Table Of Contents

Template of Proforma Invoice - Record Customer Details

One may use a pro forma invoice template to record customer details like name, address, contact number and email ID, shipping details, and invoice details such as invoice date, invoice number, and due date of payment. In addition, the description of the goods, quantity, price per unit, line totals, and the final amount calculated after making sales tax adjustments.

About the Pro Forma Invoice Template

- The companies use this template format to document the commitment concerning selling the goods to their clients professionally.

- It can be defined as a preliminary and comprehensive sales transaction record that serves as proof until and unless the details finalize adequately.

- This template acts as a preliminary document of sales offered by the company to its clients before the project completion.

- This template serves as proof of sale till the time the financial transactions are not finalized.

Elements

The formats of a pro forma invoice template are below:

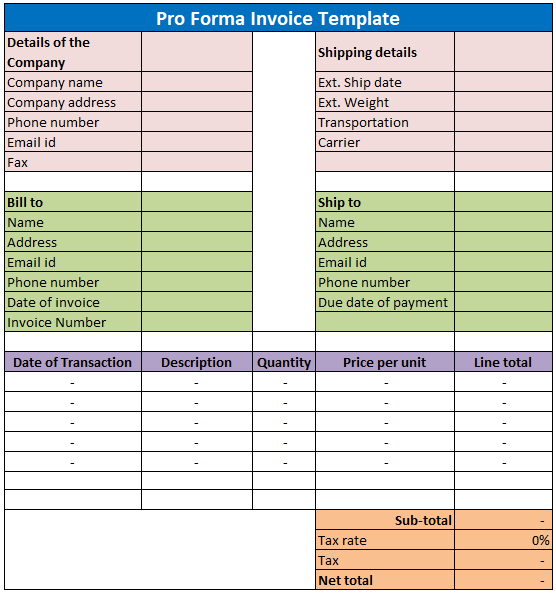

#1 - Header

The users of this template must always label the header as ‘the pro forma invoice template’ to ensure that there is no room for confusion in the future. The purpose of the invoice is easily understood.

#2 - Company’s Logo and Details

The users must fill up the logo and the company's details, like its name, address, contact number, email ID, and fax.

#3 - Bill to Details

One must provide the details of the party to whom the bill is issued. These details must also include his name, address, phone number, and email ID. One must fill these details with due care to ensure 100 percent accuracy.

#4 - Ship to Details

One must fill up the details of the party to whom the goods are supposed to be shipped. These details must include name, address, phone number, and email ID. The users must fill in these details with the utmost care to avoid errors.

#5 - Shipping Details

The users must fill in all the shipping details about transportation, carrier, shipping date, and weight in kilograms. Of course, one must fill all these details with due care to eliminate the slightest errors.

#6 - Invoice Details

The users must also mention the invoice date, invoice number, and due date of payment with utmost care in this segment.

#7 - Transaction Details

After filling in all the details mentioned above, the users can proceed with the next segment, which requires them to provide details about every transaction. These details will include the date of the transaction, description of products, quantity, and price per unit of every product.

#8 - Line Total and Final Amount

The line total must be evaluated by taking the quantity and price per unit and multiplying them with each other. To arrive at the subtotals, one must sum up the line totals calculated for each transaction. The subtotals must be account further for taxes and shipping charges. Once all these adjustments are provided, one can evaluate the final amount that the company is supposed to receive.

How to Use this Pro Forma Invoice Template?

Following are the steps to use this template:

- The person using the pro forma invoice template has to enter all the details as required in the fields that are not already pre-filled.

- The users must provide the company's details, issuing the pro forma invoice to the customer. The company's details must include its name, contact number, address, fax, and email ID.

- The users must then move on to filling the bill and ship to a segment where one must fill in the details of the respective parties. These details will include the concerned parties' names, addresses, contact numbers, and email IDs.

- The users must then fill up the shipping details like ext. shipping date, ext. Weight in kilograms, transportation, and carrier.

- The users must then proceed with invoicing details like invoice number, date of invoice, and due date of payment.

- Once all these details in the first segment are filled in correctly, the users must move to the next segment, where they will need to provide further information about every transaction. But before proceeding with the next segment, it is always advisable to cross-check the information already filled in to eliminate the likelihood of any error.

- The users must mention the date of every transaction and describe the products, quantity, and unit per price accordingly. The user must then determine each transaction's total by multiplying the quantity and price per unit. Then one must sum up all the results to arrive at the subtotal. Finally, one must add the subtotal with sales tax and shipping charges to arrive at the final amount due at the customer's end.