Table Of Contents

What Are Proxy Advisory Firms?

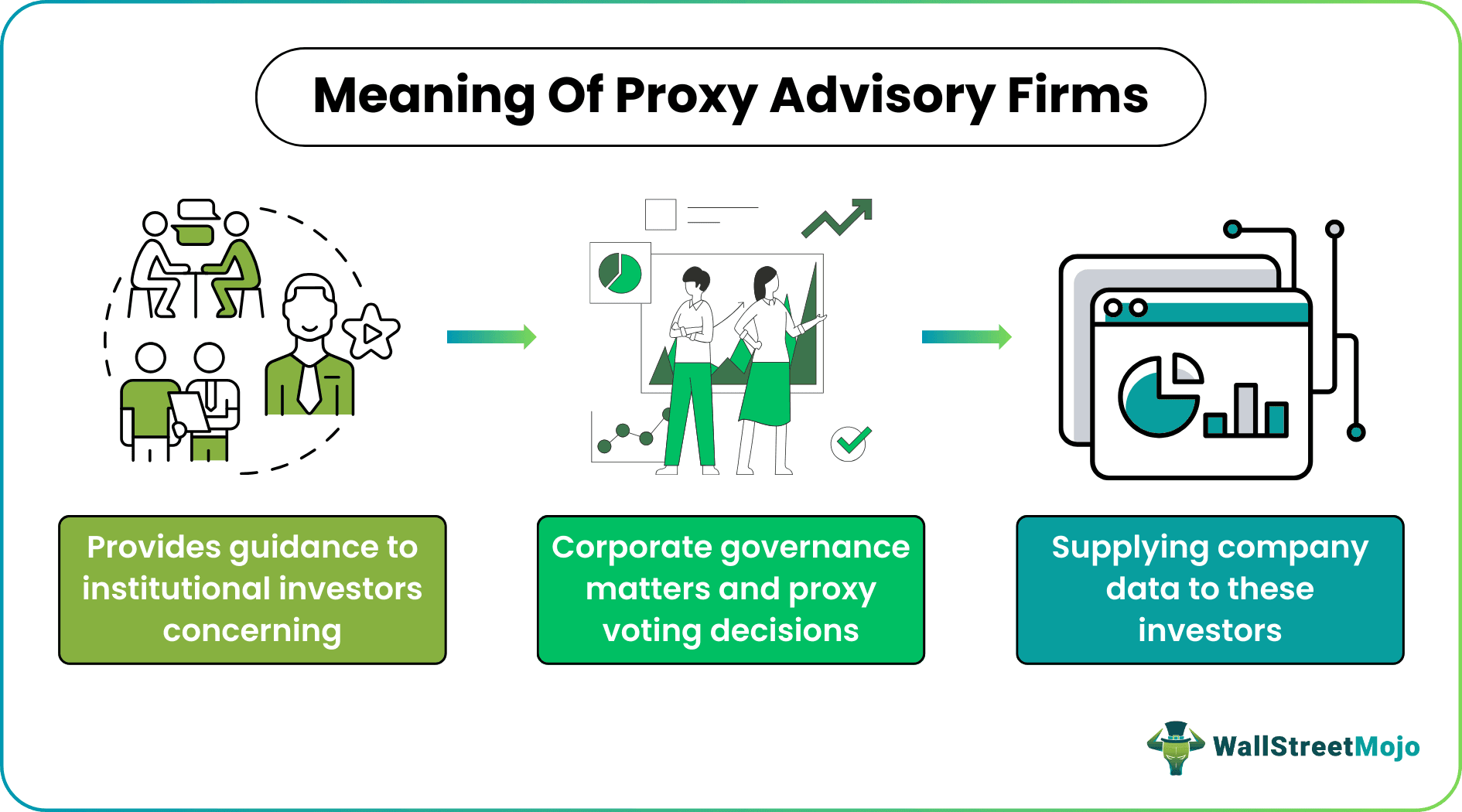

Proxy Advisory Firms or proxy voting advisory businesses (PVABs) refer to the financial institutions that provide company data and research material to institutional investors. Besides, these advisory firms have the role of sharing recommendations and participating in voting proposals during annual general meetings (AGM).

The existence of these proxy advisory firms in corporate governance dates back to the 1980s. However, it later spread to other parts of the world in the 21st century. These firms serve as essential institutions for advising corporate firms and shoulder different responsibilities in this role. Yet, there are certain limitations they face.

Key Takeaways

- Proxy advisory firms refer to the financial groups that advise corporations on transaction deals. They also supply company data to institutional and small retail investors.

- This concept prevailed first in the United States during the 1980s. However, global acceptance occurred in the later stages (in the 21st century).

- They gather the data, research, compile, and present them to the investors. Also, they help in the proxy proposals and voting systems.

- Some of the major ones include Glass Lewis and Institutional Shareholder Services (ISS). They hold around 97% of the total market.

Proxy Advisory Firms Explained

Proxy advisory firms are institutions that provide proxy proposals and company-related data to investors. They deliver advisory services to the corporates as well as the shareholders. In short, they act as a bridge that links firms to the general public. So, if a firm wishes to perform merger and acquisition (M&A), it can consult the proxy advisory groups. These groups provide their valuable feedback on the deal and communicate the news to the shareholders. In addition, they also take part in financial transactions related to the firms.

