Table Of Contents

What Is The Quantity Theory Of Money?

The quantity theory of money describes the relationship between the supply of money and the price of goods in the economy. It states that percentage change in the money supply will result in an equivalent level of inflation or deflation.

That means if the money in the economy doubles, then the price level of the goods also gets doubled, causing inflation, and consumers will have to pay double the price for the same amount of goods or services. An increase in prices will be termed inflation, while a decrease in the price of goods is deflation.

Key Takeaways

- The quantity theory of money shows the relationship between the money supply and the goods price in the economy. It states that a percentage change in the money supply may give rise to equivalent inflation or deflation.

- The central point is that the quantity money theory shows that the quantity of money estimates the value of money.

- Therefore, to end inflation, economies must verify the money supply. This theory assumes that the good's output and velocity stay consistent.

- The quantity theory of money believes that people desire to spend more if they have additional money.

- It means more people bid for similar goods/services, increasing prices.

- The relationship between value and supply of money is not directly proportional.

Quantity Theory Of Money Explained

The quantity theory of money in economics states that the quantity of money will determine the value of money. The general level of prices of products and services in an economy is directly related to the volume of money that is circulating in the economy. If the quantity of money changes in an economy, the price level will also show a change in that same proportion. So, to stop inflation, economies need to check the supply of money. This theory assumes that the output of goods and velocity remain constant.

Though the quantity theory of money formula has many limitations and has also been criticized, it also has certain merits. The quantity theory of money depends on the simple fact that if people have more money, they will want to spend more, and that means more people will bid for the same goods/services, which will cause the price to shoot up. Though empirically, the relationship between value and supply of money is not the directly proportionate one, we can see that excessive supply of money increased inflation in the past.

This theory was first formulated by Nicolaus Copernicus in 1517, and it evolved later with the help of various other economists.

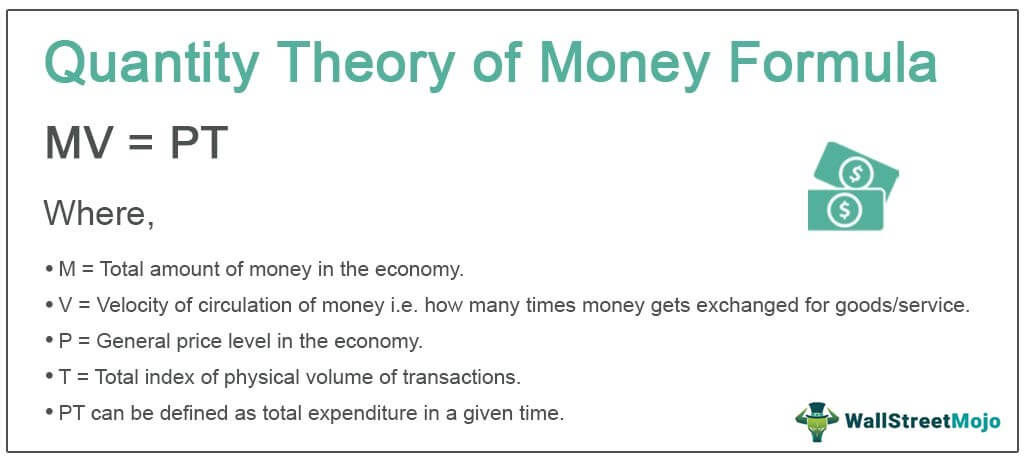

Equation

The Fisher equation can easily describe the quantity theory of money. The value of money can be described by the supply and demand of money, as we determine the supply and demand of commodities. The quantity theory of money formula can be described by

MV = PT

Where,

- M = Total amount of money in the economy.

- V = Velocity of money circulation, i.e., how many times money gets exchanged for goods/services.

- P = general price level in the economy.

- T = Total index of physical volume of transactions.

- PT can be defined as total expenditure in a given time.

Example

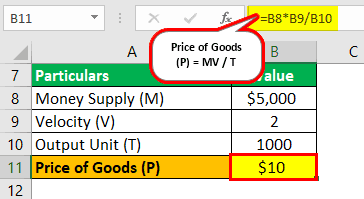

Following the example of the quantity theory of money will help in understanding this better:

Let’s say a simple economy where 1000 outputs are produced, and each unit sells for $5. If there is a total amount of money involved in $2500, then below will be the TQM equation:

Solution:

Given,

- M = $2500

- T = 1000

- P = $5

- V =?

Calculation of Velocity can be done as follows:

As per the Quantity Theory of Money equation

- MV = PT

- 2500 * V = 1000 * 5

Velocity (V) = 2

That means each dollar will change hands twice in the economy in the given period.

Let’s say now the money supply increases to $5,000. The output unit and velocity of circulation will remain the same. So, we can see the new price of goods will be:

Calculation of Price of Goods can be done as follows:

Price of Goods (P) = MV/T

Price of Goods (P) = 5000*2/1000

Price of Goods (P) = $10

So here we can say if the money supply in the economy doubles, then the price of goods also doubles to $10.

You can refer to the above given excel template for the detailed calculation of the quantity theory of money.

Assumptions

Let us look at the quantity theory of money assumptions.

- It assumes that the speed in which the money is circulating in the economy, which is the velocity of money, to remain constant and it depends on the type of population, trading facilities, interest rates, investment opportunities.

- It also assumes that the volume of the products and services are constant in the economy.

- In this theory, the prices do not play an active role.

- The theory also considers all transactions taking place are using money. Thus, money is the only medium of exchange and no one accumulated or hoards money.

The above are the various quantity theory of money assumptions.

Inflation in Argentina

In the 1980s, inflation rates in countries like Argentina, Peru, Brazil were skyrocketing. The reason was the high money supply in the economy. As the economy has more money, more people can buy the goods, which is why the value of money decreases and the price of goods increases. Argentina had a very high fiscal deficit, and it was increasing each year, and that's why the country was printing money to finance it..

Source: tradingeconomics.com

With the above graph, we can see that the inflation rate in 1989 was more than 20,000%. That means one year before if the price of a good was 1 peso, then in 1989 it increased to 20,000 pesos. The only reason was that the fiscal deficit bank had to print more money, which is why the price increased, proving the quantity theory of money inflation phenomenon.

Benefits

Some of the advantages of quantity theory of money in economics are as follows:

- It brings out the relationship between money supply and price level in the economy.

- The equation is very simple and easy to understand.

- This equation has been supported by empirical evidence.

Limitations

- Its simplicity is one of its limitations. People know that it is obvious that if the money supply increases, the price will decrease. It does not state the cause and effect of the increasing supply.

- This equation assumes that the velocity and output of goods will remain constant and will not be affected by other factors, but an actual change in any of these factors is changeable.

- It does not explain the trade cycle. If a decrease in money causes depression, then if we increase the amount of money, reversal or quantity theory of money inflation should happen, but this is not the case most times in actuality.

- It is not useful in short-term time frames. It is only useful for a long period.

- Some of this theory’s elements are inconsistent. For example, P includes the price of all goods or services in the economy, but we know that the price movement of some goods is quite rigid compared to other goods. So, it is hard to say which price we refer to in the equation.