Table Of Contents

What Is Profit Percentage Formula?

The profit percentage formula calculates the financial benefits left with the entity after it has paid all the expenses. It is expressed as a percentage of cost price or revenues and helps organizations compute the profit generated over a period, be it monthly, quarterly, or annually. In general terms, a 15-20% net profit is considered excellent.

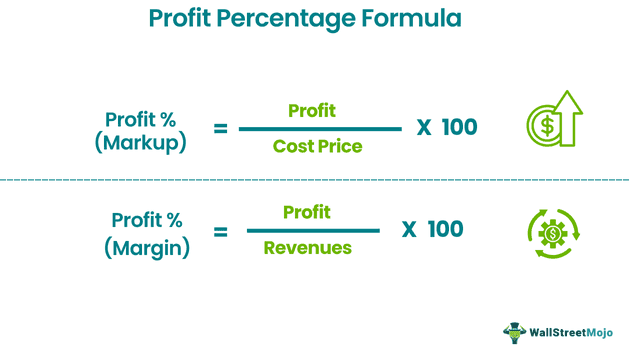

Based on the price it is calculated, profit percentage can be of two types - Markup expressed as a percentage of cost price, and profit margin, which is the percentage calculated using the selling price. Both these metrics combine to become the net profit percentage formula and determine the overall profitability of the company.

Key Takeaways

- The profit percentage formula determines the economic benefits that remain with the entity after paying all the expenses.

- It is expressed as a percentage of the cost or selling price.

- Profit percentage is of two types: – Markup, expressed as a percentage of cost price, and profit margin, which is the percentage determined utilizing the selling price.

- It is the most common tool analysts use to calculate stocks in the primary and secondary markets (IPOs).

Profit Percentage Formula Explained

The profit percentage formula allows individuals and businesses to calculate the profits generated from the gross earnings or on the cost price. While a shopkeeper finds the monetary benefits reaped on the cost price of the products or services sold, a business computes the gains against the revenue generated for a specific period after it covers the outstanding dues and other financial obligations or expenses.

Thus, depending on who is calculating the gains, the profit percentage formula differs. The gross/net profit percentage formula is calculated as follows:

Profit % (Markup) = (Profit / Cost Price) * 100

Profit % (Margin) = (Profit / Revenues) * 100

Calculation Examples

Now that we have a clear idea about the basics of the concept of net and gross profit percentage formula and its related factors, let us apply this knowledge into a few examples and calculations. These examples will give us a practical overview of the concept.

Example #1

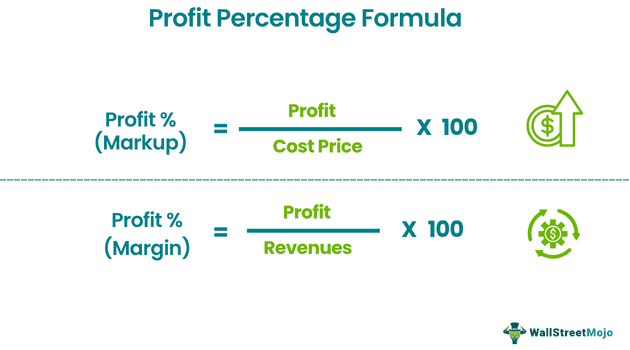

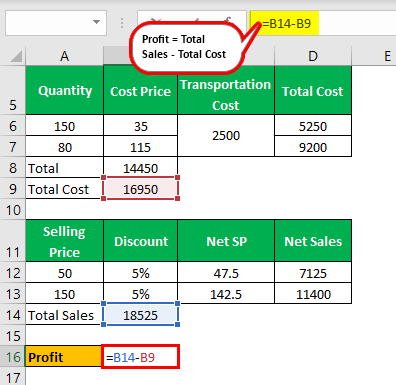

Due to heavy demand by CPA and CFA candidates, Joseph, the stationery shop owner, purchased 150 pieces of normal calculators at $35 per piece and 80 pieces of financial calculators at $115 per piece.

