Table Of Contents

What Is Pure Play Method?

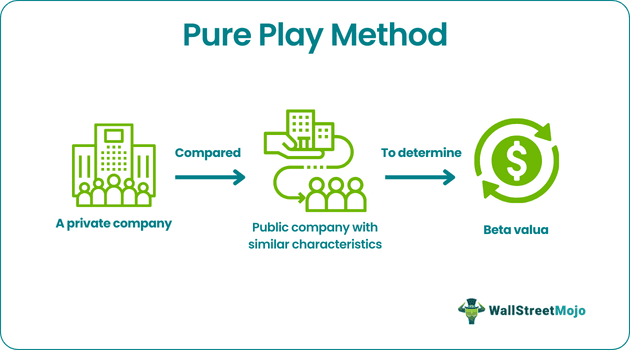

The pure-play method calculates the beta of a division of a company by using the beta of a publicly traded company that has similar characteristics to the division where the beta estimate is required. The strategy is also known as the Gordon-Halpern model.

The weighted average of the betas of the proxy businesses employed for strategy will closely resemble a division's beta. This value is then used for evaluation of the return potential of a company. The method can become more widely used as a crucial tool for project appraisal as it is put to wider use.

Key Takeaways

- The pure-play method, also known as the Gordon-Halpern model, calculates the beta of a division within a company.

- It involves using the beta of a publicly traded company that shares similar characteristics with the division under analysis.

- Estimating the divisional betas helps determine the cost of capital, which is essential for assessing the viability of projects. However, the pure-play method may not be effective in extreme cases.

- Riskier initiatives can increase a firm's beta, increasing the weighted average cost of capital.

Pure Play Method Explained

The pure-play method can estimate the divisional Betas with high accuracy. In most cases, beta is calculated by comparing the firm's or project's return with the market return and establishing the correlation. The estimation of the divisional betas of each project is an alternative to finding out the average cost of capital, as they do not work in extreme cases. Determining the cost of capital is important to assess the viability of that project. However, determination becomes increasingly difficult if there are multiple projects.

The riskier initiatives will cause the firm's beta to increase, increasing the weighted average cost of capital. As a result, the company will eventually only approve riskier initiatives (those with higher beta and higher returns under the CAPM or capital assets pricing model) while rejecting low-risk, low-return ventures. These can lead to erroneous decisions. The two keys to using the strategy are finding companies to serve as pure play proxies and using the Hamada equation to turn leveraged betas into unlevered beta and vice versa.

The article by Russell J. Fuller and Halbert S. Kerr titled "Estimating the Divisional Cost of the Capital." It is an analysis of the pure play technique. The study uses a sample of multidivisional enterprises and examines the pure plays related to each division to offer empirical support for the technique. The article concludes that a properly weighted average of the betas of pure play firms closely resembles the beta of the multidivisional firm.

Process Steps

The following steps help estimate the beta for the project using the pure-play method:

- Identify companies that closely resemble the project under analysis. These companies are known as proxy firms.

- Calculate the stock beta of the identified proxy firm(s). The beta measures the sensitivity of the firm's stock returns to market movements and reflects its systematic risk.

- Consider the proxy firm(s) leverage positions and the project being evaluated. This involves comparing the amount of debt to equity for each party, which reveals their respective leverage positions.

- Determine the project's proxy beta by adjusting the beta of the proxy firm(s) using the Hamada formula and considering the tax element. This adjustment is done assuming that the project is unlevered, meaning it has no debt.

Formula

Calculating using the pure-play technique involves several steps. First, one must select comparable firms on the stock exchange and estimate their beta. Next, the beta needs to be unlevered by eliminating the impact of financial leverage. This results in the calculation of the asset beta, representing the business risk. Finally, the asset beta is adjusted for financial risk to derive the equity beta, which is the beta calculated at the end. The formula used to calculate the equity beta is as follows:

Examples

Check out these examples to get a better idea:

Example #1

Let us consider the case of the hypothetical company XYZ. The company has the following estimated values:

The estimated asset beta for comparable companies is 1.5,

And the tax rate is 25%.

The following is the calculation of XYZ's beta.

The first step toward the beta calculation is the debt-equity ratio, which is equal to 2. Assuming that assets are two and equity is 1, we get the debt as 1 (2-1), so the debt-to-equity ratio is 1 (1/1). Substituting the same in the formula, we get,

Therefore XYZ's equity beta is 2.625

Example #2

Motorola Company conducted an analysis to determine the rate of return for its corporate division, which had different risk characteristics than the overall company. The analysis involved computing the average unleveraged beta for companies. The team calculated the division's re-levered beta and used the new beta to compute the division's weighted average cost of capital. The analysis employed the pure-play method, specifically in the Integrated Electronic Systems Segment (IESS) of the Motorola Corporation.

Through the analysis, the team estimated Motorola's overall weighted average cost of capital (WACC) to be 12.3%. They appropriately weighted the results to reflect Motorola's capital structure. The yield to maturity of long-term debt points to the cost of debt, and the cost of equity calculation happens using the Capital Asset Pricing Model. IESS, a provider of automotive electronic components, is one of Motorola's sectors; hence, the experiment had the cost of capital calculated.

The analysis team considered the beta coefficients of IESS's competitors (suppliers of the automotive industry) to develop a beta coefficient specifically for IESS. This is because IESS was not publicly traded then, and similar companies had to be taken as references. After the analysis, the conclusion was that different costs of capital are important to evaluate projects rather than employing them as it is for overall purposes.