Table Of Contents

What Is Private Placement?

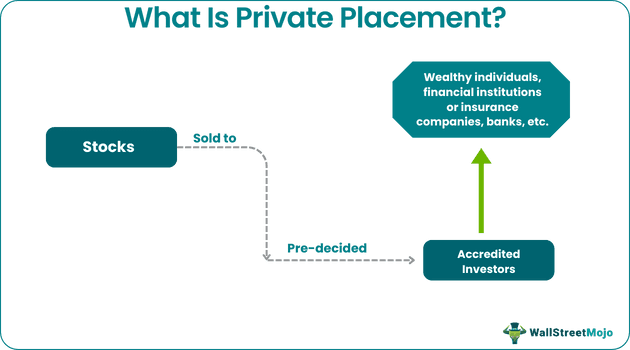

A private placement is a process whereby stocks are sold privately to investors selected beforehand. In the process, the respective stocks are not put for sale in an open market and are only accessible to those who have already been chosen based on certain criteria. In comparison to open market sales, private placement offerings have lesser regulatory requirements.

This group of accredited investors includes wealthy individuals, financial institutions, insurance firms, etc. Though the private placement program, like the Initial Public Offering (IPO). It involves the purchase and sale of securities, it does not have stricter rules and regulations related to stock transactions. It has become a common facet for start-ups that want to raise funds and delay their IPO in the future.

Key Takeaways

- Private placement of shares refers to the sale of company shares to the investors and institutions selected by the company, also called accredited investors.

- The company calls for such investors, which they choose based on certain metrics. They can be wealthy individuals, financial institutions, etc.

- It is not issued in the open market for the public. Hence, it has fewer regulatory requirements.

- It helps diversify fundraising, but finding a suitable investor is difficult. Investors often exhibit higher demands and charge higher interest rates too.

Private Placement Explained

Private placement is a stock or securities distribution strategy in which the companies sell assets to pre-decided investors. Also known as a non-public offering, these are an effective alternative to IPOs that help companies raise funds in exchange for the share in profits they earn. The investors invited for this privately-held sale are wealthy individuals and entities, mutual fund providers, insurance companies, and banking and financial institutions.

The privately sold assets offered to accredited investors fulfill the required eligibility criteria and meet a certain threshold of financial net worth. They have more experience in making investments and prudent financial decisions. The companies invite only those investors for such schemes who could afford to take risks and bear losses that may arise from such an investment.

One of the major reasons that make investors accept this invitation is the lenient rules and regulations. Unlike IPO, privately sold securities have fewer regulatory requirements to fulfill, making it an easier investment option. In addition, such placement of shares, if done by a private company, does not affect the share price as they are not listed publicly. However, for a publicly listed company, such securities distribution leads to a share price decline, at least in the near term.

It has become a common facet for start-up companies to curate private placement programs to raise funds instead of opting for IPO. It is not just because of the regulations but also to enter the open market when their company is doing better than its current situation.

Types

The process of private placement offering could be better understood by exploring the types of such distributions found in the market. Preferential allotment and qualified institutional placement are the two significant types of it.

- Preferential allotment allows the distribution of stocks and bonds to a preferred group of investors. These accredited individuals and entities include mutual fund companies, financial institutions, etc.

- On the contrary, qualified institutional placement includes institutional investors that meet the eligibility criteria per the US regulations.

Features

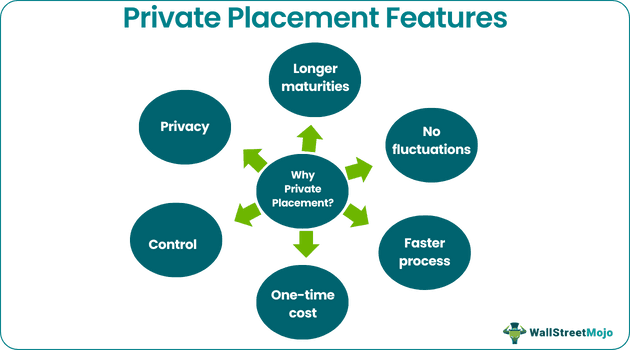

Despite purchasing shares through an open market is easier for investors, there are a handful of features that make private placement programs attractive. Let us understand them through the explanation below.

