Table Of Contents

Project Finance Jobs & Careers

Project finance jobs refer to the jobs in the area of controlling and managing infrastructure and industrial projects from the financial perspective in the long term, which includes making financial decisions regarding investment like raising funds, making contracts with vendors and negotiations, generating finance for the project and analyzing projects viability and earnings.

Project finance can be broadly defined as long-term financing projects such as infrastructure, power and plant, and other industrial projects. Today, the role of finance professionals is mounting beyond the traditional accounting and reporting functions as they are skilled enough to handle leadership roles as well.

Table of contents

- Project finance jobs involve overseeing and managing infrastructure and industrial projects from a long-term financial perspective. This includes making financial decisions related to investments, fundraising, vendor contracts, financial analysis, and assessing project viability and profitability.

- Project finance jobs can be categorized into two streams: advisory and lending.

- Common positions in project finance include Directors, Managers, and Analysts.

- Companies such as China State Construction & Engineering, Chevron Corporation, Saudi Aramco, Royal Dutch Shell, Matson Navigation Company, Crowley Maritime Corporation, Royal Bam Group, Jacobs Engineering, Goldman Sachs, Larsen & Toubro, Marathon Petroleum Corporation, Reliance Industries Ltd., and Goldcorp offer opportunities in project finance.

Project Finance Jobs Explained

Project finance jobs are for those who enjoy traveling, advising clients on financial decisions, and analyzing and projecting financial statements. This article aims to provide you with brief details about project finance jobs. The job responsibilities of these professionals, be they in infrastructure project finance jobs or others, go beyond just managing account books and tallying balance sheets. Today, they form an integral part of leadership to promote efficiency and improve an organization’s performance. And these jobs stand out in finance by advising, analyzing, and financing various industrial projects.

The positions range from an analyst to project director, but all these jobs involve the long-term financing of infrastructure projects or industrial projects.

Streams

There are two main streams in project finance jobs, i.e., advisory and lending. For example, Project Finance Group advises clients and/or lends funds for the debt used in huge investments.

Advisory

In this kind of job, the professionals advise the clients on the funds used in the huge investment. Below are the activities conducted by the Project Finance Advisor: -

- If you are appointed to a Project Finance Group as an advisor, your main task will be to handle the clients.

- If you see, the basic element for every client is to gather the funding/financial goals for their project, so as an advisor, you will guide the clients on how to arrange to collect the funds by providing them with debt funding sources and prioritizing the important element.

- As for clients, the ideal situation is to get maximized debt, load, quick financial close, and low debt pricing. So as a Project Finance Advisor, your duty will be to make intensive modeling of the client's project, carry out the due diligence of projects including pre-bid advisory, estimate the cash flows of the project, and collect marketing materials such as information memorandum and prepare the structure of the funding to meet the specific requirement of the project.

- After designing and finalizing the deal structure, as an advisor, you will reach out to the banking markets or financial institutions to raise the required finance for the client's project.

Debt Syndication

Debt syndication refers to selling loans to other banks or financial institutions. Below mentioned are the activities of a debt syndication job in project finance: -

- As project financing is required for the large project size, multiple banks find it ideal to fund together for a single project.

- Suppose you work under the main bank's project syndication or debt syndication team. In that case, you will be playing the role of an intermediate between the client and the other financial institutions.

- As an intermediate, you will finalize the structure and get loan sanctions from all the leading agencies involved in the transactions.

- Under the debt syndication team, you will also be required to interact with numerous banking and financial institutions and negotiate the terms of loan sanctions to best suit the client's requirements.

Roles

Numerous jobs generally range from an Analyst to a project and infrastructure Finance Director position. These jobs involve infrastructure financing and various industrial projects financing over a long period. Project finance jobs want a professional in this field who plans long-term cash flow rather than just analyzing and balancing the income statement and balance sheets of those corporates financing the projects. The following are the description of different positions in project finance: -

Director:

Directors visualize the failure or success of the project before preparing the project’s financial structure. To become a director of a project finance company, you need to possess the following skills: -

- You should have experience of 10 years – 12 years working with financial statements, financial analysis, and debt flow.

