Table Of Contents

What Is Private Investment In Public Equity (PIPE)?

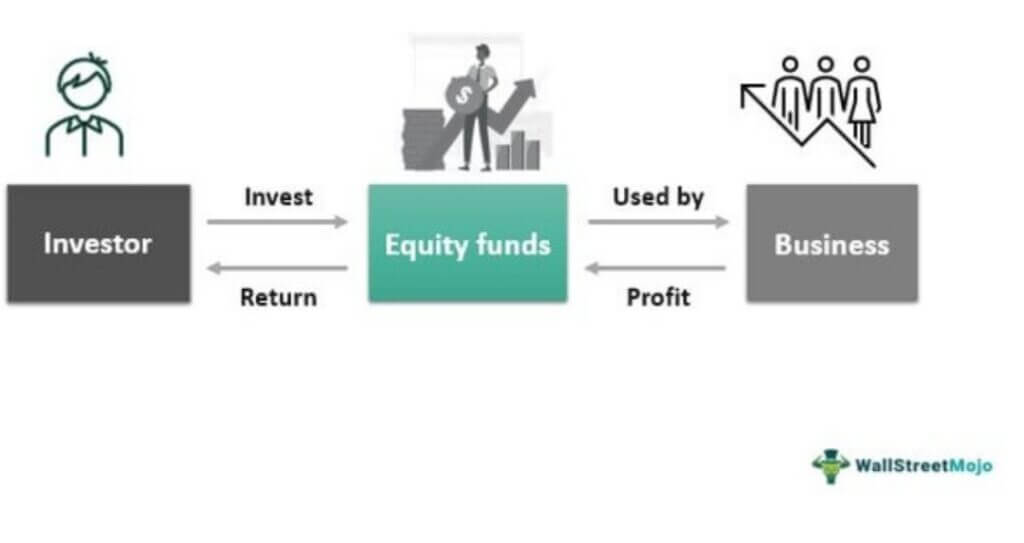

Private investment in public equity (PIPE) is an arrangement where certified private investors purchase securities belonging to publicly traded companies in bulk. Thus, it is the private placement of the publicly traded securities, i.e., trading of equity outside public stock markets.

PIPE comprises the sale of common stocks, convertible debentures, convertible preference stocks, stock warrants, etc. These shares are offered below current market values. PIPE is further classified into traditional and non-traditional subtypes. For publicly traded corporations, it is an instantaneous source of funds. In addition, this alternative is more economical.

Table of contents

- Private investment in public equity (PIPE) is a source of financing adopted by public corporations by issuing large chunks of securities to accredited private investors.

- The PIPE issuer doesn't need to undergo federal registration. Also, the issuers are not required to file with the Securities and Exchange Commission (SEC). As a result, both issuers and buyers significantly limit administrative work.

- Through PIPE, small and medium-scale public companies acquire finance from private investors. However, many such firms cannot acquire funds via traditional equity financing.

Private Investment In Public Equity Explained

Private investment in public equity (PIPE) is the bulk purchase of restricted new or existing securities—shares of publicly traded companies. Certified private investors carry it out. Simply put, it is a private placement of common or convertible preference stocks, warrants, and convertible debentures belonging to public firms—at a discounted price.

Moreover, PIPE issuers need not file securities registration with the U.S. Securities and Exchange Commission (SEC). This procedure does not require federal registration formalities. Instead, the issuing company provides resale registration statements to make the buying more convenient. Investors use this statement to offer securities to the public.

On the one hand, it is a source of capital for public companies; on the other hand, investors get a large chunk of public equity—prices are lower than the market value. Also, the issuer cannot sell these securities directly (stock exchange). However, investors can make money by short-selling equities.

Private investors are people or firms with expertise, knowledge, and an interest in investing. More often than not, they put their money into companies that require capital from them to succeed and get financial returns. They focus less on speculation and more on demonstrated growth and opportunity.

Private Investment In Public Equity Types

PIPE is a mode of offering securities belonging to publicly traded companies. But is offered only to accredited investors.

Private investment in public equities is further classified into two types:

#1 - Traditional PIPE

The issuer deals with common and convertible preferred stocks to accredited investors in such an arrangement. These are offered at fixed prices, variable prices, and exchange rates around market values. Also, investors are covered if an underlying company undergoes a takeover or merger. In such scenarios, Investors are entitled to receive a dividend.

#2 - Non-Traditional PIPE

The structured PIPE involves trading convertible debt securities like the preferred stock for which the investors pay at the closing, i.e., after the commencement of the purchase agreement. Such stocks are sold at a variable price with a Securities Act Legend restriction.

Examples

Let us look at some real-world private investment in public equity example and PIPE investors based in the US and their PE assets:

| PIPE Investor | PE Asset |

|---|---|

| Centerbridge Partners | $16900 Million |

| Castle Creek Capital LLC | $750 Million |

| Investindustrial | $12396 Million |

| MPE Partners | $3000 Million |

| Vista Equity Partners | $57000 Million |

| Montagu Private Equity LLP | $11269 Million |

| The Edgewater Funds | $2800 Million |

Pros

PIPE is a provision for issuers to seek capital from an outside source (other than the public stock market). In addition, it offers the following advantages:

- Through PIPE, small and medium-scale public companies acquire finance from private investors. However, many such firms cannot acquire funds via traditional equity financing.

- Securities sold through PIPE do not require federal registration with the Securities and Exchange Commission (SEC). As a result, both issuers and buyers significantly limit administrative work.

- For publicly traded corporations, this alternative is more economical and promising. But, more importantly, it is an instantaneous source of funds.

- PIPE securities are offered to certified investors in sizeable blocks—on a long-term basis.

- Investors also benefit from PIPE, paying below the market value to acquire these stocks.

Cons

PIPE does have its shortcomings. The disadvantages are as follows:

- First, issuers are forced to sell securities below current market values—Which is the trade-off for acquiring capital quickly.

- These securities are only available to accredit private investors.

- These securities can be frequently bought or sold— short selling of PIPE is common—adversely affecting its share prices.

- If a security’s market price falls constantly, the issuer may need to release additional shares at a lower price. This results in a dilution of share value. Such a fall in prices is caused by short selling,

- In PIPE deals, the issuing public company needs permission from existing shareholders if it issues beyond 20% of outstanding shares.

Frequently Asked Questions (FAQs)

A PIPE deal involves the issuing of public company securities. The shares are offered in bulk quantities to accredited private investors (outside the public stock market). It is a secondary means of capital acquisition for publicly traded corporations (in addition to initial public offerings issued in the public stock market).

Public companies often raise working capital through private investment in public equity by selling securities below market price. Public companies issue new common or convertible preference stocks and existing public equity. However, these shares are not sold over the stock exchange. Instead, to make money, investors short-sell securities.

Private equity firms can only invest in public companies by partaking in buyouts.

In a non-traditional PIPE transaction, the public company sells its securities to certified private investors at a variable or fixed price (usually lower than the market price).

Recommended Articles

This has been a guide to What is Private Investment in Public Equity. Here, we explain its types, example, and pros & cons. You can learn more about it from the following articles -