He spent an amount of $2,500 on transportation and other charges and labeled the normal calculators at $50 and financial calculators at $150. He also decided to provide a discount of 5% on every calculator.

Now, he wants to know the profit percentage earned by him.

Solution:

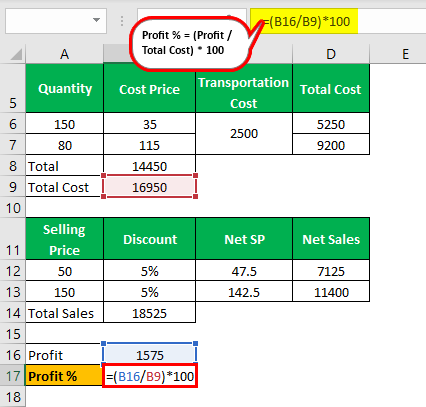

Use the below-given data for the calculation of the profit percentage formula in Excel:

| Quantity | Cost Price | Selling Price | Discount | Transportation Cost |

|---|---|---|---|---|

| 150 | 35 | 50 | 5% | 2500 |

| 80 | 115 | 150 | 5% |

The calculation of profit can be done as follows:-

Profit = 18,525 - 16,950

Here, the profit will be: -

Thus, the Profit = $1,575

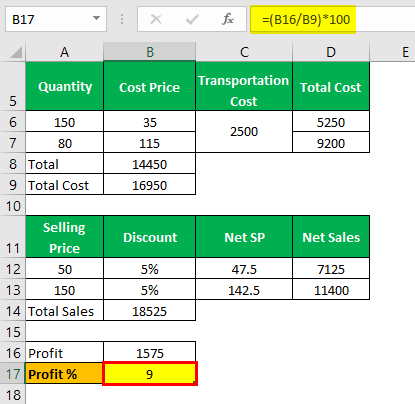

The calculation of profit percentage can be done as follows:

= (1,575 / 16,950) * 100

Profit percentage will be: -

Example #2

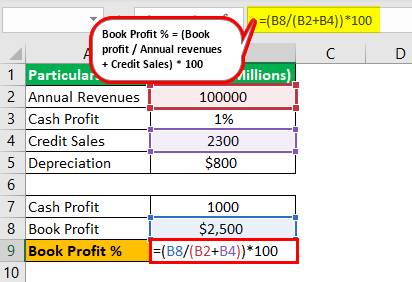

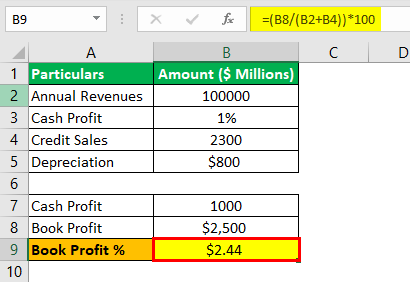

The annual revenue made by Wayne Inc. Ltd., a foot-ware manufacturing company, amounted to $100,000 million in the previous year based on the company's actual receipts and payments. The cash profit is 1% of revenues. The credit sales (not included in annual revenues) amounted to $2300 million. In addition, Wayne Inc. Ltd. charges a yearly depreciation of $800 million on its assets.

The management of Wayne Inc. Ltd. wants to find book profits and calculate the profit percentage for both books.

Solution:

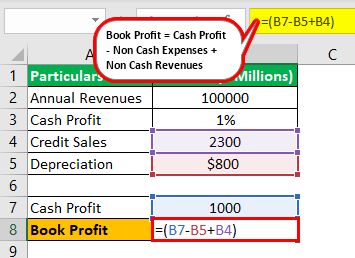

Use the below-given data for the calculation of the profit percentage.

- Annual Revenues: $100,000

- Cash Profit: 1%

- Credit Sales: $2,300

- Depreciation: $800

Calculation of Cash Profit will be -

Cash Profit = 100,000 * 1% =1,000.

