Table Of Contents

What Are Progressive Tax Examples?

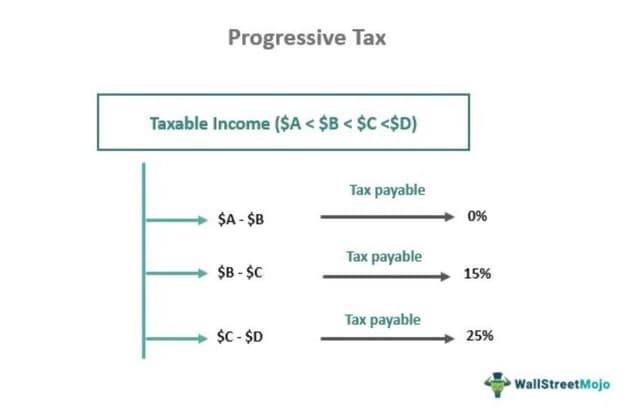

Progressive tax can be defined as a taxpayer’s ability taxation system wherein the government or the authority imposes lower income tax on the person whose income falls in the lower bracket and imposes higher income tax on the person whose income falls in the higher bracket.

It means the tax progresses as the taxpayer’s income rises, and hence it can be concluded that higher earners pay a higher rate and low-income earners pay a lower tax rate. This article discusses the top practical examples of a progressive tax.

Progressive Tax Examples Explained

Progressive tax rate example explain that with increase in income of an individual, the rate of tax payable also increases. Thus, the amount of tax depends on the individual’s income. The government uses this arrangement to collect tax in a fair manner and use it for economic development.

The tax brackets help in segregating the taxpayers according to their income range. It is just opposite to flat tax where same rate is charged to all taxpayers irrespective of their earnings. Whether the tax is less or more progressive depends on the tax range. The wider the range, the greater is the tax progressiveness.

Top 4 Practical Examples Of Progressive Tax

Let us look at some progressive tax rate example to understand the topic.

Example #1

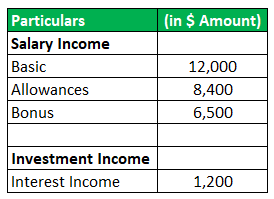

Mr. A is a salaried person, and he has earned the following income during the year:

Now it is year-end, and he wants to file a tax return and wants to know what his tax liability will be.

He has approached CPA, and he is about to calculate his tax liability with the following tax rates.

| Tax Rate | Single |

|---|---|

| 9.00% | Up to $9,525 |

| 11.00% | $9,526 to $38,700 |

| 21.00% | $38,701 to $82,500 |

Based on the above information, you are required to calculate the tax liability of Mr. X

Solution:

First of all, we need to calculate the total income of Mr. X.

Total Income = 12000 + 8400 + 6500 + 1200

Total Income = 28100

Now we shall calculate its tax liability. Up-to 9,525, 9% tax will be liable and then from 28,100 less 9,525 will be 11% which is 2,043.25.

Total tax Liable = 857.25 + 2043.25

Total tax Liable = 2900.50

Thus, the total tax for the year will be 2,900.50.

Example #2

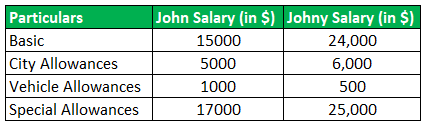

Here we explain progressive tax calculation example to understand the concept. John and Johnny have been recently hired by Big MNC from their campus recruitment, but however, their income structure is different.

We are required to calculate net income in hand and tax payable by both at year-end assuming below tax rates. Also, state the reasons for tax differences.

| Tax Rate | Single |

|---|---|

| 9.00% | Up to $9,525 |

| 11.00% | $9,526 to $38,700 |

| 21.00% | $38,701 to $82,500 |

| 23.00% | $82,501 to $157,500 |

Solution:

First of all, we need to calculate the total income, and then we shall calculate tax liability.

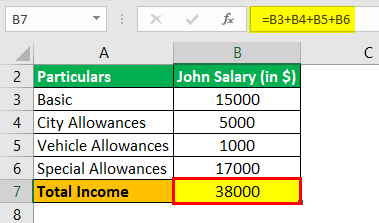

John’s Salary total income will be –

Total Income = 15000 + 5000 + 1000 + 17000

Total Income = 38000

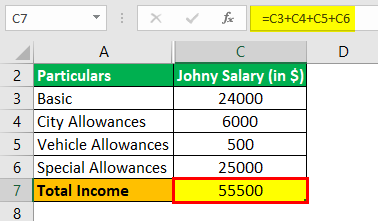

Johny’s Salary total income will be –

Total Income = 24000 + 6000 + 500 + 25000

Total Income = 55500

Now we shall calculate its tax liability. Up-to 9,525, 9% tax will be liable, and then from 28,100 less 9,525 will be 11%, and then above 38,701 21% tax would be applicable.

