Puerto Rico CPA Exam and License Requirements

Table Of Contents

Puerto Rico CPA Exam

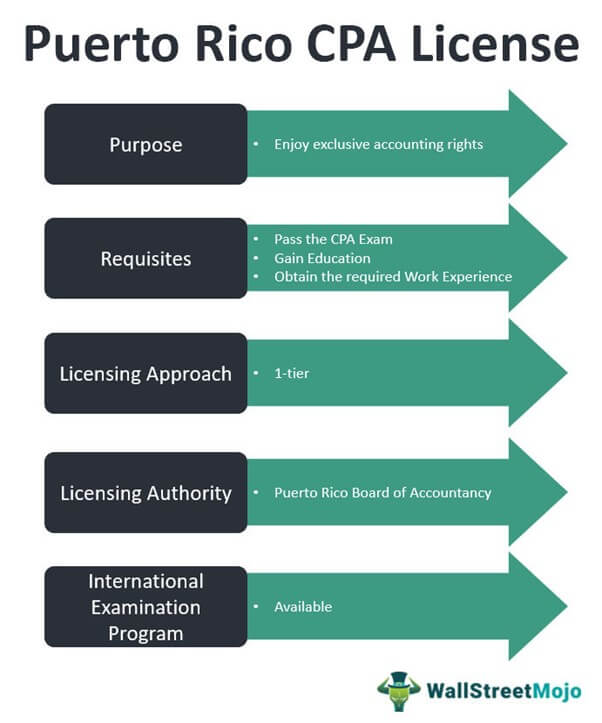

Puerto Rico CPA (Certified Public Accountant) License qualifies a professional to pursue public accountancy in the unincorporated U.S. territory. To earn the license in Puerto Rico, you must pass the CPA Exam and meet other requirements like education and experience.

The Island of Enchantment observes the one-tier licensing method. It means that you can straightaway acquire the CPA license after satisfying the licensing requirements. This method forgoes the need to obtain the CPA certificate before applying for the license.

Please note that the Puerto Rico Board of Accountancy is accountable for licensing CPAs in Puerto Rico. The National Association of State Boards of Accountancy (NASBA) offers licensing services to the state.

The state also participates in the administration of the International CPA Examination Program. Hence you can establish your eligibility through Puerto Rico to take the exam outside of the U.S. Now, let’s take an in-depth look at the Puerto Rico CPA Exam and License Requirements.

Contents

Puerto Rico CPA Exam Requirements

Puerto Rico CPA License Requirements

Puerto Rico CPA Exam Requirements

CPA Exam is a computer-based string of tests divided into four sections. Each section is a 4-hour long assessment with a passing score of 75. It is developed to confirm that only qualified professionals gain a CPA license.

Ensure to pass the licensure test within the rolling 18-month period. This timespan begins from the date you attempted the first passed exam section.

Here is all you need to know.

| Particulars | Details | ||

| CPA Exam type | Computerized | ||

| Passing score | 75 on a scale of 0-99 (each section) | ||

| Exam administration |

| ||

| Exam sections | Section | Testlets | Duration |

| Auditing & Attestation (AUD) | 5 | 4-hour | |

| Business Environment & Concepts (BEC) | 5 | 4-hour | |

| Financial Accounting & Reporting (FAR) | 5 | 4-hour | |

| Regulation (REG) | 5 | 4-hour | |

| Question types |

| ||

| Time limit to pass the CPA Exam | 18 months (from the date you attempted the first passed section) |

Eligibility Requirements

General requisites:

- At least 21 years of age at the time of certification

- A resident of/place of business in Puerto Rico (for both initial & re-exam applicants)

Educational requisites:

150 semester (225 quarter) hours of college-level education with,

- At least a bachelor’s degree

- 32 semester (48 quarter) hours in accounting

- 32 semester (48 quarter) hours in accounting and general business, including information systems, finance, business law, and economics

- At least a 2.0 GPA

Non-U.S. citizens must submit statements of intention to attain citizenship with their application.

Candidates in their final semester to complete the required education must earn 32 semesters (48 quarters) hours in accounting with at least a 3.0 GPA before submitting the exam application.

Apply for the test through CPA Examination Services (CPAES) along with the required fees and transcripts. Please visit the NASBA official portal to know the complete process. Furthermore, avail the NASBA Advisory Evaluation service to recognize any educational flaw in the documents.

Fees

Initial applicants:

| CPA Exam Sections | Exam Fees (per section) | Total Exam Fees (all sections) | Application Fees | Total Fees |

|---|---|---|---|---|

| 4 exam sections | $238.15 | $899.96 | $210 | $1109.96 |

| 3 exam sections | $238.15 | $674.97 | $210 | $884.97 |

| 2 exam sections | $238.15 | $449.98 | $210 | $659.98 |

| 1 exam sections | $238.15 | $224.99 | $210 | $434.99 |

Re-exam candidates:

| CPA Exam Sections | Exam Fees (per section) | Total Exam Fees (all sections) | Registration Fees | Total Fees |

|---|---|---|---|---|

| 4 exam sections | $238.15 | $899.96 | $130 | $1029.96 |

| 3 exam sections | $238.15 | $674.97 | $130 | $804.97 |

| 2 exam sections | $238.15 | $449.98 | $130 | $579.98 |

| 1 exam sections | $238.15 | $224.99 | $130 | $354.99 |

Candidates can’t withdraw from the exam or request a Notice-to-Schedule (NTS) extension. However, they may request a partial exam fee refund or an NTS extension in extraordinary conditions. So, always apply for section(s) that you can take within the next six months (NTS expiry period).

