Table Of Contents

What Is A Private Foundation?

Private foundations are non-profit organizations that are created for charity or tax-exemption purposes. They are established and funded by a single individual, business, or entity. The benefactor usually makes a single seed donation investment divided according to the foundation's charitable or exemption purposes.

According to the IRS 501C (3), exemptions are granted to educational, literary, public safety, sports, animal cruelty, scientific, religious, and charitable agendas. Foundations exhibit visible influence—institutes, community centers, and welfare clubs are good examples.

Key Takeaways

- Private foundations are owned by a single person, company, or entity used for tax exemption and charitable purposes.

- The initial seed donation is known as an endowment. Most foundations are associated with education, sports, healthcare, work against crime, animal cruelty, or science.

- Hospitals, universities, schools, and offices working towards a social goal are typical examples of foundations.

- Many successful businesses feel they have earned enough, and it is time to give back. Corporate foundations are established by such large corporations: for charity purposes.

How Do Private Foundations Work?

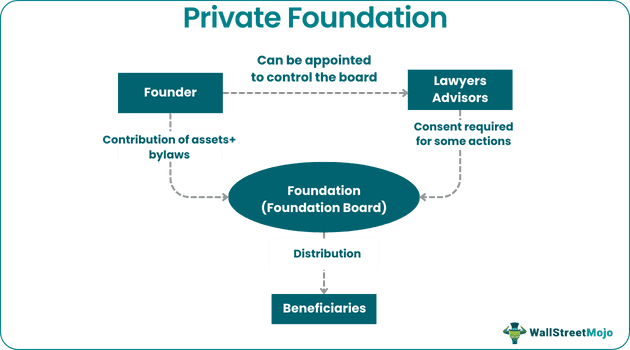

Private foundations are owned by individuals and entities with little or no intervention from the government. Instead, single seed donations fund these foundations by a benefactor—like-minded people govern them. In some cases, the foundation is owned and run by the members of a family.

The establishment and operations of foundations are reported to the IRS (Internal Revenue Service). The foundation structure allows founders to avail of tax benefits—under the umbrella of exempt purposes. But availing of those tax exemptions requires a complex and rigid legal process—to prevent misuse.

The IRS elaborates on the foundation structure in 501C (3). But due to varying state laws, foundation regulations are applied differently—depending on the particular scenario and jurisdiction.

The IRS also dictates private foundation distribution rules for corporate, international, and family-run institutions. If a foundation does not comply with the IRS, they incur penalties, fines, and charges.

According to tax laws, an institution must spend at least 85% of its net income on charitable purposes to be considered a private foundation.

How To Set Up A Private Foundation?

To set up a foundation, follow these steps:

- Define a Philanthropic Objective

Usually, a foundation’s objective centers around a particular social cause. Based on the clear objective, a mission statement is formulated.

- Solidify Grant guidelines

Particular guidelines are drafted for private foundation grants and donations. The institution must follow these guidelines while sanctioning private foundation grants and receiving donations.

- Hire a legal team

Due to tax exemptions, foundations undergo complex legal procedures—laws, bylaws, regulations, and restrictions. To deal with the legal process, foundations need to hire a team of lawyers and financial advisors.

Lawyers and financial advisors oversee foundations' compliance, tax returns, and management. In addition, suitable decision-making structures are devised. This involves board members and trustees.

- Employer Identification Number (EIN)

EIN is a nine-digit number assigned by the Internal Revenue Service to identify a business entity. Every private foundation must have an EIN to operate freely. Foundations can simultaneously apply for tax-exempt 501(c)(3) recognition.

- Paperwork and documentation

Complex legal procedures naturally involve a lot of paperwork—filing, registering, tax exemption, etc. The IRS mandates the following guidelines:

- Private foundation grants must account for 5% of investment assets (every year).

- Private foundation grants must only be made to other non-profits or educational scholarships.

- A 2% private foundation excise tax is charged on investment assets.

Types

Different types of foundations are as follows:

#1 - Independent

Such private foundations are not governed by benefactors, families, corporations, or government authorities. Instead, an independent foundation is run by a single person or group. This structure is common with endowment funds.

#2 - International

It is run and administered by a corporation but is based overseas. By default, donations are received from different sources across borders. International foundations have different home bases and international offices.

#3 - Family

Family foundations are owned and operated by a particular family. Different family members play different roles in foundation operations. However, all the members are involved in the decision-making process.

This structure facilitates ease of communication and transparency. Family foundations work toward a specific philanthropic cause or for tax exemption.

#4 - Corporate

Large organizations and corporations own corporate foundations. Many successful businesses feel they have earned enough, and it is time to give back. Most corporate foundations prefer poverty eradication, education, healthcare, and insurance concerns.

IRS Rules

Private foundation rules are as follows.

- If public disclosure is required, foundations must file Form 990-PF, foundation returns, and 1023.

- Private foundation distribution rules are mandatory—the institution must donate income to charitable purposes every year.

- A private foundation can only hold a small stake in private businesses.

- Investments must not violate tax-exemption regulations.

Benefits

- Total control and authority over decision-making and fund management.

- Charitable purposes encouraged by companies work in favor of creating goodwill.

- A foundation can possess different types of assets, either bought or donated by people.

- A foundation works for charitable purposes; therefore, they are offered a certain tax relaxation and advantages by the government.

Taxation

Let us look at private foundation tax rates.

- A specific private foundation excise tax is applied to the net investment income of domestic foundations.

- US international foundations are required to pay a tax on the gross investment income.

- These taxes must be paid annually; if it amounts to more than $500, then taxes must be paid quarterly. In addition, there are specific tax provisions for recognized charitable and private interests.

- The IRS possesses a list of foundation state laws—it might differ from one state to another. A foundation that violates tax provisions will incur penalties and additional taxation.

Examples

Let us look at some examples to understand the foundation structure better.

Example #1

Magnus owns a chain of restaurants. He is affluent and hence wants to undertake philanthropic endeavors. Specifically, he is concerned about people going to bed on empty stomachs. He is also concerned about children dying of malnutrition.

Magnus takes action and establishes a foundation that provides free meals around the city daily. In addition, this foundation provides free education to poor children and employment—at Magnus’ restaurants.

Once in a while, Magnus visits the foundation office. Magnus has complete discretion over decision-making. Soon the foundation becomes more visible and attracts outside donations to the foundation. Despite the simple decision-making structure, foundation operations involve several technicalities.

Example #2

The Bill and Melinda Gates Foundation is one of the largest examples. Bill and Melinda established the institution using Microsoft funds. The foundation provided free PCs to public libraries. In addition, bill and Melina traveled to poor locations and provided healthcare to children.

Subsequently, they transferred $20 billion of Microsoft stocks to the foundation. Between 2000 and 2022, the foundation spent $53.8 billion on charity.

Private Foundation vs Public Charity

- Private foundations are operated by family members or a group of like-minded people. On the other hand, public charities receive financial support from the government and the public.

- Private foundation excise taxes are imposed on foundations. In contrast, organizations that qualify as public charities under Internal Revenue Code 501(c)(3) are eligible for federal exemption from corporate income tax and similar state and local taxes.

- In foundations, the power of decision-making and control resides with the individual or entity running the institution. In contrast, public charities prioritize public disclosure and governmental involvement.