Table Of Contents

What Is Quote Stuffing?

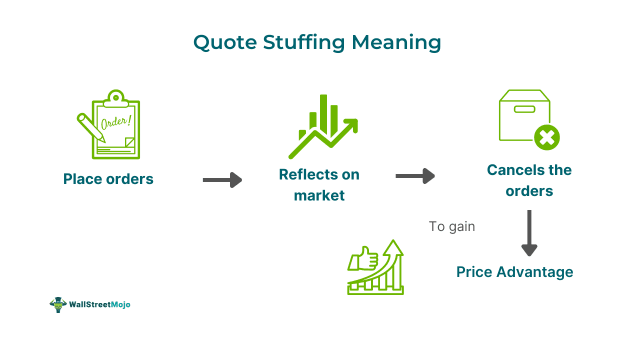

Quote Stuffing, in the equity market, is a type of market manipulation technique in which multiple buy and sell orders are placed and suddenly withdrawn or canceled. The main purpose of this technique is to create a false sense of hype in the market and gain a price advantage over rivals.

Quote stuffing occurs when traders want to compete with others. As a result, the rest of the market has no time to match their timing. However, it can cause severe disruptions in the market and volume traded.

Key Takeaways

- Quote stuffing is a market manipulation technique traders use to place high-volume trades and cancel them as the market reflects these orders.

- In 2010, Nanex's founder, Eric Scott Hunsader, coined this word after the Flash crash that happened in the same month.

- Usually, high-frequency traders (HFT) are a part of it. They use varied algorithms to create a false sense of belief about a particular trend in the market.

- The only difference between quote stuffing, spoofing, and layering is that the trader cancels after reflecting on the former. But, in spoofing, it cancels before execution.

Quote Stuffing Explained

Quote stuffing trading is a stock market manipulation that tries to stuff unnecessary trades or quotes within the market. Here, traders try to trade at large volumes, but they cancel the trades as they can create that trend. In short, they tend to perform this before anyone notices. As a result, no one gets a chance to identify and detect these trades. Therefore, it causes sudden chaos in the market volume. Plus, there are extreme highs and lows due to this.

The term was first coined by the founder of The Nanex firm, Eric Scott Hunsader, in 2010. Hunsader termed it a strategy to help gain a price edge over competitors. The possible quote stuffing is visible within high-frequency traders. As per Nasdaq, almost 50% of the trades account for high-frequency trading (HFT). However, traders use unusual algorithms, which leads to quote stuffing. They place and cancel the orders at a subsequent rate, surpassing bandwidth. These trades are also known as phantom orders.

Usually, phantom orders occur when trades exceed the defined limit. And if they do so, the exchange can suffer havoc. A perfect example would be the 2010 Flash Crash (or crash of 2:45) in the United States. It started at 2:32 EDT and lasted for 36 minutes on the exchange. At this point, the Dow Jones Industrial Average fell by 1000 points. Moreover, there was a loss of $4.1 billion in trade on the New York Stock Exchange (NYSE).

Thus, various regulatory authorities have stepped forward to monitor possible quote stuffing detection. These include the Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA), and the Commodities and Futures Trading Commission (CFTC).

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Examples

Let us look at the examples of quote stuffing to have a better view of the concept:

Example #1

Suppose ABC Ltd is a stock operating on the New York Stock Exchange. Steven is a long-term trader in the same market. So, he attempts quote stuffing. He buys ABC Ltd stock at different prices and periods. As Steven places these orders, the market slowly reflects the information. Within a few days, the rest of the traders notice a bullish trend as candles go green. Now, reacting to it, directional trading takes place and starts following the trend. However, Steven has different plans for it.

As the market goes bullish, Steven reverses his position. So, if he entered a trade of $50,000, he would sell them. As a result, the rising trade volume witnessed a downfall. The chart goes bearish with Steven's selling. It causes uneven price candles, leading to fluctuations in the market indices. There are possible ways to detect quote stuffing, but it gets complicated.

Example #2

On September 13, 2010, a New York-based high-frequency trading (HFT) firm, Trillium Capital, received a $1 million quote stuffing fine. The firm created a false appearance by placing orders. Using a high-frequency trading strategy, Trillium traders forced other market participants to execute against limit orders and cancel orders to fabricate false market activity. This resulted in 46,000 times that Trillium traders received favorable prices.

As a result, seven traders, along with the director, senior vice president, a vice president, and a chief compliance officer, were found to be afflicted with quote stuffing and market manipulation.

Quote Stuffing vs Spoofing vs Layering

Although the three concepts sound the same, they differ slightly. Let us look at their differences to comprehend them better:

| Basis | Quote Stuffing | Spoofing | Layering |

| Meaning | It refers to placing trades and canceling them once the market has reflected the information. | Here, spoofing tries to place orders but cancels them before execution. | Layering allows traders to place multiple orders at a price away from the market price. |

| Purpose | To deceive the market participants by placing large orders and gaining a price advantage. | To manipulate the supply and demand forces and create a particular trend for a shorter time. | To force the other traders to follow that temporary price and adjust to it.

|

| Example | Mr. A placed a 1000 shares buy order and canceled it after the trend turned bullish. | Mr. B buys 500 shares with a stop-loss and cancels it midway before execution. | If the market price of ABC Ltd is $100, Mr. L places multiple orders at $95, $97, and $98. |

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.