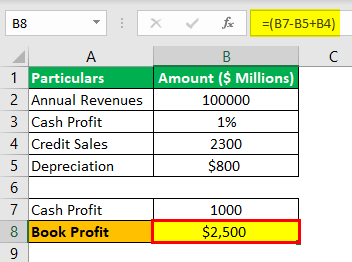

Calculation of Book Profit can be done as follows: -

Book Profit = 1,000 - 800 + 2,300

Here, book profit will be: -

Therefore, the book profit = $2,500.

The calculation of the book profit percentage can be done as follows: -

= 2,500 / (100,000 + 2,300 ) *100

Book profit percentage will be: -

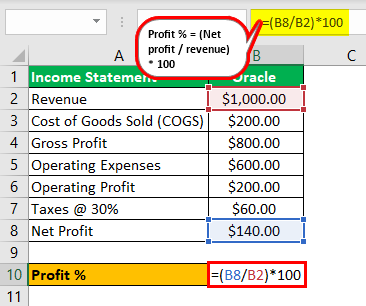

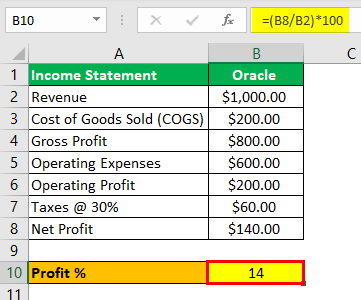

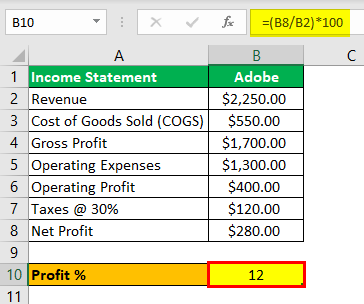

Example #3

Mr. Bruce Wayne, a start-up investor, wants to invest in a new IT start-up based on the project's profitability. That means the idea that shows a higher profit % will be eligible for fund allotments.

Oracle and Adobe, two companies, present their ideas with the expected revenue generation and associated costs.

Based on the details below, Mr. Bruce Wayne needs to decide which company should be selected per the criteria.

| Income Statement | Oracle | Adobe |

|---|---|---|

| Revenue | $1,000.00 | $2,250.00 |

| Cost of Goods Sale (COGS) | $200.00 | $550.00 |

| Gross Profit | $800.00 | $1,700.00 |

| Operating Expenses | $600.00 | $1,300.00 |

| Operating Profit | $200.00 | $400.00 |

| Taxes @ 30% | $60.00 | $120.00 |

| Net Profit | $140.00 | $280.00 |

Solution:

Let's calculate the profit percentage for Oracle can be done as follows:

= (140/ 1,000) * 100

Profit % for Oracle will be: -

Next, let us calculate the profit percentage for Adobe can be done as follows:-

= (280 / 2,250) * 100

The profit percentage for Adobe will be: -

Adobe shows higher revenues of $2,250,000 and higher net profits of $280,000 in its income statements than Oracle, with revenues and net profits of $1,000,000 and $140,000, respectively. But, on calculating both companies' profit percentages, Oracle outperforms Adobe with a profit percentage of 14% for Oracle and 12% for Adobe. Hence, Mr. Wayne should select Oracle based on profit percentage for fund allocation.