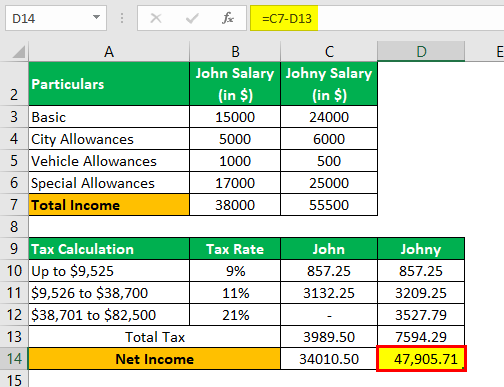

John’s total tax will be –

Total Tax = 857.25 + 3132.25

Total Tax = 3989.50

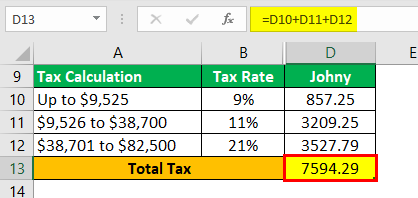

Johny’s total tax will be –

Total Tax = 857.25 + 3209.25 + 3527.79

Total Tax = 7594.29

John’s Net Income will be –

Net Income = 38000 - 3989.50

Net Income = 34010.50

Johnny's Net Income will be –

Net Income = 55500 – 7594.29

Net Income = 47905.71

Net income shall be 38000 – 3989.50, which equals 34,010.50 for John, and for Johnny, it would be 55,500 less 7,594.29, which shall equal to 47,905.71.

The reason for tax differences is because Johnny falls in a 21% bracket, and he is paying the higher tax due to higher income, and it can be noted the tax progresses with income.

Thus from the above progressive tax calculation example, we can understand how the tax rate distribution takes place.

Example #3

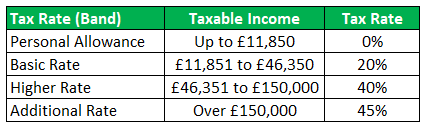

Kennedy has been living in the UK for around 10 years, and his income has increased since then. He is earning £150,000 yearly now. Below are the tax rates of the UK.

Based on the above information, in this example of progressive tax, you are required to calculate the net income that Mr. Kennedy is currently earning.

Solution:

The UK also follows the Progressive tax rate system, and we shall calculate its tax liability by calculating 20% from 11,851 to 46,350, and then similarly from 46,351 to 150,000, the rate applicable will be 40%.

Total Tax Liable for Mr. Kennedy:

Total Tax Liable = 41460

Net income of Mr. Kennedy will be –

Total Tax Liable = 150000 - 41460

Total Tax Liable = 108540

Therefore, the Net income of Mr. Kennedy shall be 150,000 less 41,460, which equals 1,08,540.

Example #4

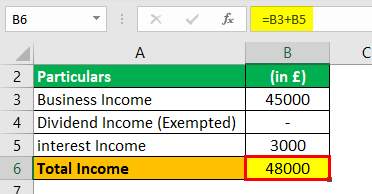

Mr. Morgan has the following income details:

- Business Income: £45000

- Dividend Income: £15000

- Interest Income: £3000

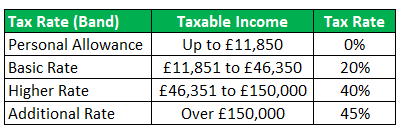

The government has exempted the dividend income from tax. Mr. Morgan has shifted from the US to the UK, and he has hired a tax attorney, based on below tax rates, you are required to calculate his tax liability.

Solution:

First of all, we need to calculate the total income.

Total Income = 45000 + 3000

Total Income = 48000

Total tax Liable will be –

Total tax Liable = 6900 + 660

Total tax Liable = 7560

The UK also follows a Progressive tax rate system, and we shall calculate its tax liability by calculating 20% from 11,851 to 46,350, and then similarly from 46,351 to 150,000, the rate applicable will be 40%.

The total tax liability would be £7,560.