Table Of Contents

Meaning of Property Plant And Equipment (PP&E)?

Property plant and equipment (PP&E) are long-term tangible assets that are physical. These are non-current assets used in the company's operations for a longer part of the time. They are also called the fixed assets of the company as they cannot be easily liquidated. These are also referred to as tangible or fixed assets that cannot be easily liquidated by the company.

Property plant and equipment are considered long-term capital investment and their purchase shows that the management believes in the company's long-term outlook and profitability. PP&E assets are expected to generate economic benefits. Net plant, property and equipment include machinery, vehicles, equipment, land, office, furniture, etc.

Property Plant And Equipment (PP&E) Explained

The property, plant and equipment are also called fixed assets. They are tangible assets that add long term value to the business. Moreover, they are used in the manufacturing process or supply of goods and services. They may also be used for administrative purposes or rental purposes and play a very significant role in any company and s they are an important asset category.

The importance of property plant and equipment note varies from company to company based on the nature of the industry. Property plants and equipment represent only one portion of the company's assets. It is essential to monitor a company's investment in PP&E, as it is vital for long-term success.

In this entire asset category, there are different classes of property plant and equipment where the property is the land and building that the company owns or has taken on lease or leased out to any other business. Land refers to the ground and any other resource that exists on or below it. The buildings are considered to be the structures that are built on that land which may include warehouses, retail outlets, factories, offices, etc.

The plant is the machinery or equipment and vehicle that the company uses in the manufacturing process. Many types of machines may be used in the business, such as manufacturing equipment, transport vehicles, assembly lines, the entire computer system connecting all the processes of the organization, etc. The equipment are also referred to as any other assets that are used in the daily operation but do not fall under the category of building or property or machinery used in the production process. They include office furniture, stationary, tools, and fixtures, that support daily business activity.

Formula

Now that we have an understanding of the basics of a property plant and equipment note, let us now understand the formula that shall act as a basis for our understanding of the related factors of the concept.

Net PPE = Gross PPE (+) Capital Expenditures (−) Accumulated Depreciation

INC Corp. owns machinery with a gross value of $ 10 million. Accumulated depreciation recorded so far was at $5 million. Due to the wear and tear of the machinery, the company purchased new equipment at the cost of $ 2 million.

Net PPE = $ 7 Million ($ 10 Million+ $ 2 Million - $ 5 Million)

How To Calculate?

Let us look at the different steps that help the business in calculating the value of the asset and do property plant and equipment accounting. This shall help us understand the practical application of the formula we just discussed.

- Determine the initial cost - The first step is to calculate the cost price of the asset. This will include the price at which the asset is purchased plus any additional cost that can be directly attributed to the process of acquisition and installation. This may include transport costs, installation costs, any legal fees paid during the process, or the cost of any modification made to the asset.

- Deduction of depreciation – Then the depreciation amount should be deducted from the cost of the asset. Depreciation is a systematic allocation of the cost of an asset over the useful life. By deducting this value from its cost, the business gets the net book value of the asset in the current period.

- Any additions – If there is any addition made to the asset to make it suitable for use in the business, then that value should also be added to the net property plant and equipment. It may also include any upgradation or improvement made to the asset to increase its usefulness.

- Account for disposal – If any such asset has been disposed of or retired, then the book value of the disposed asset needs to be deducted from the total net book value of all the assets in the business. This will ensure that the current value is only for the part of the asset that is remaining and is still being used in the business.

Recognition

The cost of net of property plant and equipment shall be recognized as an asset only if it is probable that future economic benefits will flow to the entity, and its cost can be reliably measured.

PP&E that qualifies for recognition shall be measured at its cost. The initial cost may include the following:

- Employee costs directly attributable to construction or acquisition of PP&E; the cost of site preparation; initial delivery and handling costs; installation and assembly costs; the cost of testing assets’ functionality; professional fees, etc.;

- Suppose payment for an item of PP&E is deferred beyond standard credit terms. The difference between the cash price equivalent and the total cash outflow is recognized as interest over the credit period unless the interest is capitalized.

- Suppose the asset is acquired in exchange for another asset. In that case, the cost will be measured at its fair value unless there is an absence of a commercial element or the fair value of both the asset received and the asset given is not quantifiable. If the asset obtained via an exchange transaction is not recorded at the fair value, then it's the cost determined based on the asset's carrying amount.

- Subsequent cost or capital expenditure to PP&E can be added if the investment is made either in updating and maintaining existing equipment or purchasing additional equipment.

Example

Now that we understand the basics, formula, and the calculation aspect of the concept, let us apply our theoretical knowledge to practical application through the examples below.

Example #1

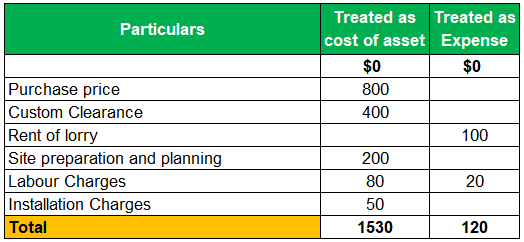

Sigma Inc. acquires a new asset. The purchase price of the asset is $ 800,000. Also, the company incurs the following costs:

- Custom Clearance: 400

- Rent of lorry (Note 1): 100

- Site preparation and planning: 200

- Labour Charges (Note 2): 100

- Installation Charges: 50

Notes:

- A lorry has been acquired on rent and used by the business for transporting anything and not specifically obtained for this asset.

