Table Of Contents

What Is Profit And Loss Statement Template?

The profit and loss statement or the income statement is one of the most important financial statements of the Company, which provides the details of the Company's revenues and expenses during the particular period the income statement is created.

The income statement could be of any period, monthly, quarterly, half-yearly, or annually. The Profit and Loss Statement excel templates here discuss the monthly and annual income statements. The two can help businesses generate their income statement after entering a few financial numbers of their business. Both the templates look alike in terms of the contents – the period for which the numbers are put in the template varies.

Profit and Loss Statement Template Explained

The statement of profit and loss template is the document which gives a stakeholder a summary of the financial condition of the company. It displays the net income or loss as well as the revenues earned, and the expenses incurred during the course of the business.

Based on the information given in this template, the investors can take informed decision regarding whether to invest in the company or not. Even other stakeholders like the creditors can take decisions regarding the financial status of the business and accordingly lend money by evaluation the creditworthiness.

The profitability and the financial performance of the business is clearly shown in the simple profit and loss statement template.

Components

The major components to be filled by the user in the P&L Template in Excel are as below which may be profit and loss statement template for small business or established companies.

| Gross Sales | It is the total sales done by the Company during the time period. |

| Other revenue | Any other revenue earned by the Company from various sources like interest income, etc.; It represents the total earning of the company within that period. The revenue may come from the primary operation or from secondary sources, or from any income from interest and sale of assets. |

| Cost of Goods Sold (COGS) | This line item includes the Cost of total goods sold by the Company. This cost represents the direct cost incurred from producing or acquiring the products and services that are sold by the company. They include expenses related to raw material, direct labour or any overheads related to manufacturing that can be directly attributed to the process of production. |

| Employees' expense | Employees’ expense includes salaries, wages, benefits and other long term benefits provided to the employees which are a direct cost to the Company |

| Marketing Expenses | Marketing expenses done by the Company to improve sales are input in this line item. |

| Rent | This line item includes the rent paid by the Company for their office, factory, manufacturing units, or warehouses, |

| Office Supplies and General Expenses | This line item includes the expenses done on office supplies, utilities like electricity, and other general expenses. |

| Other expenses | Any additional expense which is not mentioned in the above expenses is input in this line item |

| Depreciation and Amortization | It includes depreciation and amortization expense on assets acquired or bought by the Company |

| Interest Expense | This line item consists of the interest expense paid by the Company for loans taken by it from banks |

| Income taxes | Income tax is the tax paid on the income earned by the Company. The user can set this to (percentage tax rate* Earning Before Taxes) depending on the tax rate of his Country. It represents the tax expense as per the applicable tax rates of the country and the amount of tax liability on the income generated. |

Thus, the above are some of the important components of the statement of profit and loss template that are commonly used by the stateholders from financial information related to the business. These components provide a comprehensive view about the ability of the business to generate profits through proper control of its cost. This template is used to compare the company performance with its peers and is acts as a benchmark to make financial decisions.

How To Make?

Creating a template for the profit and loss of an organization requires a designed and structured format which will be able to capture the relevant financial and accounting information of the business in a systematic way.

The below mentioned steps will give a clear idea about how to create the structure of a profit and loss statement template for small business or established companies.

- Time period – It is necessary to identify the time period which will be covered in the template. The may be a month, a quarter or an year.

- The header – The header of the template will include information like the name of the company, the title of the document and the time period.

- Revenue section – This will include the area of recording revenue like the sales revenue, service revenue and income. A separate line for a subtotal cam be included.

- Cost of goods sold section – This will include various cost components like direct labor, manufacturing overheads, inventory, etc.

- Separate sections for operating income and expenses – Item under the operating expense should be recorded in details and then subtracted from the gross profit to get the operating income.

- Non-operating items -They should also be recorded as per the items like interest income/expense, investment income/expense, etc.

- Income before tax – Then comes income before tax by subtracting or adding the non-operating income/expense form the operating income expense.

- Tax – In the next step, the tax amount is calculated based on the above income.

- Net Income – In the next step, the net imcome is arrived at by subtracting the tax amount form the Income from tax.

