Table of Contents

What Is Property Development Financing?

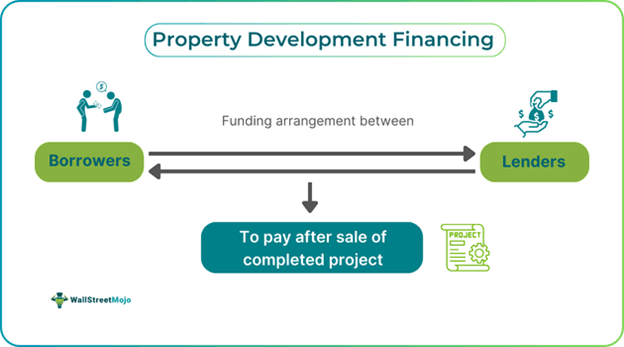

Property development financing is an arrangement of funding typically used for large-scale construction projects. The funds are often given as medium—or short-term loans and are paid off after the completion and sale of a project or by replacement through long-term funds.

Exploring finance options for developing a project is advisable as it provides access to capital, mitigates risk, and helps the borrower manage their cash flows. This eases the concerns of stopping the projects due to fund unavailability. The process provides confidence for the stakeholders and investors regarding the completion of the project.

Key Takeaways

- Property development financing is a funding arrangement in which funds are allocated for large-scale projects and repaid after their completion or sale.

- They are available for new property development, refurbishment, restoration, conversions, etc.

- Various types of funding include commercial mortgages, auction financing, bridge financing, etc.

- Lenders often require details of the borrower's project history, profit projection, gross valuation of properties, and insurance, among other details.

- Pros of the arrangement include short-term funding and flexibility in payments, while cons include high interest rates and additional fees.

How Does Property Development Financing Work?

Property development financing is a funding arrangement used to finance large-scale projects. The funding can be used for refurbishment, restoration, property conversions, and ground-up developments (funding both the purchase of land and the associated building costs. The amount acquired depends on the value of the project at its completion time. Similarly, the period of loan also depends on the type of funding as it decides the amount of time required for completion.

The arrangement of seeking funding for developing projects can be used to purchase land, properties, and other real estate projects waiting to be developed. It can be used to fund the cost of labor and materials. They can be used to pay for expenses on refurbishments, indoor decorating, structural changes, or even legal fees. Furthermore, the funds can also be used to convert one type of property to another. The funds lent are typically in the range of 75%-90% of a property's value against which the loan is secured.

The funding is based on properties owned by the borrower. Hence, the financing options are available for both residential and commercial spaces. The arrangement is agreed upon based on two primary criteria. First is the amount of security available for the borrower to avail of the loan. Second is the commercial viability of the project. The funding is often released gradually.

Types

Given below are some of the types of development financing:

- Auction finance: They are arrangements where properties are bought through auctions (often at discounted rates). The auction money has to be paid within a few weeks and in full. Raising necessary deposits through auction finance. It is a short-term financing plan and, hence, could be expensive. Developers can use the option when they have no business plan and when lenders require a strong credit history.

- Bridging finance: It is funding used to bridge gaps that occur between buying a property and securing a reliable financing option for the project. These are short-term funding options. They are available faster and help cover necessary costs in a short time frame.

- Bridge-to-let: They are customized versions of bridging finance. The funding is tailored to suit projects and is not intended to cover the completion of the whole project. It supports the initial property acquisition process.

- Commercial mortgages: These financing options can be exercised for properties that are not intended to be used as private residential properties. They are an interest-based option similar to traditional private mortgages with a repayment plan and a specific period of repayment.

- Application Checklist: Some of the factors that are checked before financing are given below:

- Developer details: The lenders would require the developer's background and experience. This may include the details of the projects completed and whether they were completed on time and within the budget. They may also ask for details of incomplete projects and their reasons. Sometimes, they may also ask about the profit made and the level of development of the projects. Similarly, they might want to know the source of funds used for purchasing the properties and their asset-liability statement.

- Development details: This includes details on the project's development teams (the main contractor, project manager, employer agent, architect, consultants, etc.). It may also require details on planning permission and application details, the appraisal (costs of and, building and selling, including the profit expected), disclosures of the sites used, specialist reports on different phases, etc.

- Construction: The details of the third-party construction services, detailed budget work schedules, and project timelines are required. The collateral warranties of development teams, key members, new build warranties, and project certifications are also requested.

- Insurance: The professional indemnity insurance details of the development team key members, construction risk policies, and all level insurance coverage confirmation details are required.

- Exit strategy: The lender needs to understand the repayment strategy and how the borrower intends to repay them. The method and selling agent details are all required here.

- Other necessary details: Some such details are required: the borrower's identity proof, breakdown of development costs, financial accounts, estimated gross value of projects, drawings, or plans of the property development.

Examples

Let us look at some of the examples to understand the concept better.

Example #1

Suppose Dan is the owner of a construction company and wants to develop a senior citizens' residence society. He plans to build a society area within 100 meters that helps seniors reside and avail themselves of facilities and entertainment options. Dan has to approach a lender who could fund that idea.

He decides how he wants to manage the project and creates a project plan, a plan of amenities that would be included. It should be attractive and convincing for himself and the lender. Afterward, Dan decides on the type of funding he wants. He immediately applies for bridging loans as he wants to pick a reliable long-term lender. He scans the market for reliable lenders who not only have funds but also don't have unfair lending terms. Dan also looks at the lender's interest rates and repayment period and sees if it is feasible for him. Dan proceeded to gather documents, review contractual terms, and complete the application. Once the application was approved, he started the project.

Example #2

Grosvenor is a privately owned international property investment and development company. It announced (September 2024) the promotion of Michael Ward to head its North American development financing program. The program oversees the financing of mixed-use and residential projects in the North American regions and aims to raise funds for key market developments. The list of key markets includes places such as Vancouver, Toronto, and California. The development initiatives are said to be worth 45.3 billion.

Pros And Cons

Given below are some of the pros and cons of the financing arrangement:

Pros

- It helps secure money on properties that are typically considered unviable or unsuitable by most lenders. Examples include run-down and derelict buildings.

- Borrowers can get access to large amounts, sometimes even 100% of the property value.

- The funding arrangement offers flexibility in the payment methods.

- The funds are released in stages, and hence, the project completion is ensured as planned.

- Helps people to build projects without an elaborate credit history.

Cons

- The loans are considered risky, and hence, the interest rates are higher.

- Several costs are involved, such as drawdown fees, valuation fees, legal and administration charges, etc.

- If a proper lender is not found, it could impact the progression of the project, as the funds are usually released in stages.