Table Of Contents

What Is A Purchase Ledger?

A purchase ledger is a ledger in which all the accounting transactions related to the company's purchase of goods or services during a period are recorded, showing the lists of the purchases along with the amount the company has paid to its supplier or the amount due to the supplier.

A purchase ledger account is not maintained by the purchasing department but is in the database of the accounts team of an organization. It is a useful metric to segregate all expenses relating to the procurement of goods or services for a company with its vendors or suppliers. It also distinguishes between outstanding purchases and the ones that have been paid for.

Purchase Ledger Explained

The purchase ledger records the company's transactions involving the suppliers' purchases of the goods and services. It contains detailed information on the purchases made by the company, which helps in the analysis of the different aspects. The balances are aggregated periodically, then posted into the purchase ledger control account.

It has information about individual accounts of different business suppliers from whom it has made purchases during the period with a credit or without credit.

It helps the purchase ledger clerk monitor all the purchases made by the company during the period and ensure that sufficient purchases are made. If there are fewer purchases than required, it will hamper its production process, and on the other side, if there are more purchases than required, it will block the company's money, which could be used for other purposes.

The balances of this company's ledger are aggregated periodically, which are then posted into the purchase ledger control account. So, it is the summary of the ledger having no detailed transactions.

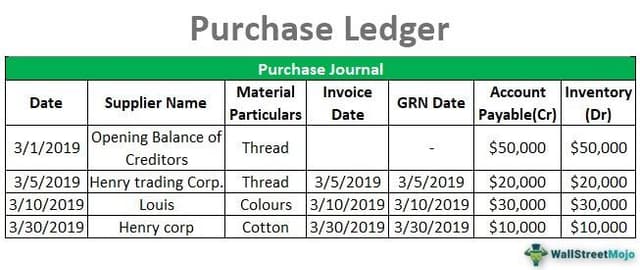

Data fields might include different information wherever applicable. Like date of purchase, name of the supplier or the related code, invoice number of the invoice given by the supplier, purchase order number, code used by the company for identifying the purchases, the amount paid or payable to the supplier, tax paid which applied to those purchases, the status of the payment, etc.

Format

The format of a purchase ledger account is an important factor of the process as it must record all necessary and relevant information about the purchases and give an overview of the overall expenditure of this nature.

- Date of purchase

- Supplier name

- Invoice number

- PO (Purchase Order) number, if any

- Item code or master code for the product’s sub-category

- Taxes

- Total amount

- Status of payment: Paid or Outstanding.

Journal vs Ledger Video Explanation

Jobs

Let us understand the jobs and responsibilities relating to maintaining this ledger. The employees that share the responsibility of doing so are accountants, bookkeepers, and purchase ledger clerks. Let us understand their responsibilities through the points below.

- Updating vendor and product codes

- Assisting with queries relating to the purchase ledger

- Updating and maintenance of the ledger to ensure accuracy

- Co-ordinating with the accounts team and suppliers for payment status

- Petty cash supervision

- Logging, filing, and reporting invoices

- Processing and authorizing payments

- Processing expenses, both personal and company expensitures.

Example

Let us understand the importance of curating a purchase ledger account that helps a company segregate all expenditures relating to the procurement of goods or services from its suppliers. This example shall give us a practical overview of the concept and its intricacies.

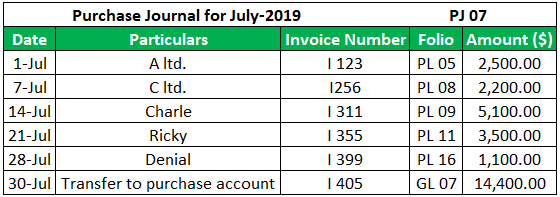

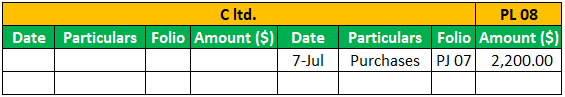

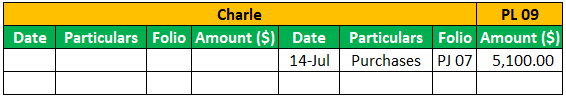

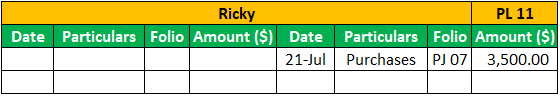

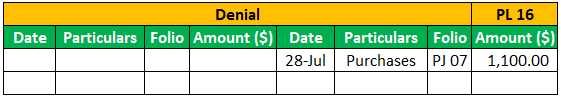

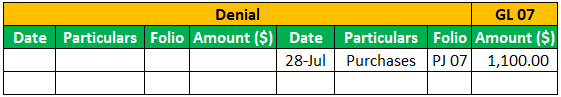

The following is the purchase journal of the Company for the period of July-2019.

Prepare the purchase ledger using the purchase journal for the month as given below:

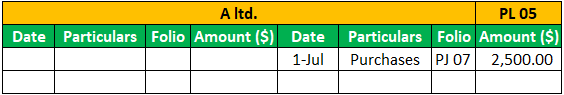

Solution

From the purchase journal, entries will be posted on the purchase ledger having the accounts of the different suppliers of the company, which are as follows:

Advantages

Let us understand the advantages of hiring a purchase ledger clerk who ensures all entries relating to this account are maintained in a meticulous manner.

- It helps monitor all the purchases made by the company during the period and ensure that sufficient purchases are made. If there are fewer purchases than required, it will hamper its production process, and on the other side, if there are more purchases than required, it will block the company's money, which could be used for other purposes.

- This shows the balances due to the creditors from whom the purchases have been made on credit. This helps the company know the liability at the particular point of time it owes to its suppliers.

- The purchase ledger has a list of all the purchases. Thus, it can give a list of the frequent suppliers and the supplies that involve a considerable sum of money.

- In case the company wants to conduct the information about its purchases. It can use the purchase ledger as it contains different information like date of purchase, supplier name, invoice number, purchase order number, amount, tax amount, etc.

Disadvantages

Despite the various advantages, there are a few factors that prove to be a disadvantage. Let us discuss them through the points below.

- In case of an error by a person in recording the purchases in the company's purchase ledger, the purchase ledger account can, at the same time, lead to overstatement or understatement in the balances of the accounts that use such ledger as its base.

- It requires the time and involvement of the person responsible for recording the transactions in this ledger.