Table Of Contents

Professional Employer Organization (PEO) Meaning

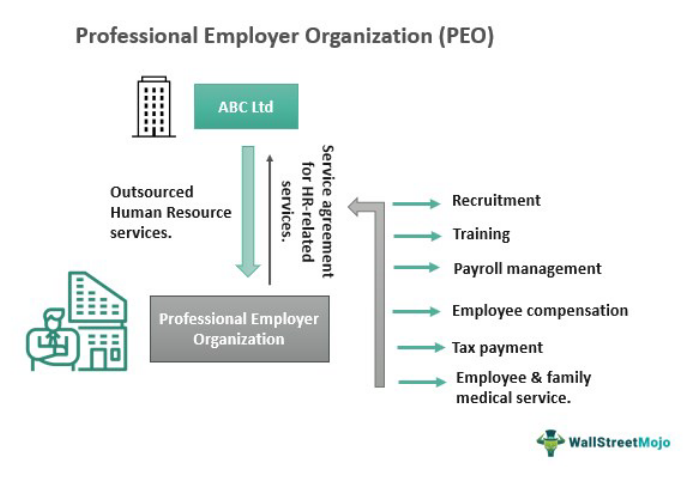

A professional employer organization (PEO) is an entity that coordinates with other organizations to look after various employee-related responsibilities. For example, it might include employee benefits and administrative tasks like payroll, healthcare, taxes, recruitment, etc. PEOs mainly cater to small and medium-sized enterprises (SMEs).

Organizations outsource their human resource services to PEOs by entering into a contract. Through the agreement, the PEOs lease employees and help the employer get efficient, low-cost, hassle-free human capital services. As a result, employers save money and time by delegating and sharing services with PEOs and divert these resources toward other essential business matters and opportunities.

Key Takeaways

- Professional employer organization services allow companies to outsource their workforce-related tasks to an entity that is an expert in this field.

- PEOs enter into a contract with employers who are mostly SMEs and handle tasks like employee compensation, recruitment, payroll, healthcare, taxes, etc.

- It helps organizations save time and capital to channel toward other productive business needs to help the company grow and expand.

- The arrangement provides low-cost, hassle-free, and efficient human resource services since PEOs are professionals with better ideas and concepts in this field.

How Does Professional Employer Organization Work?

A professional employer organization (PEO) provides professional human resource-related services at a low cost, for which they enter into a contract with organizations. The PEO’s clients, the employers, report employees’ wages using the PEO’s federal employer identification number (FEIN), thus making them liable for any services concerning the workforce.

As mentioned in the contract, the professional employer organization services that the employer will opt for include employee recruitment, compensation, benefits, payroll, taxes, training, development, etc. They use skill and expertise to handle the activities and charge a fee for their services over and above the overhead costs of employees, which is a percentage of the total workforce or payroll.

A certified professional employer offers workforce services and handles complex legal employment matters and risk management, creating better employer-employee relations and healthy work culture in the organization.

Some small agencies provide employment-related services but differ from certified professional employer organizations. They handle only staffing needs for the short term, related to some temporary projects.

PEOs are treated as co-employers of their client companies, giving them better-negotiating power and access to a quality workforce pool. As a result, they have a better workforce and can obtain insurance coverage for workers at a much lower cost than the company can manage individually. Sometimes the deal can cover both the client company and the PEO. They also arrange programs for drug testing or drug screening.

How To Start?

There are specific steps that turn an enterprise into a certified PEO, as given below:

Step #1 – Eligibility

To become eligible to work as a global professional employer organization, the criteria are:

- First, it must be a business entity.

- It must have at least one office in the United States.

- It should have experience in financial and organizational management and tax handling at the federal, state, and local levels.

- Some individuals should manage the entity where a majority should be citizens of the US. They should have knowledge and skill related to tax compliance in employment at the federal and state level and must be aware of the various business practices of the same.

Step #2 – Application through the online IRS registration system

An entity should follow the application process for professional employer organization certification in the following sequence:

- Identity verification of each person working in the entity.

- Responsible Individual Personal Attestation (RIPA) and get the INDV number.

- Creation of a controlled group/corporation to work in the business.

- Finally, complete the application as a PEO.

Step #3 – Check the application status/post the Surety bond

The entity has to keep track of the application status. If the status is "open," it is still being reviewed by the IRS. The entity has to submit a bond called Certified PEO Surety Bond in the online registration system within 30 days, in case the IRS has already reviewed the application.

Thus, after submitting the bond and getting the certification, an entity will get the status of a CPEO, which has met the Internal Revenue Service (IRS) requirements.

Examples

Here are a few examples to understand the concept.

Example #1

Tech Developers is a company in the software industry headquartered in New York City, New York. It is expanding and planning to open branches in various other cities in the United States.

Since the company is growing, there is an urgent need to hire a more skilled workforce in different parts of the country, which calls for professional help. Therefore, Tech Developers decided to opt for PEO services from Perfect HR Global, which has earned quite a good name for itself in this sector for top-class HR services.

The decision indeed proved very helpful for Tech Developers. The company outsourced various staffing-related work like recruitment, training, payroll management, compensation management, employee and their family medical service, life insurance coverage, tax payments, employee workplace safety, risk management, etc.

The organization saved a lot of effort and time, diverting those resources towards more productive uses necessary for expansion.

Example #2

The PEO market in the United States will climb up to 147,134 million by the end of 2030, as reported by Straits Research. The demand for this service is exceptionally high in the healthcare sector. In addition, the trend among companies to outsource their human resource-related services to an external professional entity is gaining importance because it reduces operational costs drastically.

Example #3

The growth of the employment rate for a global professional employer organization sector is much higher than the growth rate of the US economy. Research also shows that the total number of employees in this sector is similar to the combined workforce of companies like Walmart, Amazon, Kroger, and Home Depot. The study also shows that companies that use the PEO arrangement have a higher survival and growth rate than companies that do not because PEOs can provide better job satisfaction to employees. In addition, organizations experience higher growth in revenue and profits.

Benefits

Working with a PEO has certain benefits. They are as follows:

- Administrative benefits – The PEOs can arrange good quality and low-cost insurance, other health benefits, retirement benefits, etc., for the employees.

- Legal compliance experts – They handle legal matters concerning employment and save the business from unnecessary penalties and fines.

- Staffing support – The PEOs provide expert staffing support by attracting talented workers and partnering with the company’s HR team to provide strategic support.

- Tax filing and payroll management – They possess sound knowledge about the payroll and procedures for filling taxes in the state, which benefits the company and reduces errors.

- Research and analytics – They do a lot of research in the human capital field related to current trends in skillset requirements, market pay scale, type of job openings, departments with high vacancies, etc. Such data help them to do their job better.

- Reduce the workload of employers – The employer can reduce their workforce-related workload since they outsource the services to another skilled and professional entity, the PEOs.

- Save time and cost – PEO services help organizations free up time and cost and simultaneously increase efficiency, which can improve business growth and expansion.

- Better tracking and risk management – A PEO can conduct workforce assessment and monitoring that minimize risk and help the business to grow.

- Training and retention – Such entities provide employee training and development opportunities and help design better management and retention methods, which also helps reduce hiring-related costs.

- Trust - Since working as a PEOs requires certification and a legal agreement, there is an element of faith and trust in the whole arrangement.