Table Of Contents

What is Profit After Tax?

Profit after tax (PAT) can be termed as the net profit available for the shareholders after paying all the expenses and taxes by the business unit. The business unit can be any type, such as private limited, public limited, government-owned, privately-owned company, etc.

Tax is an integral part of an ongoing business. After paying all the operating expenses, non-operating expenses, interest on a loan, etc., the business is left out with several profits, known as profit before tax or PBT. After that, the tax is calculated on the available profit. Finally, after deducting the taxation amount, the business derives its net profit or profit after tax (PAT).

Key Takeaways

- Profit after tax, also known as net income or net profit, represents the amount of money a company earns after accounting for all expenses, taxes, and interest payments.

- Profit after tax takes into account the taxes paid by the company on its pre-tax earnings.

- Taxes are calculated based on applicable tax rates and deductions, and they can significantly affect a company's overall profitability.

- Profit after tax is a critical financial metric used to assess a company's financial performance. It is often compared to previous periods or industry benchmarks to evaluate growth, profitability, and efficiency.

The formula of Profit after tax

The formula of PAT can describe as below:

Profit After Tax (PAT) = Profit Before Tax (PBT) – Tax Rate

- Profit before tax: It is determined by the total expenses (both Opex and non-operating) excluded from Total revenue (operating and non-operating revenue).

- Taxation: The taxation is calculated on PBT, and the country's geographical location determines the taxation rate. For example, the taxation rate in India stands at 30% (approximately).

After calculating, the taxable amount is subtracted from PBT to get profit after-tax or Net profit. However, in the case of negative profit before tax (when total expenses exceed total revenue), the taxable component is not required. Therefore, tax is only applicable in the case of profitability.

Examples of Net Profit After Tax

Example #1

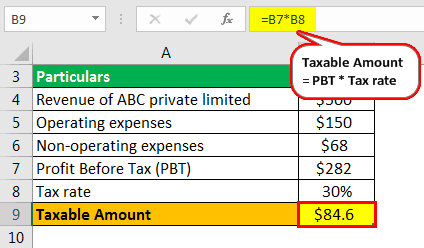

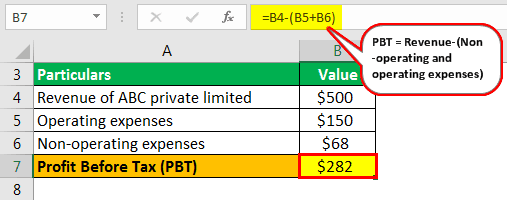

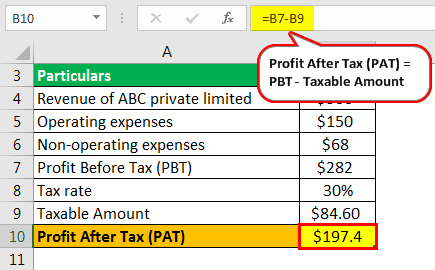

Suppose ABC private limited earns revenue of $ 500, and its operating and non-operating expenses stand at $150 and $68, respectively. The tax rate stands at 30%. Calculate profit after tax (PAT) for the company.

Solution:

From the above data, we get the following information.

- Revenue of ABC private limited: $500

- Operating Expenses: $150

- Non-Operating Expenses: $68

Thus, if we deduct Non operating expenses and operating expenses from revenue, we would profit before tax.

- PBT = $ 500- $(150+68)

- = $ 282

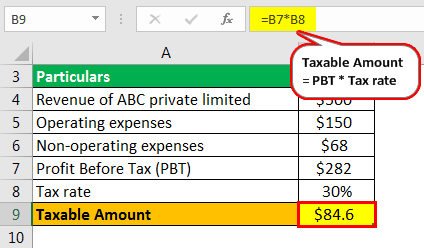

Now calculate the Taxable amount by using PBT and the given tax rate.

