Table Of Contents

Professional Corporation Meaning

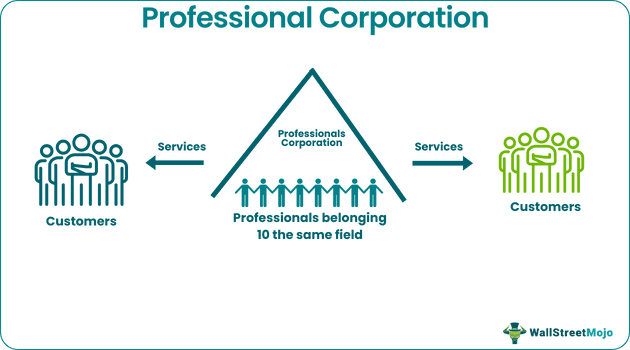

Professional Corporation (PC) or a professional service corporation is a business entity where a group of licensed professionals having the same occupation jointly offer services. The main objective of professional corporations is to limit the owners' liabilities in case of malpractice or negligence by other owners.

Professional corporations best suits doctors, engineers, accountants, attorneys, and architects to render services as a legal entity. It functions like any other corporation but differs in terms of liability, taxation, scope, etc. In addition, the laws governing the formation of PCs vary depending upon the state of incorporation.

Key Takeaways

- Professional corporations are business organizations where people in a particular field come together to offer professional services.

- A major advantage of this type of entity is that any professional mistake by one owner does not make the others personally liable.

- Common professional corporation examples include those incorporated by engineers or architects, attorneys, doctors, accountants, etc. These entities have to satisfy certain requirements to become PCs.

- PCs are usually taxed like other corporations; however, medical PCs can claim tax deductibles, provided they realize certain conditions by the Internal Revenue Service (IRS).

Professional Corporation (PC) Explained

Professional corporations can be helpful for professionals in certain fields to start a business and provide quality service. A PC functions just like any other corporation. Its structure, too, is similar to that of other business entities.

The incorporation of a PC involves lots of documentation and other procedures. First, the professionals, who are also the owners, draft the articles of association, register the company, name the company, obtain permits from authorities and finally get the approval for the company.

One of the most notable features of a PC is that it reduces the owners' liability in two ways. Firstly, the liability of the business doesn't extend to the owners personally in case the company goes bankrupt. Secondly, it is possible that any malpractice or negligence by one owner can harm the other owners. However, in PCs, the liability will not extend to the others.

Professionals who have a common occupation mostly run a PC. But some states allow non-professionals to be shareholders of the companies. That is, if the owners and employees hold 95% of shares in the company as mandated by the government, then non-professionals or people who belong to another field can hold the rest 5%. But, again, this depends on the state of incorporation.

Also, it is important to mention that PCs meeting the requirements for S corporations can appeal to be treated so. In such a case, the company will qualify for pass-through taxation, which will benefit the business.

Requirements of Professional Corporation

There are many types of legal entities – partnerships, corporations, S corporations, limited liability corporations, etc. They differ in many respects. Nevertheless, PCs have certain legal requirements, fulfilling the status they will be accorded. The following are the requirements for the formation of PCs:

- The professionals who wish to form the PC should all have a valid license for practicing the occupation.

- The professionals should be citizens of the state where they wish to incorporate the PC. Also, they should have practiced their profession in the same state.

- The laws of the state govern the incorporation of a PC. Some states do not allow non-professionals to form PCs.

- Further, there are many other requirements as stated by the IRS to obtain tax benefits.

Examples

Let's look at some professional corporation examples to understand how they work.

Example #1

Suppose Joe and Nick are engineers who started a professional corporation. It is found that Joe did some malpractices that put certain clients at losses, and now they demand compensation. Since Joe bears the liability of the loss, he alone is responsible for mitigating it for the client if the insurance does not cover it, which would otherwise have been the responsibility of both Joe and Nick.

Example #2

Consider, MedProfs, a medical professional corporation in New York. It began with ten doctors who wanted to deliver quality health care at an affordable price. Now, it has over 50 doctors working to fulfill its purpose. Being a medical PC and satisfying the exemption rules under IRC Section 501 (c)(3), MedProfs qualifies for the tax deduction under IRC Section 170. Hence, it could claim tax deductibles, which was a huge relief for the owners.

Taxation

PCs, like other corporations, endure a taxation at the rate of 21%. But, to qualify for this tax rate, PCs must have 95% of business activities conducted within the specialization area. Also, former or current employees of the same profession should hold at least 95% of the PC shares.

However, a medical professional corporation can claim some exemptions subject to it fulfilling certain conditions, which are as follows:

Exemption under Internal Revenue Code (IRC) Section 501 (c)(3):

- Medical PCs should not be a part of any parent organization, such that the business activities of the PC benefit the parent organization.

- It should not be for the personal benefit of the professionals.

- It cannot distribute dividends to its shareholders. However, most shareholders are the owners, who are also the professionals offering the service.

- PCs must not participate in any political campaigns or activities. They should not try to hold any political influence.

Such organizations can enjoy tax deductions as per IRC Section 170.

Also, since PCs are limited liability entities, the owners must pay their income tax separately.