Table of Contents

What Are Qualified Adoption Expenses (QAE)?

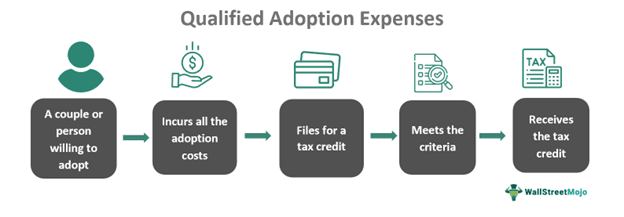

Qualified adoption expenses are the amount of money paid to adopt a person who is younger than 18 years old or an older person who needs care. It is paid as an essential cost by the person willing to adopt to the adoption agency. These costs are incurred either before or after the legal adoption.

When someone adopts a person, they become adoptive parents. In the US, the Internal Revenue Service (IRS) defines such costs as reasonable expenses. It categorizes it as an adoption tax credit, which can be claimed in the tax filing by reducing the adoptive parent’s taxable income. However, the IRS will only allow it if the tax-filing parents meet the eligibility criteria.

Key Takeaways

- Qualified adoption expenses (QAE) are reasonable expenses that are incurred during the adoption of an individual younger than 18 years of age or an older adult in need of care.

- For 2024, the maximum QAE tax credit is $16,810, as per the IRS guidelines. It remains a nonrefundable tax credit aimed at assisting adoptive parents with adoption-related expenses.

- Irrespective of whether the adoption was successful or not, all the expenses incurred by an applicant during the process of an attempt or failure endeavor are also qualified for tax credit.

- Claimed through IRS Form 8839, the IRS has strict guidelines for the type of expenses, foreign child adoption, US citizens, older people, and children with special needs.

Qualified Adoption Expenses Explained

Qualified adoption expenses include all the expenditures incurred during the entire adoption process of a child below 18 years of age. They also cover expenses for an older adult in need of care. When a couple or an individual decides to adopt a child, it is a noble cause, but it is also a complex process that requires time and effort. Most importantly, it involves a reasonable amount of money for legal proceedings, documentation, legal fees, attorney payments, adoption agency fees, and other related expenses.

In the US, the Internal Revenue Service, which is the federal tax authority, recognizes this and understands that such expenses are large. Thus, these expenses are defined as reasonable expenses that shall be categorized for an adoption tax credit. When a person who has tried, attempted, failed, or even successfully adopted a child files for a tax return, they can claim this as an exclusion or a tax credit, reducing their tax liability or taxable income.

For this, the applicant can file IRS Form 8839 for qualified adoption expenses, which may also include essential travel expenses, food, and accommodation expenses apart from the general expenses of the whole process. The IRS reviews a tax return claiming the exclusion or tax credit with meticulous attention to detail. The applicant must retain all receipts, bills, and records of payments made during the adoption process, along with copies of tax returns filed each year.

Who Is Eligible?

According to the qualified adoption expenses instructions, the eligibility criteria are listed below:

- Any individual who has paid such expenses to adopt a child below the age of 18 or an older person who requires care is eligible for the adoption tax credit.

- The eligibility stands effective even if the adoption hasn’t been finalized or was finalized in a different tax year.

- Both the child and the older person shall primarily be US residents or citizens. The applicant may qualify for the tax credit if they adopt a foreign child under certain circumstances.

- However, in the case of the adoption of a child with special needs, there are different and specific rules to claim the credit on Form 8839.

Maximum Qualified Adoption Expenses

Below is the information regarding the maximum QAE:

- The maximum qualified adoption expenses tax credit for 2023 was $15,950, which increased to $16,810 in 2024.

- It is a non-refundable tax credit. Hence, the full benefit of the credit can only be recognized if the applicant’s total tax is at least equal to their adoption tax credit.

- In case the entire credit is not utilized, the left-out amount can be carried forward to offset the applicant’s future tax for up to the next five years.

- The applicant's income plays an integral role in the adoption process and eligibility criteria. As the income increases and goes beyond a certain threshold, the applicant’s eligibility for the tax credit declines.

- The IRS dictates certain restrictions and limitations on married couples filing separately and claiming the tax credit as well.

How To Claim?

The following steps are to be followed to claim for the costs of QAE:

- Any person or parent filing for tax will have to use IRS Form 8839 to claim both the exclusion and adoption tax credit.

- The tax credit and exclusion have separate income and dollar limitations. The income limit on the adoption credit and exclusion depends on the adopting individual’s modified adjusted gross income (MAGI). Hence, it should fall between certain dollar limits so that the credit and exclusion can be reduced or eliminated.

- In 2024, the Modified Adjusted Gross Income (MAGI) criteria starts at $252,150 and ends at $292,150. If an adopting individual’s MAGI falls below $252,150, their credit or exclusion remains unaffected. However, if it exceeds $292,150, the credit will be reduced to zero.

- Additionally, the dollar limit for 2024 must be reduced by both the QAE incurred during the adoption process and any expenses claimed in prior years for the same adoption effort.

- When determining the dollar limitation, QAE incurred and claimed for an unsuccessful attempt at domestic adoption must be taken into consideration. These QAE must be combined with the expenses paid in association with a later attempt at domestic adoption to accurately calculate the adoption tax credit or exclusion for the adopting individual. It is irrespective of whether the subsequent attempt is successful or not.

- The dollar limitation applies individually to both the credit and the exclusion. An adopting individual can claim both the exclusion and credit, but they must claim any allowable exclusion first before claiming any allowable credit.

- The amount of QAE that is available for the credit is decreased by the exclusion costs.

Examples

Below are two examples of QAE to understand the concept better:

Example #1

Suppose John and Jennifer are a married couple. They live in New York and decide to adopt a child. They go through various adoption agencies and finally find a girl of 18 months. The couple goes through the entire adoption process and incurs every type of qualified adoption expense for a married couple there is. Fortunately, the adoption is sanctioned, and the parents bring the baby home. At the time of filing their income tax return, the couple uses Form 8839 to claim their adoption tax credit and exclusion.

The IRS goes through their application and grants the tax credit. Now, this is a very straightforward example. However, in the real world, there are a bunch of factors that affect the claiming process and the adoption process separately parallel to certain qualifying criteria, limitations, and restrictions stated by the IRS in the US.

Example #2

November is acknowledged as the national adoption month, particularly in Dayton, Ohio, where a statewide program has been launched to help offset adoption-related expenses. In 2021, the Family Forward Program was introduced to reduce the costs of expenses in adoption, which is a common hurdle for people willing to adopt.

The program is administered by the Ohio Treasurer’s Office, assisting families in managing the adoption process expenses. There are many cases where prospective adoptive parents finance the upfront costs until they can take benefits of the adoption tax credits. To take advantage of this program, the applicant must be an Ohio resident.