Table of Contents

Private Mortgage Insurance (PMI) Meaning

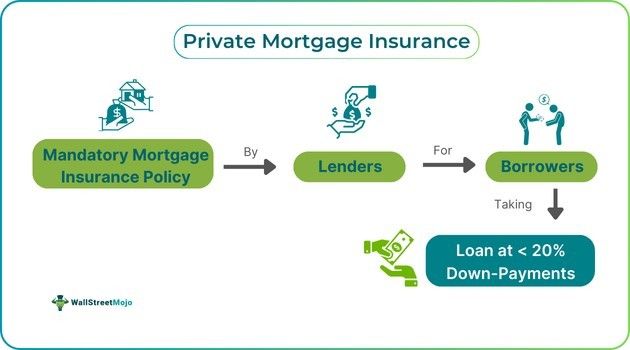

Private mortgage insurance (PMI) is a category of mortgage insurance mandatorily bought by borrowers taking out traditional loans using a down payment below 20% on the asset's purchase price. It helps lenders protect their investment in the loan if borrowers fail to repay the loan as per the loan agreement.

PMI helps people realize their dream home easily and sooner despite below-par initial equity. It has to be paid monthly or upfront, adding to monthly costs. As soon as the equity in the house reaches 20%, PMI decreases the monthly cost of the mortgage.

Key Takeaways

- Private Mortgage Insurance (PMI) is a requirement for borrowers offering less than a 20% down payment to protect lenders if the borrower defaults on the mortgage loan.

- Its types include borrower-paid, lender-paid, single-premium, split-premium, and Federal Home Loan Mortgage Insurance Premiums, each with varying premiums and durations, ensuring lender safety.

- It has benefits like reducing down payments, upfront capital, and long-tenure costs for borrowers while lowering lender risk and rarely being tax deductible.

- It is necessary for mortgage loans taken at less than 20% down-payment, while MIP is mandatory for all FHA loans, irrespective of downpayment.

Private Mortgage Insurance Explained

Private mortgage insurance (PMI) is a mandatory insurance policy lenders ask borrowers who give a down payment of less than 20% on a traditional mortgage. It safeguards lenders from loan defaults. It comes bundled with a monthly premium in the mortgage payment but can be either financed or paid upfront. Although it does not benefit the borrower directly, it makes them eligible for mortgage loans with smaller down payments.

Exploring insurance options can help you find coverage that fits your unique needs. For those interested in comparing a range of insurance products, resources like SuperMoney make it easier to review and select policies from top providers.

It helps borrowers with a contained amount of savings to get to mortgage as early as possible. Since the insurance provides lenders against risk, it has made it convenient for financial institutions to sanction loans to borrowers offering small down payments. It has become an advantageous proposal for long-term and first-time borrowers as it gives flexibility in financing means, including faster home purchases.

Private mortgage insurance in real estate has stabilized the housing market, thereby promoting economic growth and development. It also lowers the risk of lenders promoting a highly efficient financial system.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

Types

Let us discuss the types of PMI for the benefit of readers:

- Borrower-Paid Mortgage Insurance (BPMI) is the most common type, allowing borrowers to pay monthly premiums until they approach 20% equity in their mortgage home.

- Lender-Paid Mortgage Insurance (LPMI): The lender pays the premium for insurance, usually leading to a higher interest rate that is non-cancellable.

- Single-Premium Mortgage Insurance (SPMI) reflects one-time payments undertaken at closure, minimizing monthly payments that make PMI nonrefundable in case the borrower refinances or sells.

- Split-Premium Mortgage Insurance: It conjoins monthly and upfront payments, enabling smaller initial costs while handling monthly expenses.

- Federal Home Loan Mortgage Insurance Premium (MIP): It is needed for FHA-insured loans offering safety to lenders and consisting of monthly and upfront payments that typically last up to 11 years.

Examples

Let us use a few examples to understand the topic.

Example #1

An online article published on 30 July 2024 discusses PMI as the most vital resource low down-payment purchasers use under existing housing market challenges. As per the late report published in 2023 by U.S. Mortgage Insurers (USMI), almost 800000 Americans put to use PM in purchasing homes, of which 64% were first-time home buyers. The median loan amount was $346817 for homes that were brought under the PMI option.

PMI facilitates home-buyers to become eligible, having down payments below 3%, allowing access to house ownership and aiding $283 billion as mortgage originations. The report also highlighted the role of PMI in decreasing the duration of saving for personal homes. Moreover, it contrasts starkly with 27 years with a 205 down payment against a smaller duration for 5% down payments normally used along with PMI.

Example #2

Let us assume a young couple – Zara & Muke of old York City buy their maiden home together for $500000. They give $50000 as a downpayment for it, leading to a loan of $450000. Now, as their down payment remains less than 20%, they must pay private mortgage insurance rates at a yearly rate of 1%. It means they have to pay an amount of $4500 annually or $375 monthly as PMI.

Now, after regularly paying the loan for the last two years and experiencing an appreciation in home value, their loan balance has reduced to $400000. Since the new value of their home now stands at $550000, they request the cancellation of their PMI. After that, the lender also confirms that Zara and Muke have reached the needed level of 20% equity threshold, permitting them to eliminate PMI to save money every month.

Benefits

For borrowers with good credit scores, PMI has the following benefits:

- It helps borrowers access the housing market by reducing down payments below 20%.

- It decreases upfront funds needed to buy a home, making it easier for many to buy homes.

- Borrowers get the option to select payment options consisting of upfront and monthly premiums.

- PMI can be canceled as soon as the borrower approaches 20% equity, decreasing long-tenure costs.

- PMI lowers the risk of lenders as it covers potential losses arising from borrowers' defaults.

- It helps borrowers not capable to buy home with large down payments.

- PMI may become tax deductible in some rare cases, offering extra financial relief, but it must be consulted with experts in this field.