Table Of Contents

What Is The Principal-Agent Problem?

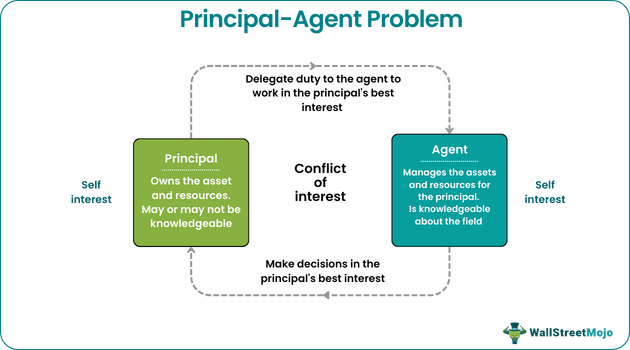

The principal-agent problem showcases the conflict of priorities between two parties: a principal and their agent. The principal owns certain assets and hires an agent to make decisions on behalf of them. Conflicts arise when the agent starts to act in their own best interests instead of acting in the interests of their clients.

This creates potential losses and undesirable situations for the principal. One primary reason for this conflict is the asymmetric distribution of information between the principal and agent, i.e., the person hired to manage the assets holds more information than the asset owner, resulting in an information gap.

Key Takeaways

- The principal-agent problem occurs when the principal hires an agent to work in their best interests, but the latter decides to act in their own self-interest, challenging the client.

- It can cause monetary losses for the client along with operational challenges, and market failures, and diminish the trust between the two parties.

- A real-life example can include CEOs or insurance agents catering to their own interests instead of the shareholders or clients.

- Solutions to this problem include structuring a strong contract, incentives, and penalties through performance analysis and reducing the information gap.

Principal Agent Problem Explained

The principal-agent problem emerges whenever there’s a conflict of interest between a person (the principal) and someone they hire to act in their interest (the agent), but the agent prioritizes their interest over their clients’. The latter emphasizes maximizing their own benefit instead of the client.

The situation was first studied in the 1970s when the economic theorists Michael Jensen and William Meckling reunited to publish a paper that discussed the structure of this concept which they called the 'agency theory. They argued that the nature of the relationship between the owner and their contractual relationships defines the firm's expenses.

They also discussed how information asymmetry and uncertainty cause the principal-agent problem in corporate governance. Essentially, the principal-agent is an optimal relationship where the principal delegates its authority to an agent for solving an issue. The agent decides to help the principal. The principal retains the ownership of all the assets involved in the transaction or business, but they give the agent the right to manage them, hoping to get the best result.

However, that circle breaks with a conflict of interest when the agent gets the assets and uses them on behalf of their interest instead.

Causes

The person hiring the agent does not know whether this person will work on their behalf or not. But supposedly, they trust them. However, they are neither aware of the field or agent nor do they possess the degree of information the agent does. It makes it difficult for them to determine if the solutions and strategies implemented are in their best interest to them. As a result, the principal depends on the agent by making a leap of faith.

An agent may start to look out for their best interest for a variety of reasons. It can vary from unethical professional objectives to improper incentives or a lack of moral conduct from the principal's side. The owner might not be sticking to the contract or earning way more than they claim to be. At the same time, they may not be compensating the agent enough. Both parties will always look after their own interests had there been no proper alignment of roles.

Conflicts of that sort are common among board members and shareholders, trustees and beneficiaries, etc.

Effects

The principal-agent problem definition is better understood when the effects are studied well. Here, the principal inevitably faces some challenges due to the acts of self-interest by the agent. It can be monetary losses or operational challenges for the firm. The principal-agent problem in corporate governance can also cause a market failure, which is the faulty allocation of resources. Instead of using their resources most profitably, the principal will lose some of it by hiring a service that won't provide what is needed.

It not only affects the person who is losing money because of the agent but it diminishes the overall efficiency of the whole market. In addition, the client will incur agency costs, which increase the costs of using that specific service and make them less attractive.

Another consequence is the erosion of trust in a certain industry. Services and people who do not deliver as promised often tarnish their reputations. It can have a huge impact on the long-term economy of a certain industry, for example

Examples

Let us consider the following real-life principal-agent problem examples for understanding the concept better:

Example 1

A technology company decides to hire Mark as the new CEO. He is chosen for this position and the shareholders believe that he will bring value to their shares, given his market reputation and the attention he manages to get from the media.

After a few months on the job, however, the CEO discovers that it may be more profitable to act in his own interest instead of ensuring that the company is profitable. Hence, he starts focusing focus on projects that would keep him in the spotlight and maximize his own image instead of the value of the firm.

They can’t monitor what he’s doing all the time, so they may lose a lot of money until they discover that the CEO is consciously not acting in their interests.

Example 2

Another example could be seen when someone wants to buy insurance. They can’t do it alone, so they need to look for an agent. However, this agent may want to help himself more than the customer and pick a plan that gives him a higher commission, not the best service.

In this case, the person would be losing money when they could have used a better service if they had more information about the plans.

Solutions

Fortunately, there are ways to solve this problem. Let us have a look at some of the principal-agent problem solutions to know how to overcome it:

#1 - Structuring a Strong Contract

A strong contractual agreement is necessary to pay groundwork for seamless business operations. The contract must be detailed, thorough, and inclusive of incentives, performance evaluation, and compensation. It should also list procedures to oversee all regulatory measures.

#2 - Evaluating the Performance

One can create mechanisms that will evaluate agents' performance based on their decisions. If the agents do well following these criteria, they will receive a reward. However, if it's clear that the agents are acting only in self-interest, they may get sanctions. Periodical performance evaluations, for instance, are excellent solutions.

For example, shareholders can write a contract in which the CEO that they're hiring will be rewarded for acting in a way that benefits them, such as making the price of the shares go up. Similarly, the contract could have some clauses which would affect the CEO negatively if it's proven that he's working against the shareholders. However, to prove this, they would still need to know how their work is going, which is not always possible, so the reward for good behavior is still important.

#3 - Increasing Awareness

Another solution to this problem is increasing awareness about the responsibilities and services provided by the agent. The problem is caused by asymmetric information, so both sides need to be well informed. By raising awareness about the work of the agent and the field in which this person works, one will effectively be creating an environment in which it's harder for the agent to get away with this kind of behavior.