Table Of Contents

What Is A Private Activity Bond (PAB)?

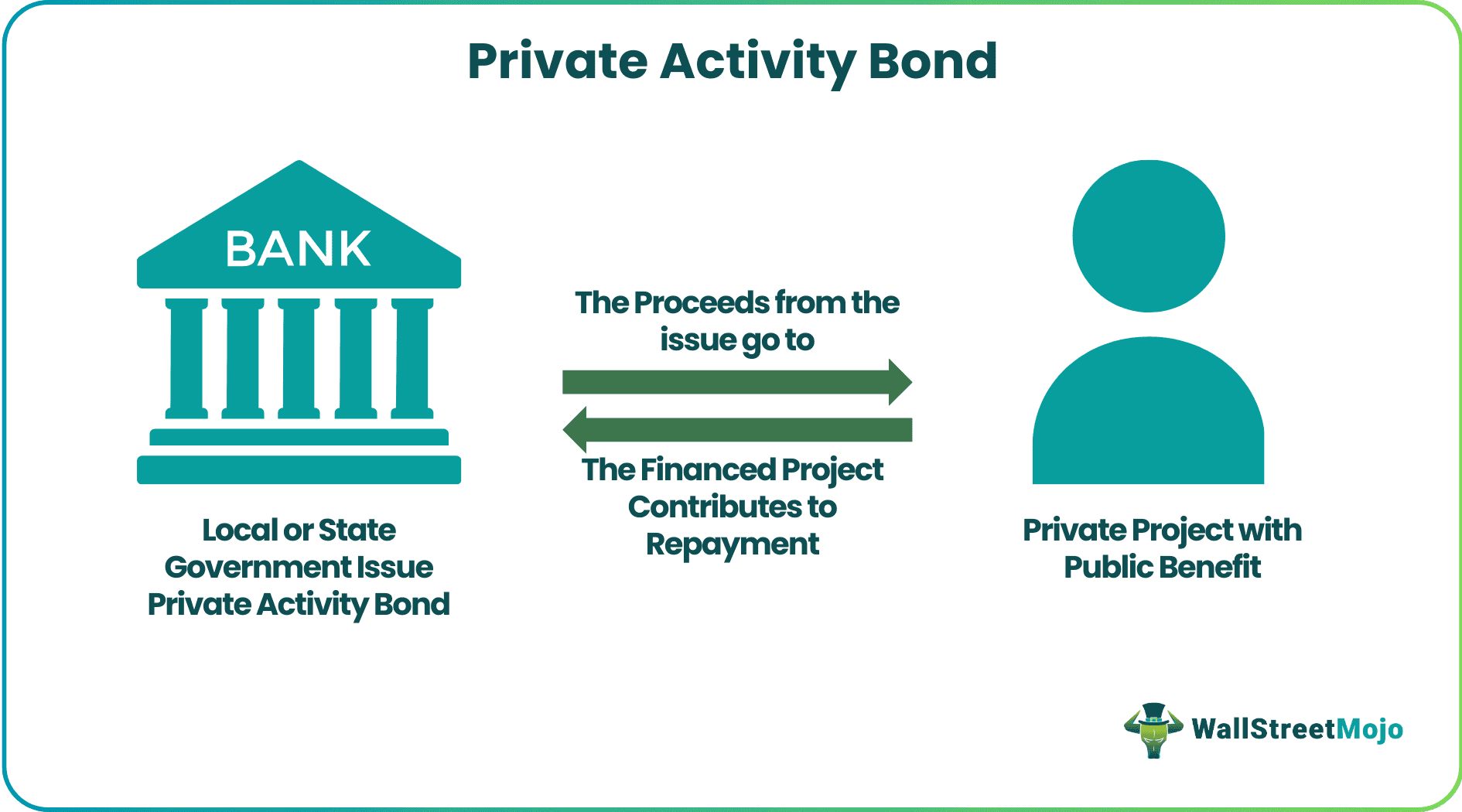

A private activity bond (PAB) is a bond issued by or on behalf of a local or state government for channeling the proceeds from the issue to private projects or activities with public benefit. It is an example of a classification of state and local government bonds that primarily benefits private entities.