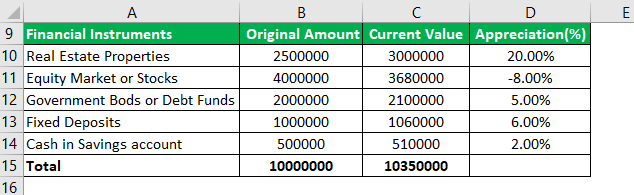

Example #4

Suppose Mr. Bruce Wayne won $10 million in a lottery five years ago and invested all of it in a diversified portfolio as follows: -

| Income Statement | Allocation (%) | Amount |

| Real Estate Properties | 25% | 2500000.00 |

| Equity Market or Stocks | 40% | 4000000.00 |

| Government Bond or Debt Funds | 20% | 2000000.00 |

| Fixed Deposits | 10% | 1000000.00 |

| Cash in Savings Account | 5% | 500000.00 |

| Total | 100% | 10000000.00 |

After five years, he conducted a valuation of all of his assets and investments at a recent point in time. As per the current valuation, he wants to know the net profit percentage for five years.

The current valuation of his portfolio is shown as follows:-

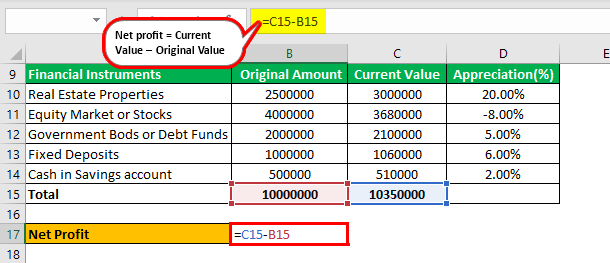

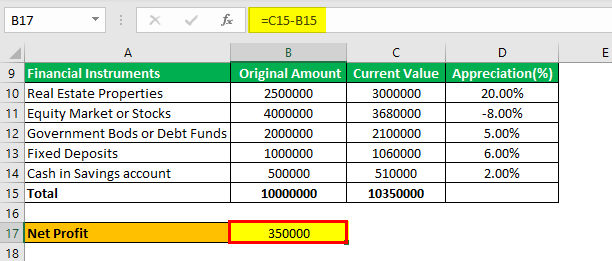

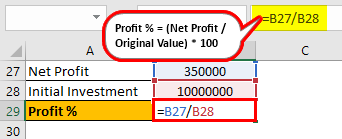

The calculation of net profit can be done as follows:-

Net Profit = 10,350,000 - 10,000,000

The net profit will be -

Net profit = $350,000

The calculation can be done as follows:

=350,000 / 10,000,000 * 100

Profit percentage will be: -

Mr. Wayne allocated the max portion in the equity market and stocks, resulting in negative returns due to depressions in global and domestic markets. Still, since he diversified his portfolio into various assets, he ultimately ended up with a profit percentage of 3.5% and earned $350,000 on its overall investment.

Relevance & Use

When an entrepreneur starts a business, even though their intentions are to revolutionize their industry or change the viewpoints of their target audience, it might not be enough to impress investors and loan officers. Therefore, the profitability and scalability of the business take the fore front of the discussion.

Let us understand the relevance and uses of the net profit percentage formula in the context of its importance to a business and its financial health.

Profit percentage is a top-level and the most common tool to measure the profitability of a business. It measures the ability of the firm to convert sales into profits. i.e., 20% means the firm has generated a net profit of $20 for every $100 sale.

- It not only gauges the capacity of the management to generate higher sales/ revenues but also considers how efficiently it reduces its costs.

- The standard profitability indicator suggests that profit percentage comprises two components - Sales and expenses, and the Profit Percentage equation. Here, the Profit Percentage equation = (Net Sales – Expenses) / Net Sales or 1 – (Expenses / Net Sales). So if one could minimize the expenses ratio to net sales, it could achieve a higher profit percentage. Therefore, one can either increase sales or lower the costs/expenses.

- Investors and financiers like venture capital, private equity, etc., always evaluate the profit percentage of the start-up to check the potential of the service or product.

- Large corporations have to reveal the expected marginal revenues. They will generate the additional funds from issuing debt bonds or equity shares or raising a loan. The companies generally present a future expected profit percentage figure to their investors.

- The profit percentage figure is the most frequently used tool by analysts to evaluate stocks in the primary market (IPOs) and secondary market.