- Taxable Amount = Tax @30% on PBT

- = (30% of $282)

- = $84.6

Therefore as per formula

- PAT = Profit before tax – Tax

- =$(282- 84.6)

- = $197.4

Example #2

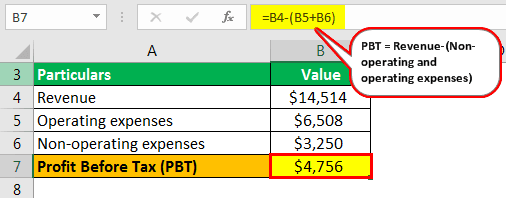

Suppose Australia and New Zealand Banking Group Limited earn revenue of $ 14,514, and its operating and non-operating expenses stand at $6,508 and $3,250, respectively. The tax rate stands at 28%. Calculate net profit after tax for the company.

Solution:

From the above data, we get the following information.

- Revenue: $14,514

- Operating Expenses: $6,508

- Non-Operating Expenses: $3,250

Thus, if we deduct Non operating expenses and operating expenses from revenue, we would profit before tax.

- PBT = $ 14,514 - $(6,508 +3,250)

- = $ 4,756

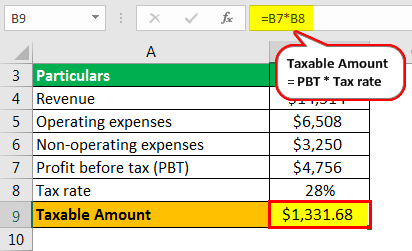

Now calculate the Taxable amount by using PBT and the given tax rate.

- Taxable amount = Tax @28% on PBT

- = (28% of $4,756)

- = $1,331.68

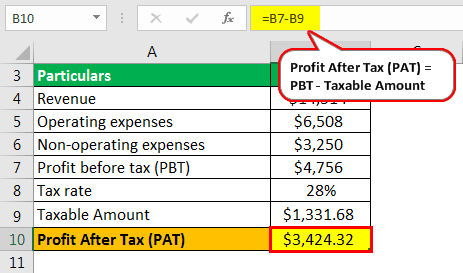

Therefore, as per the formula.

- PAT = Profit before tax – Tax

- = $(4,756-1,331.68)

- = $3,424.32

Advantages

- PAT helps to determine the health of the business. It is an important parameter to evaluate business performances by the shareholders.

- PAT determines the margin, operational efficiency, remaining profits, and dividends, distributed after paying all the expenses.

- Higher PAT determines the higher efficiency of the business, and lower PAT indicates the business's average or below average operational efficiency.

- Dividend distribution is directly proportionate to the PAT. As the higher the amount, the higher would be the dividend yield.

- The stock price of a particular business also depends on PAT, as the profit growth helps increment the stock price and vice versa.

- Because of profitability, the government of the particular company gets the taxable amount, which is used for the betterment and development of the respective countries. Dividends are also distributed to investors or shareholders.

All the above conditions are applied for profitability, higher revenue, and lower expenses.

Disadvantages

- It is calculated only in the case of profitability. Tax is not applicable during losses; hence, the business is not sustainable during continuous losses.

- Poor operational efficiency leads to losses. Thus, there is a question mark on the business's management, business model, and cost-effectiveness.

- In case of a higher Tax rate, Net Profit after tax or the Bottom-line of the company decreases, leaving less amount for the shareholders and 'reserves and surpluses.'

Limitations

- PAT does not apply in case of operating losses.

- Tax is not calculated during losses.

Important Points

- It reflects the profitability of a particular business. In other words, higher profitability (compared to its previous year or peers) indicates better business prospects.

- The growth of a business is determined by Bottom-line growth. If the growth rate of profit after tax is higher than the revenue, then the margin of the business has expanded in real terms, which indicates positivity and better pricing power of the business compared with its peers.

- However, in tepid economic times, PAT gets reduced as the operating expenses increase more than the revenue growth.

Conclusion

Profit after tax or Net profit or the bottom line is denoted by the earnings left after incurring all the expenses by the company. Therefore, higher profitability denotes higher PAT and lowers profitability denotes lower profit after tax. However, loss or profit from exceptional items sometimes leads to abnormal decreases, increases in profitability,y or even losses.

Sometimes, a tax rebate is adjusted, and a refund is added to the loss amount, which might reduce losses. PAT is the primary aspect of any business which determines the future of the particular business, as the remaining profitability is for further expansion through capital expenditure.