- It would help if you had an analytical mind to understand the varied range of factors that may influence the success of a project.

- You should also have experience in marketing research and sales to understand the factors affecting the project's earnings.

- You will require sharpened leadership skills to lead a project finance team.

Managers:

The project finance manager is the one who is capable enough to lead a team. To work as a manager in the project finance team, you will require to possess the following skills: -

- You need to have experience of 3 years-5 years working as an analyst, making an intensive modeling structure of a company.

- You will be required to undertake all the necessary activities, i.e., collecting the information, preparing the projection model, finalizing the design, etc., to meet the clients' funding financial requirements or funding needs.

- You will need to coordinate with banks, financial institutions, private equity funds, rating agencies, and other participants in the financial community to ensure the timely accessibility of finance for the project. And also coordinate with the finance providers on due diligence, term sheet negotiations, and documentation.

- You will work with a project development team to identify, analyze and execute the most optimum financing solutions for projects.

Analyst:

This job involves assisting seniors and preparing reports. If you are planning to get this job as an analyst, you must possess: -

- It would be best if you had an MBA degree in Finance from a top management institution.

- Your job will be to assist the directors and set up various contracts.

- As an analyst, you should make digital reports on projected earnings, risk, and cash flow.

- You need to possess management skills to manage teams, client meetings, and contract negotiations.

- You are required to retain the skills of effective communication, resource management, and negotiation skills as the responsibility level, scope, and complexity will differ according to the nature of the project.

Skills

An aspirant is expected to have proper knowledge on project finance between three to five years of professional experience in infrastructure project finance within a project finance bank or a corporate house focused on project development/financing. One should/must:

- Know how to screen new projects, define project description and scope, and conduct feasibility studies to determine the financial viability of new ventures projecting cash flow and growth opportunities.

- Have strong knowledge of financial modeling, capable of building sophisticated "project finance" economic models from scratch.

- Work in coordination with banks, financial institutions, and consultants to arrange syndication and raise funds from various financial institutions/banks/lease finance companies.

- Have knowledge of project finance documentation and experience handling financial closing work either as a project developer or a lender.

- Know how to compile and prepare cost and performance reports as per Cost Accounting Records Rule (CARR), cost-benefit analysis, and critical analysis of cost reports; recommending necessary corrective actions, and conducting financial research of similar companies and/or projects for benchmarking ratios and performance tracking.

- Be a Chartered Accountant (C.A.) / Certified Public Accountant (CPA) / MBA (Finance) and needs to know the areas of project proposals, project finance management, and all the financial accountabilities related to multiple projects.

Responsibilities

The responsibilities these individuals have, include:

- To make inclusive financial models for several projects to deliver cash flow forecasts, scenario analyses, risk assessments, and return analyses.

- Individuals have to work closely with the project development team to identify, analyze and execute the most optimum financing solution for projects which include debt and equity.

- Individuals must coordinate debt facilities' drawdown/repayment formalities and monitor compliance with financing conditions and obligations.

- Individuals must coordinate due diligence, term sheet negotiations, and documentation with finance providers.

- Coordinate with banks, financial institutions, and consultants to arrange syndication and raise funds from various financial institutions/banks/lease finance companies.

- To evaluate capital investment proposals and calculate project/dividend IRRs, DSCRs, sensitivity analysis, etc.

- To compile and prepare cost and performance reports as per cost accounting Records Rule (CARR), cost-benefit analysis, and critical analysis of cost reports, recommending necessary corrective actions.

- Investigate historical dealings to categorize pricing, debt levels, trends, and greatest practice. It also has to conduct a financial analysis of similar companies and/or projects for benchmarking ratios and performance tracking.

