Table Of Contents

Example #1

Company XYZ ltd is in the textile industry, which is manufacturing and selling the different readymade garments in the market. The company has the policy to prepare a Profit and Loss Statement every month and then after the end of the financial year, one profit and loss statement for the whole year.

During the month of June-2019 Company generated revenue by selling the garments of $ 100,000, when the cost of goods sold was $ 60,000. Along with this, the Company generates income from selling the waste material left after making the garments worth $ 9,000 and an interest income of $ 4,000.

On the expense side, during the month the company incurs expenditure on rent of premises of $ 5,500, wages to factory workers of $ 15,000, an annual depreciation charge of $ 7,700, utility expense of $ 9,000.

Prepare the Profit and Loss Statement for the month ending on June 31, 2019, for the company.

Statement of the Profit and Loss Account

Thus during the month, the company generated a net income of $15,800 for the month ending on June 31, 2019. The above Profit and Loss Statement for the company XYZ ltd is prepared using the Single-step Profit and Loss Statement approach, where all the expenses are listed in the statement in major the single broad category without the further division of the categories into the subcategories. It is simple and easy to make as a further division of the categories is not required, which saves time as well.

Example #2

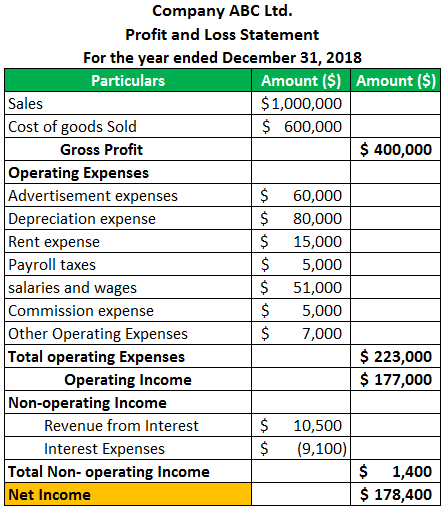

Company ABC ltd is in the business of manufacturing and selling sports equipment in the market. The company has the policy to prepare a Profit and Loss Statement after the end of the financial year for the whole year. During the year ending December 31, 2018, the Company generated revenue of $ 1000,000 by selling the different types of equipment manufactured by it.

The costs of goods sold in the material used were $ 600,000 during the year. The Opex incurred by the company during the year includes advertisement expenses of $ 60,000 depreciation expenses of 80,000, rent charges of $15,000, payroll taxes of $5,000, salaries and wages of $ 51,000, commission to agents for the sales worth $ 5,000 and other operating expenses of $ 7,000.

During the year, interest earned by the company on loan given to other parties was $ 10,500, and interest paid on loan taken was $ 9,100. Prepare the Profit and Loss Statement for the year ended December 31, 2018, for the company.

Statement of the Profit and Loss Account

Thus during the year ending December 31, 2018, the company generated a net income of $178,400. The above Profit and Loss Statement for the company ABC ltd is prepared using the Multistep Profit and Loss Statement approach, where the categories of the different expenses are subdivided into the category, which seems to be more relevant on the basis of its function.

This approach of the Profit and Loss Statement requires time and efforts when compared with the single-step approach as proper classification of all the expenses in their specific relevant category is required, but this helps the management of the company and its other stakeholders to review the performance of the company in a detailed manner so that proper analysis of each category of the expense can be made in a better way.

Example #3

Baker’s is the bakery shop selling bakery items in the town. Every year for its record, it prepares the income statement for its shop. During the year ending December -2018, the total sales of the shop were $ 70,000, and the cost of goods sold was $ 30,000.

The spending of the company on the rent was $6,000, on utility was $5,000, and on the salary of one staff working was $7,000. Prepare the Profit and Loss Statement for the year ended December 31, 2018, for the shop.

Thus during the month, the Bakery shop generated a net income of $22,000 for the year. The above Profit and Loss Statement is prepared using the Single-step Profit and Loss Statement approach, where all the expenses are listed in a single broad category without the further division of the categories into the subcategories.

Conclusion

Profit and Loss Statement helps in measuring the activity of the business over the period and its net earnings. It summarizes the revenue and expenses of the company for the period that is important for the purpose of analyzing the source of money and the application of the money out of business.

The Profit and loss statement is useful for the various stakeholders of the company in different ways, as they have different requirements. Like creditors of the company would like to know that the company is earning a sufficient amount of profits or not so that company can pay off their amount on time, the government of the country in which the company is working would like to have knowledge of the amount of the profit which the company is earning so as to know that whether a company is paying the correct amount of tax to the government or not.