Required Documents

You must submit the below-mentioned documents to CPAES:

| Documents | Submission Authority |

|---|---|

| General Requirements | - |

| Official transcript(s) (maybe submitted electronically) | Academic institute |

| Testing Accommodations Request Form (if applicable) | You |

| For U.S.-based education credentials | - |

| Certificate of Enrollment (requirements not fulfilled at the time of application) | Academic institute |

| For International education credentials | - |

| Credential evaluation report | NASBA International Evaluation Services (NIES) |

| Translated copy of each international transcript | You/NIES |

Please note that the photocopies of transcripts are unacceptable. Moreover, CPAES must receive these documents within 45 days of applying. Or else you will have to re-apply.

Puerto Rico CPA License Requirements

After passing all the CPA exam section within 18 months, the next step is to fulfill other requirements for claiming your Puerto Rico license. Let’s view the Puerto Rico CPA licensure essentials:

| Particulars | Requirements |

| U.S. Citizenship | Required |

| Puerto Rico residency | Required |

| Minimum age | 21 years |

| Character proof | Certificate of Good Conduct from the Police Department |

| Social Security Number (SSN) | Required |

| Education requirement | 150 Semester hours (with a baccalaureate degree) |

| Exam requirement | Pass all 4 CPA exam sections with at least 75 points in each |

| Experience requirement | 1 year of full-time or 3 years of part-time experience (1820 qualifying hours) |

| Other requirements | Certificate of Compliance with ASUME |

| Certificate of membership with the Puerto Rico CPA Society |

Submit your CPA licensure application, documents, and fees through the NASBA Online Licensing Application System. Further details are specified on the website.

| Particulars | Fees |

|---|---|

| Initial license | $207 |

| Transfer of grades | $250 |

| Reciprocal license | $250 |

Education Requirements

Candidates must hold a bachelor’s degree from a nationally or regionally authorized institute. In addition, ensure to earn at least 150 semester hours with a minimum of 2.0 GPA in accounting and business courses. For more information, kindly check the Eligibility Requirements section.

Exam Requirements

Applicants must pass the CPA exam within the rolling 18-month period. All four exam sections have a passing score of at least 75 points. Furthermore, you may visit the Puerto Rico CPA Exam Requirements section for more details.

Experience Requirements

Puerto Rico CPA licensure applicants must gain one year of full-time or three years of part-time work experience. It includes at least 1820 qualifying hours in public accounting, industry or private practice, or academia. Also, ensure to get it verified by a CPA in good standing.

Continuing Professional Education (CPE)

Puerto Rico requires you to renew your CPA license every three years. CPA practitioners must complete 120 CPE credit hours. At the same time, non-practitioners must obtain 90 credit hours for license renewal.

Here are the complete details.

| Particulars | Details | |

| License Renewal Date | December 1 (Triennially) | |

| Renewal Fee | $225 | |

| CPE Reporting Period | August 1-July 31 (Triennially) | |

| Total CPE hours Requirement | CPA practitioners | 120 hours |

| Non-practicing CPAs | 90 hours | |

| Ethics Required | 3 hours (for both practicing and non-practicing CPAs) | |

| Programs |

| |

| Credit available for the supervision of seminar-type & thesis graduate courses | ||

| Other Subject Area Requirements | Non-practicing CPAs | 30 hours in industry-specific subjects |

| CPA practitioners | 40 hours in accounting, auditing, & tax with

| |

| Credit Limitations | Published Materials | Maximum 60 hours |

| Self-Study |

| |

| Subjects like Communication, Behavioral Sciences, Public Relations, Sales of Insecurities | Maximum 24 hours for CPA practitioners |

Satisfying the prerequisites mentioned above will get you the Puerto Rico CPA license. Note that Puerto Rico has no ethics exam or additional educational requirements to obtain a CPA license. Hence, it is relatively easy to earn a reputed license on the Caribbean Island.

Congratulations to those who managed to pass all hurdles and now hold the prestigious license! However, ensure to sustain it by fulfilling the CPA CPE requirements.

Puerto Rico Exam Information & Resources

1. Puerto Rico Board of Accountancy (https://www.estado.pr.gov/en/authorized-public-accountants/)

Physical Address:

Board of Examiners of Certified Public Accountants

Administración de Terrenos Building

Chardón Ave. #171 3er Floor

San Juan, PR 00918-0903

Postal Address

Department of State

Assistant Secretary of Examination Boards

Board of Examiners of Certified Public Accountants

P.O. Box 9023271

San Juan, PR 00902-3271

Phone 629-203-1992

2. Puerto Rico CPA Society (https://www.colegiocpa.com/)

Capital Center Bldg. I

239 Arterial Hostos, Suite 1401

San Juan, PR 00918-1400

Ph: (787)622-0900

1-800-981-9942

3. Puerto Rico Department of Labor & Human Resources (https://www.trabajo.pr.gov/)

505 Building Prudencio Rivera Martínez

Ave. Muñoz Rivera

Hato Rey, PR 00918

Recommended Articles

This article is a guide to Puerto Rico CPA Exam & License Requirements. We discuss Puerto Rico CPA requirements, CPA exam, and license with CPE requirements. You may consider the following CPA Review providers to prepare for your exams –