- Include $ 20,000 salaries of the entity’s own employees working full time

Solution:

Thus, from the above example the process and steps of calculating and identification of the asset class is very clear.

Example #2

Foresee Power announced its financial results for 2022 in April 2023. The company experienced a revenue growth of over 53% to €111 million euros. In 2023, they forecasted revenue growth of €160 million.

Moreover, they also announced that they stopped considering EBITDA as a performance metric and replaced it with adjusted EBITDA as it corresponds to operating income before amortization and impairment of intangible assets, amortization of right of use on property, plant, and equipment.

Measurement

Given below are some of the methods or models that are frequently used in a business to measure the value of net property plant and equipment so as to get a clear and true picture of the worth of the asset in any company.

#1 - Cost Model

The Asset is measured at its cost reduced by accumulated depreciation and impairment loss if any.

#2 - Revaluation Model

The Asset is recorded as per the revalued amount. I.e., the fair value of the asset at the time of revaluation, less depreciation, and impairment, as long as the asset's fair value can be measured.

- Under this, the revaluation of property plant and equipment should be carried out regularly to ensure that the carrying amount does not differ materially from its fair value at the balance sheet date. If an item is revalued, then the entire class of assets should be revalued.

- If the revaluation of assets increases in value, the same should be credited to other comprehensive income and accumulated in equity under the revaluation surplus. However, the increase shall be recognized in P&L A/c to the extent that it reserves a revaluation decrease of the same asset previously recognized in P&L.

- A decrease arising from revaluation should be recognized as the expense to the extent that it exceeds any amount previously credited to the revaluation surplus relating to the same asset.

- The revaluation surplus shall be transferred to retained earnings when the revalued asset is retired or disposed of.

Depreciation

The depreciation amount should be allocated systematically over the asset's useful life. The residual value and the useful life of an asset should be annual. If expectations differ from previous estimates, the changes shall be accounted for as a change in an accounting estimate.

- The depreciation method can be considered based on the pattern in which the asset’s future economic benefits are expected.

- The depreciation method shall be reviewed annually; has there been a significant change in the expected consumption pattern of future economic benefits; the depreciation pattern should be changed prospectively as a change in estimate.

- Depreciation shall be recognized in profit or loss unless it is included in the carrying amount of another asset.

- There are various methods of depreciation like the Straight line method, WDV method, accelerated depreciation method, double declining method, etc.

Impairment

Impairment of assets takes place when the carrying value of the property or the asset is more than the fair value. The property, plant, and equipment note are normally valued at the historical cost after reducing the accumulated depreciation.

However, while doing the measurement of property plant and equipment, during the usage and working life of the asset, due to continuous usage for the production process, there may be conditions that indicate that it is not possible to recover the carrying value of the asset. This may result in impairment.

Compensation from the third party for PP&E impairment shall be included in the P&L when compensation is receivable. A carrying amount is higher than an asset's fair value, reduced by its selling cost and utility. The net property plant and equipment should not be valued higher than the recoverable amount.

Derecognition

The carrying amount of PP&E shall be derecognized on disposal; or when no future economic benefits are expected from its use or disposal. In such cases the asset is removed from the financial statement through some procedures. Derecognition may take place due to sale, exchanging it with any other similar but useful asset of simple abandonment.

During the sale, the profit or loss sale is calculated by deducting the carrying amount from the sale proceeds received against the asset. The Gain or loss arising from derecognition shall be included in the profit or loss statement either as a separate component or a line item if it is considered to be very significant or along with other gains or losses.

However, it they are disposed of in any method other than sale, like exchange or abandonment, then they will be continued to be treated as an asset till it is totally disposed of. The depreciation will also continue, and the asset is tested for impairment till the carrying amount becomes zero.

If they are abandoned or retired; the value gets deducted by it carrying amount as during the time of its abandonment. The loss is equivalent to it carrying amount then recorded.

In case of exchange, the asset’s carrying amount is removed from the balance sheet and the fair value is written. In this case, the difference between the carrying amount and fair value is the profit or loss.

Disclosure

The Financial statements shall disclose for each class of PP&E the basis for property plant and equipment accounting; depreciation methods used; the useful lives or depreciation rates; the gross carrying amount and its accumulated depreciation; reconciliation of the carrying amount at the beginning, and the end of the period.

- It shall also disclose restrictions on title and items pledged as security for liabilities; expenditures to construct PP&E during the period; contractual commitments to acquire assets. Compensation from third parties for impairment.

- In case of revaluation – the effective date of revaluation; whether an independent value is involved; for every revalued class of PP&E, the carrying amount at which the asset would have been recorded under the cost model and the revaluation gain, including changes in the same during the reporting period and any limitation on paying out the balance to shareholders.

Recommended Articles

This article has been a guide to meaning of Property Plant and Equipment (PP & E). Here we explain its formula, examples, depreciation, and derecognition in detail. You may learn more about accounting from the following articles –