At the end if the template, the business may include any additional information or disclosure or notes that are relevant to the accounting period. This will include some short explanations about any particular event or transaction which may impact the financial data, relevant for audit purpose and important for stakeholders.

Examples

Let us try to understand the concept of simple profit and loss statement template with the help of some suitable examples.

Example #1

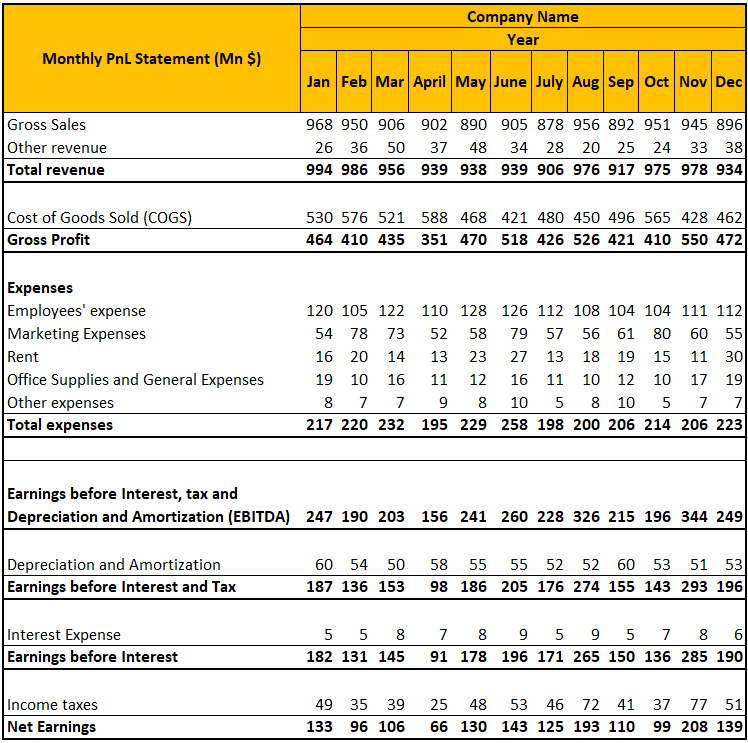

Monthly Profit and Loss Template in Excel

The monthly P&L Template in Excel will look like the following:

Example#2

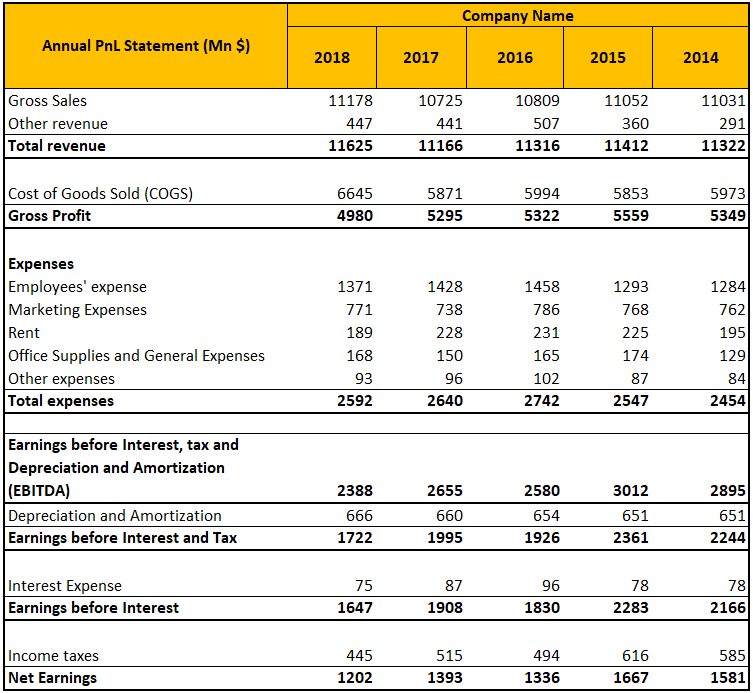

Annual P&L Template in Excel

The annual basic profit and loss statement template in Excel will look like the following:

You can download this Template from here - Profit and Loss Statement Excel Template

Recommended Articles

This article has been a guide to what is Profit Loss Statement Template. We explain how to make it along with examples and its various components. You can learn more about financing from the following articles –