Table Of Contents

What Is Private Debt?

Private debt refers to loans or other forms of debt financing provided by private entities, such as banks, hedge funds, or private equity firms, rather than governments or public institutions. It aims to provide a flexible and customizable source of financing for companies and individuals.

It aims to provide a source of financing for companies or individuals. Companies may need help accessing traditional forms of debt like bank loans or bonds issued by governments or public institutions. In addition, one can use it for various purposes, such as business expansion, acquisition, refinancing, and leverage.

Key Takeaways

- Private debt is a form of financing provided by private entities, such as banks, hedge funds, and private equity firms, rather than by governments or public institutions.

- It can finance various activities, such as business expansion, real estate development, and acquisitions.

- In addition, there are several types of personal debt, each with unique characteristics and terms, such as corporate bonds, mezzanine financing, and senior secured debt.

- Obtaining such debts can be complex and time-consuming, and borrowers may need to work with legal and financial advisors to navigate the process.

Private Debt Explained

Private debt is money that individuals, businesses, or other non-government entities borrow. It includes loans from banks, company bonds, and other forms of lending such as lines of credit and mortgages. Private debt can also have debts from friends or family.

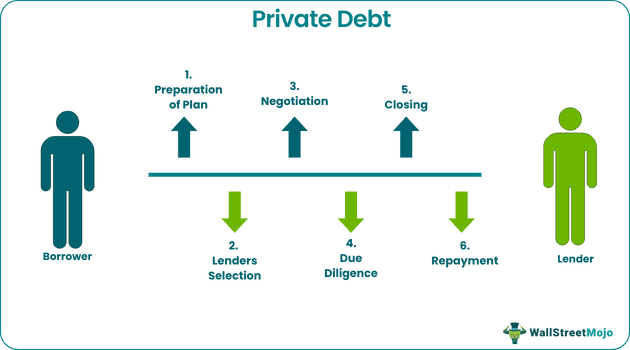

The process of obtaining it can vary depending on the specific type of debt and the lender. It includes the following steps:

- Preparation: The borrower must prepare a business plan and financial projections demonstrating the ability to repay the debt. They will also need to gather financial statements and other documents to assess the borrower's creditworthiness.

- Lender selection: The borrower must select a lender willing to provide the type of debt financing required. This can include banks, hedge funds, private equity firms, and other financial institutions specializing in personal debt.

- Negotiations: The borrower will need to negotiate the terms of the debt with the lender, including the interest rate, repayment schedule, and any covenants or other conditions.

- Due Diligence: The lender will conduct a due diligence review of the borrower's financials and business operations to confirm the borrower's ability to repay the debt.

- Closing: Once the lender satisfies himself with the due diligence review, the loan closes, and the fund disburses to the borrower.

- Repayment: The borrower must make regular payments to the lender to pay down the debt, as outlined in the loan agreement.

Types

Companies and individuals can access several private debt financing with unique characteristics and terms. Some of the most common types of personal debt include:

- Corporate Bonds: Corporate bonds are securities that raise capital for a company on public markets.

- Mezzanine Financing: Mezzanine financing is a type of debt that needs to be ready for an initial public offering (IPO) or cannot secure traditional bank financing. It is more expensive than a conventional loan and bears a higher risk.

- Senior Secured Debt: Senior Secured debt is a type of debt that secures the borrower's assets, meaning that the lender has a claim on specific investments in the event of default.

- Junior Debt: Junior debt is a type of debt that ranks behind senior debt in the event of default.

- Uni-Tranche Debt: Uni-tranche debt is a type of debt that combines features of senior and mezzanine debt and is provided by a single lender. It is less risky than mezzanine debt but more expensive than senior debt.

- Asset-Based Lending: Asset-Based Lending is a type of debt that secures by the assets of the borrower, such as accounts receivable, inventory, or equipment.

- Real Estate Financing: Real estate financing is a type of debt that finances the purchase or development of commercial or residential properties.

- Leveraged Loans: Leveraged loans are loans that extend to companies or individuals with a high amount of debt relative to their cash flow or assets.

Examples

Let us understand it better through the following examples.

Example #1

Suppose a real estate development project developer may use private debt to finance the construction of a new residential complex. For example, a developer may borrow money from a private lender to acquire the land, pay for the construction costs, and cover other expenses associated with the project's development. Once the project is completed and the units are sold or leased, the developer will use the proceeds to pay off the debt.

Example #2

Recently in January 2023, A1 Garage Door Service Holdings, Inc. received a senior secured credit facility from Audax Private Debt, a New York-based company, in its capacity as Administrative Agent and Joint Lead Arranger to assist Cortec Group Fund VII, L.P., a Cortec Group affiliate, in its growth capital investment in A1 company.

Public Debt vs Private Debt

Governments issue public debt to finance government spending, while private entities issue private debt funds to finance business and individual activities. As a result, public debt is less risky than personal debt but has a lower return.

Both debts are forms of borrowing, but they have some key differences:

Public Debt

- They are issued by governments or public institutions such as central banks and municipalities.

- Finances government spending such as infrastructure, social programs, and public services.

- They are typically issued as bonds, which individuals and institutions can buy.

- The interest on public debt is often tax-deductible.

- The full faith and credit of the issuing government or entity back them.

- Interest rates on government bonds tend to be lower than on private loans.

Private Debt

- Private entities such as banks, hedge funds, and private equity firms issue it.

- Finances business expansion, real estate development, and acquisitions.

- It is typically issued through loans or other debt securities.

- Interest on such debt is not tax-deductible.

- The full faith and credit of the government do not back them.

- Interest rates on such debt tend to be higher than on government bonds.

Private Equity vs Private Debt

Private equity is a form of investment. It involves the acquisition of an ownership stake in a company. In contrast, personal debt is a form of investment that involves lending money to a company or individual. Private equity investments bear higher risk/higher return, while private debt investments carry lower risk/lower return.

Some of the key differences in both forms of alternative investment are:

Private Equity

- It involves the acquisition of an ownership stake in a private company by purchasing shares or by taking the company private.

- Private equity firms typically invest in companies that do not trade publicly and are looking for growth or operational improvements.

- Private equity firms often use leverage (borrowing money) to acquire companies and increase returns.

- The ultimate goal of private equity firms is to improve the acquired companies' performance and exit the investment by selling their stake, typically after several years.

- Private equity investments are of higher risk and return than traditional investments such as stocks and bonds.

Private Debt

- It involves lending money to companies or individuals rather than acquiring an ownership stake.

- It can finance various activities, such as business expansion, real estate development, and acquisitions.

- It has a set repayment schedule with a fixed or variable interest rate.

- The ultimate goal of a private debt investor is to earn a return on a loan through interest and principal payments.

- Debt investments bear lower risk than private equity investments but typically have lower returns.