The distribution of shares done privately has many features, which are the reason investors await such invitations. These options are specifically kept aside for the chosen investors and hence offer the company the entire control to deal with them. The maturity periods of the securities are extended to a significant period, and the fluctuation in the market conditions does not affect the interest rate applicable for these non-public offerings.

As discussed above, the regulatory requirement to meet is lenient, and the cost involves a one-time cost for the investors to pay. Overall, the process of distribution is faster than IPO. Hence, investors are always willing to invest in these deals.

Rules & Requirements

A certain set of rules and requirements have to be followed by both the company and the investors of a private placement offering. Let us understand them through the discussion below.

Regulation D of the US Securities and Exchange Commission (SEC) rules and guides the private placement of shares. This regulation allows firms to sell the assets to accredited or selected investors only. Once the investors are in, the companies issue them the private placement memorandum.

The commission has recently changed the definition of accredited investors who are offered a chance to buy stocks and securities privately. In August 2020, SEC added the following points to the existing definition of such investors:

- Any individual or a married couple or anyone equivalent to a spouse possessing a net worth of at least $1 million with the cost of their primary residence remaining excluded while calculating could be an accredited investor, or

- An individual with a minimum income of $200,000, or

- A married couple with a minimum combined income of $300,000 per record of the last two years as well as for the current year, and

- An individual with specific professional certifications or credentials or designations obtained from an accredited education or professional institution as recognized per SEC’s order from time to time, along with individuals holding a significant position in accordance with Series 7, Series 65, and Series 82 licenses.

Examples

Let us understand the concept of a private placement program with the help of a couple of examples. These examples shall give us a practical overview of the concept and its related factors.

Example #1

Company A has been suffering from a financial crisis for a few months. However, it plans to sell some of its shares to raise funds quickly to pay its debts. It decides not to invite all investors as it will likely consume more time.

Thus, it selects trustworthy investors and sends them invitations to buy its shares. Despite the poor run of sales and rising debt in the last quarter, most of them agree to purchase its shares, given the company’s past performances.

This helps Company A pay off all its debts without consuming much time and spending resources on other forms of raising funds to meet their financial obligations.

Example #2

Verses AI Inc., a cognitive computing company headquartered in Vancouver, Canada. They announced their private placement offering in June 2023 worth C$13,000,000. They declared that the offering was curated to take advantage of the listed issuer financing exemption under Part 5A of the prospectus exemption.

The placement will be conducted in most parts of Canada apart from Ontario and a couple of other states.

The proceeds from this arrangement will be used for business development, general corporate purposes, and for funding the general working capital after the fees for underwriters and other charges are deducted.

Advantages & Disadvantages

Private distribution of shares has its own set of advantages and disadvantages, given the opportunity to raise funds that organizations receive and the difficulty that companies face in finding a suitable investor. Let us have a look at the pros and cons of private placement offerings through the table below.

| Pros | Cons |

|---|---|

| Maturities extend for longer, hence returns are long-term | Finding suitable investors is difficult |

| The process of investing and raising funds is faster. | The buyers are more demanding as they expect higher rates of returns. |

| Fewer regulatory requirements | |

| Investors are pre-decided | |

| An easier way of raising funds than an IPO |

Private Placement vs Preferential Allotments vs Public Offering vs Rights Issue

Private placement and preferential allotments sound similar, with the latter being part of the former. However, these two differ in certain terms. In addition, the private selling of securities is also different from a public offering and rights issue, which are also major types of distribution of shares amongst investors.

Let us find out how private placement programs differ from preferential allotments, public offerings, and rights issues through the comparison below.

- A preferential allotment is a scenario in which private placement acts as a mode of share distribution.

- While the latter finds significance with respect to all kinds of securities, the former only deals with equity shares and convertible securities.

- Public offering refers to the sale of shares in an open market where the securities are accessible to all interested investors. On the contrary, the private or non-public offering is the distribution strategy in which companies sell shares to invited investors privately.

- While in the case of rights issues, firms send invitations to a large group of investors, the private placement of shares involves inviting only a selected group of investors for the private selling of securities.