Table Of Contents

What is the Purchase Return Journal Entry?

The company passes Purchase Return Journal Entry to record the return transaction of the merchandise purchased from the supplier. Here the cash account debits in case of cash purchases return journal entry or the accounts payable account in case of credit purchases, and the purchase return account will be credited to the company's books of accounts.

Passing these journal entries helps companies determine the exact stock in their inventory by reducing the returns from their suppliers. The corresponding accounts are credited with the amounts debited to balance the entries. The entries are based on cash or on credit as the respective accounts have to be credited back due to the return.

Purchase Return Journal Entries Explained

Purchase return journal entries show that a company has directly reversed stock from their inventory back to their suppliers. Since goods purchase return journal entries reduce the outstanding payments of the company, they are recorded on the credit side.

Thus, the purchase return journal entries are recorded in the company's books of accounts when the goods purchased either on cash or credit are returned to the supplier of such goods.

When the goods are purchased in cash or credit, then the purchases account will get debited in the company's books of accounts which will be shown in the income statement of the company and the cash account or accounts the payable account will be credited because it will either reduce the cash in case of cash purchases or it will create the liability of the company in case of credit purchases. Now, when the company returns the goods against the purchases made previously, then the cash account or accounts payable account for the cash purchases or credit purchases, respectively, will be debited with a corresponding credit to the purchase return account as there is the return of the goods out of the company to the supplier.

How to Record?

When the company is purchasing goods from the supplier, then in the books of accounts, there will be a debit in the purchases account as it will increase the company's inventory (assets). There will be credit in the Cash account if purchased in cash or the accounts payable account if purchases have been made on credit from the third party (supplier). The Journal Entry to record Purchase is as below:

Purchases in Cash

| Particulars | Dr ($) | Cr ($) |

|---|---|---|

| Purchase A/C …..Dr | XXX | |

| To Cash A/C | XXX |

Purchases on Credit

| Particulars | Dr ($) | Cr ($) |

|---|---|---|

| Purchase A/C …..Dr | XXX | |

| To Accounts Payable A/C | XXX |

Now, when the company returns the goods against the purchases made previously, then the cash account or accounts payable account for the cash purchases or credit purchases, respectively, will be debited with a corresponding credit to the goods purchase return journal entry as there is the return of the goods out of the company to the supplier. Therefore, the book entry to record the return against the purchase of goods by the company is as follows:

Purchase Return of Goods Purchased in Cash

| Particulars | Dr ($) | Cr ($) |

|---|---|---|

| Cash A/C …..Dr | XXX | |

| To Purchase Return A/C | XXX |

Purchase Return of Goods Purchased on Credit

| Particulars | Dr ($) | Cr ($) |

|---|---|---|

| Accounts Payable A/C …..Dr | XXX | |

| To Purchase Return A/C | XXX |

Example

Let us understand the concept of goods or cash purchase return journal entries with the help of an example. The example will help us understand the intricacies of the concept.

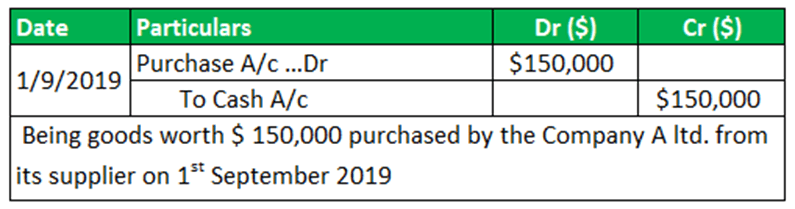

Company A ltd. purchased goods from suppliers worth $ 150,000 on 1st September 2019 by paying the cash with the condition that goods can be returned only within 15 days from the date of purchase. On 13th September 2019, A ltd returned the goods to the supplier. Pass the necessary journal entry in the company's books of accounts to record the purchase of goods and return of such goods to the supplier?

Solution:

On 1st September 2019, when goods were purchased in cash from the supplier, the purchase account will be debited, and the cash account will be credited. The entry is as follows:

On 13th September 2019, when the goods are returned to the supplier, the cash account will be debited with a corresponding credit to the purchase return account. There is the return of the goods out of the company to the supplier. The entry to record such purchase return is as below:

Journal vs Ledger Video Explanation

Importance

Inventory is essentially the lifeblood of any business. Using the best accounting tool to maintain an up-to-date inventory report or manage their interactive online catalogue helps companies run their accounting and logistics departments without hassle. It’s also important to check website safety before using any online tools or platforms to protect financial data and company records. In the same way, businesses focused on digital growth often use an smm panel to streamline their social media marketing efforts, manage multiple campaigns, and monitor engagement efficiently. Let us understand the importance of passing the goods purchase return journal entries from the company’s point of view.

- When they are returned to the supplier of the goods, the cash account or accounts payable account for the cash purchases or credit purchases will be debited with a corresponding credit to the purchase return account as there is the return of the goods out of the company to the supplier.

- To know the exact balance of the inventory present in the company at a particular point in time, the company can reduce the balance of such purchase returns from the inventory balance.

Advantages

Let us understand the advantages of cash or goods purchase return journal entries through the points below.

- It helps the company record every transaction involving the return of the goods purchased by the company either in cash or credit from its supplier, thereby keeping all the track of the same.

- When the company is recording the return of the purchases, it can reduce the balance of such purchase returns from the inventory balance to know the exact balance or the status of the inventory present in the company at a particular point in time.

Disadvantages

Despite the advantages mentioned above, there are a few factors that prove to be a hassle. Let us understand the disadvantages of credit or cash purchase return journal entries through the discussion below.

- The recording of a purchase Return journal entry involves the intervention of a human, so chances prevail that the person engaged in recording such a transaction may commit a mistake in such recording, which will ultimately present the wrong picture of the company.

- In the case of the companies where there are many returns, it becomes time-consuming to record every such entry.