Table Of Contents

What are Purchase Journals?

Purchase journals are special journals used by an organization to keep track of all the credit purchases. It is also known as a Purchase book or Purchase daybook. While credit transactions are recorded in the Purchase book, cash purchases are entered in a general journal. It is worth mentioning that only the credit purchase of goods is recorded in such journals, and any capital expenditure is excluded.

Most organizations have a separate purchase department that takes care of the complete purchasing process, which is identifying required goods, classifying, asking for quotations, placing the order, and confirming the receipt of goods matching the desired description.

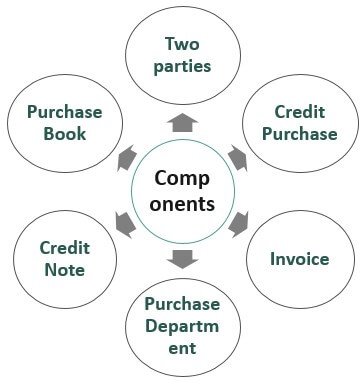

Components of Purchase Journal Entry

#1 - Two parties

In every purchase, there are two parties, a buyer and a seller. Both parties agree to a price that the purchaser pays in consideration of goods or services. This purchase price is the transaction amount for all purchase journals. The person or organization from whom the purchase is made is called the supplier, and when the purchase is on credit, the supplier will appear as Creditors on the balance sheet till the time payment is made.

#2 - Credit Purchase

An organization acquires various goods and services from multiple Suppliers. When a good is purchased on credit, the following journal entry is posted – Let’s say X Ltd. purchased $500 worth of goods from Y Ltd. –

When payment is made –

#3 - Invoice

An invoice is a document that the seller issues to the purchaser. It is a detailed document. It contains the date of invoice, name, and address of the supplier, name of the organization to which it is billed, address and name of the organization where the goods ship, quantity and description of the goods, and payment method needed by the supplier, the currency of the invoice, taxes, etc. An invoice is an important document, which is an issue along with goods, and when it reaches the purchaser, the purchaser will match the goods arrived with Purchase Order placed.

#4 - Purchase Department

Most organizations have a separate purchase department responsible for the procurement of goods. So, when any person or department needs any goods, they have to send a request to the Purchase department; if the goods are already available in the stock or warehouse, the purchasing department will issue the goods. If the goods are not available, the purchasing team will identify the supplier who specializes in needed goods, and they will place the order. Once the order has arrived, they will check that it matches the required description and quantity matches what was requested. Once the purchasing department confirms that goods have been received, the invoice goes to accounts for payment.

#5 - Credit Note

In cases where the goods supplied do not match the description or have quality issues or damage, the purchaser has to return them to the supplier. Then the supplier will issue a Credit Note document, which will be adjusted against the payments of goods in the future. For example, X Ltd. returned goods worth $1,000, and Y Ltd. issued a credit note for that value. So next time X Ltd. will purchase $5,000, it only has to pay $4,000 as $1,000 will be adjusted against credit note.

#6 - Purchase Book

The purchase book records all the credit purchases in one place, and details of Suppliers, invoice number, currency, quantity, and other details are mentioned there. The balances for these Suppliers from the Purchase book are transferred to individual ledgers, and a total of expense heads is debited to an expense account. This is one of the basics books in the bookkeeping process, which is essential in preparing ledger balances, trial balance, and final accounts. Below is a sample purchase book XYZ Ltd for August 2019. In this case, the balances of $500, $1,000, and $2,000 will be posted to individual ledgers of Nike, Adidas, and PUMA Ltd. Also, the Purchase account will be debited by $3,500.

Advantages of Purchase Journals

- The details of all the suppliers are found in one place, which helps in reconciling ledger balances and trial balances.

- Easy to maintain and track data for Supplier analysis

- The total credit purchase and type of purchase are found in one place.

- An essential document for the smooth functioning of the purchasing department

- During year-end audits, finding the invoice numbers related to any Suppliers becomes accessible from purchase journals.

- One of the famous and widely maintained books

Journal vs Ledger Video Explanation

Disadvantages of Purchase Journals

- A separate accountant is needed, which costs time and money.

- If the wrong supplier account is selected in the purchase book, it leads to an error in preparing the trial balance and final accounts

Conclusion

Purchase journals are a vital part of the accounting process of any organization. When implemented carefully, a sound system will help in just-in-time purchases, which will lead to saving in time and money. Also, the purchase analysis extracted from these journals helps negotiate new contracts. Purchase journals also help in Creditors management, tracking returned goods status, credit notes, and updated ledger balances of Suppliers, all of which are required for a business to be successful and up to date. It also helps in audit facilitation by providing the data needed by auditors.

Recommended Articles

This article has been a guide to Purchase Journals. Here we discuss components of purchase journals along with examples, advantages & disadvantages. You can learn more about accounting & bookkeeping from the following articles –