The Revenue and Expenditure Control Act of 1968, approved by the U.S. Congress in 1968, served as the foundation for the current definition of PAB. It has a significant impact on the current treatment of PABs. Furthermore, the interest on private activity bonds is not tax exempt, unlike the interest on other state and local governmental bonds.

Key Takeaways

- A private activity bond is a bond that is issued by or on behalf of a local or state government to allocate the proceeds to private initiatives or endeavors that will benefit the general population.

- Unlike the interest on other state and local government bonds, the interest on PAB is not tax-exempt.

- The bond issuers provide investors money, known as "bond proceeds," to finance a private project. The cash flow from the project also contributes to the interest and principal payments to the investors.

- Universities and private schools, hospitals, healthcare facilities, airports, mortgage protection, student loan funding, rental properties, and other eligible public and private projects can be financed using PABs.

Private Activity Bond Explained

The private activity bond program provides funding for private projects. The bonds are free from regular taxes, and the federal government limits the total amount of bond issues. Bond issuers lend investors money to fund a project, known as "bond proceeds." The investors are subsequently paid back with interest and the principal amount by utilizing the return from the private project financed.

There are several requirements that projects must achieve before they get government funding through PABs. Examples of common qualified projects funded through PABs, among other things, include universities and private schools, hospitals, and health care facilities, airports, mortgage protection, student loan funding, and rental properties. PABs do not fund private projects or initiatives that provide no public benefits. Examples include liquor stores and gambling establishments. PABs provide a reasonable solution for private entities to identify funds for projects and programs if they benefit society.

According to IRS section 141, a bond issue treatment as a PAB bond issue occurs if the issue meets the private business tests (private business use test and private security or payment test) or private loan financing test.

- Private Business Use Rule: The issue passes the private business use test if more than 10% of the issue's proceeds are for use in a nongovernmental person's trade or business. Any activity undertaken by a non-natural person is a trade or business. The issuance is a PAB issue if the private business use test and the private security or payment test defined by IRS section 141 are good.

- Private Loan Financing Test: Bonds of an issue are PABs if more than the lesser of 5% or $5 million of the proceeds or earnings of the issue is to (directly or indirectly) make or finance loans to persons other than governmental persons.

Examples

Let us look at private activity bond examples to understand the concept better:

Example #1

American Airlines was a significant issuer of private activity bonds. Municipalities can authorize the issuance of "municipal debt" by private corporations. About $1.5 billion of the $3.3 billion municipal bonds American Airlines sold were unsecured. The unsecured bonds funded projects at the Dallas-Fort Worth Airport, Newark Airport, Chicago's O'hare, and PR's Luis Munoz Marin Airport. American Airlines went into bankruptcy in November 2011, precipitating a sharp decline in the market value of its unsecured PABs.

Example #2

In New York City, tax-exempt private activity bonds are a crucial funding source for housing construction. Housing agencies issue bonds to fund loans for housing construction. They use proceeds from the bond sale to lend to developers. The principal and interest flow to the bondholders as the developers repay their debts.

However, both federal and state statutes and regulations govern this bond offering. Federal regulations place yearly limits on the total volume of tax-exempt PABs issued in each state and impose affordability standards on using these bonds for housing financing. State legislation governs the distribution of the "volume cap" (private activity bond volume cap) among housing and economic development organizations throughout the state.

Are Private Activity Bonds Tax Exempt?

The general rule states that interest on private activity bonds is taxable. However, given the bond is not a qualified PAB, not be an arbitrage bond and meets the requirements under the U.S. Internal Revenue Code section § 149. Also, examining the Internal Revenue Service Form 8038 (Information Return for Tax-Exempt Private Activity Bond Issues) confirms whether it is a qualified private activity municipal bond interest or not. Therefore, an alternative minimum tax is applicable on the interest from PAB except for the interest from the hospital and non-profit college bonds.