Salaries

Project Finance Jobs are still in high demand. The salaries of project finance professionals differ as per the position, role, and years of experience. However, still, these are highly paid careers compared to other areas in finance. The following table will give you the details of the salaries of project finance professionals: -

| Project Finance Job Role / Experience | Basic Salary Range ($) | Bonus (%’ age) |

|---|---|---|

| Analyst 1-3 years | 40,000 – 65,000 | 30-70% |

| Managers 3-5 years | 60,000 – 90,000 | 30-100% |

| Vice President | 80,000 – 130,000 | 50-120% |

| Director | 120,000 – 220,000 | 50-200% |

| Managing Director | 150,000 – 350,000 | 100-300% |

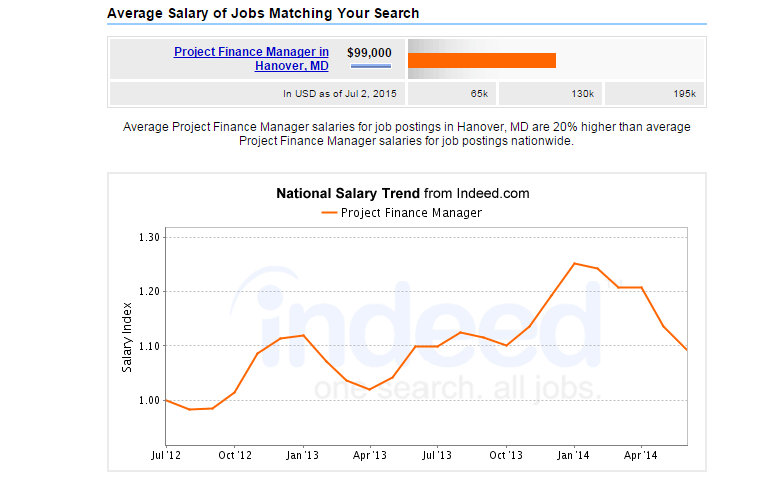

The survey found that at large investment banks, some senior project finance professionals earn basic salaries of $200,000. But, in addition, many people had attained bonuses getting seven figures. And also, in the energy sector project, Finance Directors earn a median salary of $100,000, with a bounty of typically 100%. Even at the Assistant Director level, salaries are $70,000 and an average bonus of 80%. The graph below shows the range of salaries offered to the project finance manager.

Source: indeed.com

Companies Offering Project Finance Jobs

Many companies offer these jobs as this field is still in great demand today. Various infrastructure companies, energy, and power companies, large investment banks, steel companies, oil and gas companies, etc., require a comparatively huge amount of funds for their projects compared to other sectors or companies. Therefore, they are looking forward to projecting finance professionals.

The following is the list of companies that offer such jobs, including renewable project finance jobs. They are: -

- China State Construction & Engineering

- Chevron Corporation

- Saudi Aramco

- Royal Dutch Shell

- Matson Navigation Company

- Crowley Maritime Corporation

- Royal Bam Group

- Jacobs Engineering

- Goldman Sachs

- Larsen & Toubro

- Marathon Petroleum Corporation

- Reliance Industries Ltd.

- Exelon Corporation

- Anglo American Platinum

- Goldcorp

Frequently Asked Questions (FAQs)

Project finance jobs are not completely recession-proof, as economic downturns can influence them. For example, during a recession, there may be a decrease in project funding, investment activity, and new project development, which can impact the demand for project finance professionals. However, certain industries or sectors, such as infrastructure and renewable energy, tend to be more resilient during economic downturns, which can stabilize project finance jobs.

In project finance, the focus is on financing specific projects, often involving large-scale infrastructure or development initiatives. Project finance professionals analyze the financial viability of projects, structure financing arrangements, manage risk, and ensure project completion. On the other hand, traditional corporate finance jobs involve managing a company's financial operations.

Project finance jobs come with specific challenges, including:

1. Assessing and managing project risks, such as construction delays, regulatory changes, and market fluctuations.

2. Navigating complex legal and contractual frameworks related to project agreements and financing arrangements.

3. Conduct thorough due diligence to evaluate project feasibility and financial viability.

Recommended Articles

This article is a guide to Project Finance Jobs and Careers. We explain the roles, skills, responsibilities, salaries, and list of companies offering the jobs. You may also look at these articles below to learn more about project finance: -

- Structured Finance Jobs

- How to Get Into Project Finance?

- Top 10 Finance Certifications Programs

- Corporate Finance Career Path