In general, most of the proxy voting advisory businesses focus on the five major areas. These includes proxy voting, proxy research, transaction deals, environment, social and governance (ESG), and board diversity. Thus, if a firm plans an upcoming corporate social responsibility (CSR) program, this news stays with the management first. In the later stages, the firm announces it to the investors and respective promoters. However, at specific points, investors may need help to gather information or perform research. Proxy advisory groups play a crucial role by collecting data, conducting research, and providing concise insights to companies. They also highlight key points that can aid in voting sessions.

The top proxy advisory firms, Institutional Shareholder Services (ISS) and Glass Lewis wield control over more than 97% of the proxy advisory market, effectively overseeing nearly 38% of shareholder votes. Though the recommendations are received, the asset managers still evaluate the issues themselves, and based on their observations, they decide whether to follow the advice or not. As a result, managers end up refusing the recommendations in some cases.

A survey conducted by the American Council suggests that 95% of the time, firms follow ISS' recommendations, emphasizing the need for a balanced approach considering the subjective nature of investment recommendations and the growing influence of ESG investing.

Role

In contrast to the above functions, there are other specific crucial roles that proxy advisory groups must perform. Let us look at them:

- Helping in corporate governance: The foremost function of the proxy advisor is to participate in corporate decisions. They intend to provide advice to the firms regarding their transaction deals. It includes mergers, acquisitions, debt structure, and similar transactions. This process is known as proxy advisory.

- Provide company data to the investors: Apart from providing feedback, the maximum list of proxy advisory firms focuses on investors. They try to supply the company's data regarding a significant deal or transaction to the latter. As a result, the shareholders are aware of the happenings and decide on their stake. They also aim to boost transparency levels until minimum with this role.

- Create a report on the entity's performance: PVABs also supervise the entity's performance on a frequent basis. With their observation, they prepare a report or a scorecard detailing their performance. As a result, it becomes easy for the shareholders to analyze the firm's operations.

- Engage in proxy proposals and voting: In addition to the above roles, proxy advisory groups also participate in proxy proposals. These proxy statements (also known as Form DEF 14A) provide a brief knowledge of the company's essential issues. These advisory groups guide the shareholders on how to vote on such matters. Therefore, investors can easily understand the firm and decide on their vote.

- Provide analysis on ESG: The proxy advisory groups also decide on the strengths and weaknesses of the firms. Besides, they also analyze the environmental and social factors that can influence the company's prospects and future growth.

- Protect the investor's interest: Lastly, these advisory groups ultimately aim to protect the investors by providing enough information about the company. As a result, it results in effective decision-making in terms of investments.

Examples

Let us look at some examples of the concept to comprehend the concept better.

Example #1

Suppose John owns a company that operates in the steel industry. This firm manages to supply bulk quantities of steel to significant suppliers and even government projects. Plus, they are also listed on the NYSE (New York Stock Exchange). However, after seven years of establishment, they wish to acquire Jamson Steel Ltd through a synergy deal. But, in this process, there are various prospects and downsides. As a result, John decides to approach Louis (who operates a proxy advisory firm), who owns Mirror advisory services and provides advice on important matters to the corporations. They performed an in-depth analysis of the deal and provided a scoreboard for the same.

As a result, the steel firm could easily decide and finally agreed to proceed with the deal. They also announced the news to the subscribed shareholders. However, the investors still could not access the transaction data. Therefore, the Mirror advisory group gathered the information, compiled it, and released it publicly. Hence, every investor could make investment decisions regardless of research performed on their behalf.

Example #2

According to a recent news update as of November 2023, the proxy advisory firms ISS and Glass Lewis released their statement on Acer Therapeutics. The pharmaceutical company is in talks with Zevra Therapeutics, Inc. for a merger. The advisory firm ISS suggested that this transaction deal may bring a positive reaction in the market. Also, the Acer shareholders will be likely to experience a new capitalized structure with positive prospects.

As a result, they have finally recommended the shareholder's vote of the latter for merger and other proposals. However, this deal is only possible when the proposal receives sufficient votes.

Importance

Although proxy voting advisory businesses have various roles to perform, they also have a generous amount of significance in the equity market. Let us look at them:

- The involvement of PVABs helps investors to vote for proposals and major deals smartly.

- With the research data presented, even global investors can have access to such deals via proxy advisors.

- The importance of proxy advisory firms stands out among small investors who need help accessing data. They serve as information collectors to provide all relevant information about the company to them.

- These advisory firms are vital to conducting a transaction deal. They provide enough feedback and expertise on specific growth opportunities.

- They supply enough data like proxy statements to the SEC (Securities of Exchange Commission). It acts like a prior proposal for the upcoming decisions of the company.

Challenges

Following are the limitations and challenges performed for advisory services. Let us look at them:

- Conflict of Interest: There may be a conflict of interest between proxy advisors and consultancy firms. It mainly arises due to the advice presented to the corporates. Therefore, it is vital to clearly mention the area of advice before partnering with the companies. Also, unnecessary build-up of Chinese walls must be avoided.

- Inappropriate disclosure of facts: In addition, these groups should also adequately disclose material facts. In most cases, information needs to be communicated to investors. Thus, it affects the investor's interests. Such disclosures include shareholder's pattern, audited balance sheet, and profit and loss.

- Lack of independence: Furthermore, the board of proxy advisors or such firms may act selfish to their motives. If they remain the same, a personal objective may exist that can influence the decisions. As a result, the growth opportunity may turn subjective. In short, they should act independently from the shareholders.