned above, there are a few disadvantages that are as discussed below.

- Markets are not entirely efficient. Information asymmetry is there, and many insiders react much earlier than other investors due to the information edge.

- In many cases, stock prices have shown a trend year on year.

- One lousy news affects a stock price for several days, even months.

Random Walk Theory Vs Efficient Market Hypothesis

Both the random walk theory economics and efficient market hypothesis help investors in understand the price movements of stocks. However, there are a few differences in their fundamentals and implications. Their differences are discussed below.

- The Random Walk Theory posits that stock price changes are unpredictable and follow a random pattern, rendering past data and trends irrelevant for predicting future prices.

- In contrast, the Efficient Market Hypothesis (EMH) contends that financial markets instantly and accurately reflect all available information in stock prices.

- It asserts that prices always incorporate new information, making it nearly impossible for investors to consistently outperform the market using past data or insider information.

- While both theories focus on market efficiency, the Random Walk Theory emphasizes the unpredictability of price movements, while the EMH highlights the rapid and comprehensive assimilation of information into prices.

- The EMH supports the notion that investors should embrace passive strategies like index investing, while the Random Walk Theory suggests that attempts to predict price patterns are futile.