Table Of Contents

What Is Price to Rent Ratio?

Price to Rent Ratio is a metric calculated as the price of a property to its annualized rent and which helps in determining whether it makes sense to buy the property or rent it considering various factors involved in making each scenario lucrative at the same time pointing out the drawback of each, therefore it helps the home-seeker in making an informed decision.

This ratio is significant for real estate investors who get an opportunity to assess the value of their properties. It helps them learn about what their investment in the real estate properties would yield as return. Based on the return that they would receive, the owners decide whether to sell their property or put it on rent.

Price to Rent Ratio Explained

Price to Rent Ratio allows real estate property investors to understand the best options for them. The resultant guides them and let them decide if they would reap more profits by selling a property or renting it out. In short, the price to rent ratio gives clearer picture to real estate investors of their return on investment (ROI).

Along with helping the investors figure out the ROIs, this ratio also allows analysts in the real estate sector to identify the changes in the demands and trends guiding the housing market. In addition, the real estate aces detect if the market trends are indicating more of renting properties or selling them.

When the ratio obtained is low, it indicates the investments potential to earn more profits for longer terms. On the other hand, the higher ratio reflects that the investment made into the real estate sector would lead to short-term returns. As a result, investors aim to purchase a house for long-term benefits when the property price to rent ratio is lower, while they rent out property when the ratio obtained is high and there is only possibilities of short-term profits.

A good way to decide whether to buy or rent a home could be by comparing the present value of all the mortgage payments and other costs of ownership and the benefits of the same and arriving at a net present value. Next, doing the same for renting the home by finding the PV of the future rent payments after incorporating the expected inflation. Doing so will give us which option is better suitable.

In a way, the price to rent ratio does the same. If the former is the case, the ratio would be higher; otherwise, it would be lower. Although the ratio will always be higher than one because the rent would never be higher than the cost of owning the place, factoring in the advantage of owning should justify the owning decision; otherwise, renting is more appropriate.

If the ratio obtained is below 15, it is considered a positive sign to sell properties as real estate investors are willing to purchase them. On the contrary, a ratio more than 21 indicates the market is the best to rent out assets. Similarly, if the ratio falls anywhere in between, it’s better to buy than rent a property. However, the returns derived from buying or renting a property depends on the advantages and disadvantages of home buying and renting out.

Advantages and Disadvantages of Home Ownership

Although some countries have different benefits and costs for home-ownership, in general, they are more or less similar.

- Stability: Once people are at a certain stage of life, where they can see a future in a certain city, they plan on making long term living arrangements and therefore prefer buying a home to avoid the renewal of the rent agreement and the possibility of having to move to another home in case of nonrenewal.

- Tax Deductions: In the US, the interest on the mortgage and the property tax are exempt from taxation in the case of homeownership; therefore, that helps reduce the owners' tax liability.

- Capital Appreciation: The prices of homes increase, so, in general, the homeowner benefits from selling it at the appreciated price. It helps a lot if the purchase price is very low because the return is high.

- Old-Age Benefits: Once the entire mortgage is paid off, the homeowner doesn’t need to worry about regular expenses in his old age. However, in the case of rented homes. They still have to pay the rent when the income is low, as most old-age people live on pensions or fixed incomes.

- Expensive: Mortgage payments are higher than rent payments, in general; therefore, the expense is higher, and defaulting on payments may cause a bigger loss because the previous payments become a sunk cost in case of default leading to foreclosure.

- Repair and Maintenance: Owning a home makes the owner responsible for the repairs and maintenance of the home, which is a big expense if such repairs are frequent. Therefore due diligence should be done before buying a home.

- Mortgage: Home loans are long term liabilities, and therefore, one needs to be sure of having a long-term inflow stream that enables the owner to pay off the mortgage.

Advantages and Disadvantages of Renting

- Flexibility: At the start of their careers, people need the flexibility to switch cities easily; therefore, they prefer renting. Also, as income increases and life requirements change, people need to move on to bigger and more appropriate places. Renting enables them to do it quickly.

- Cost-Effective: Maintenance, repairs, property taxes, etc., are the owner's responsibilities, while the renter only needs to worry about the rent, so initially, renting is a cheaper option when people are starting a career.

- Amenities: Generally, apartment complexes have sporting and fitness amenities, among others, which give the renters the convenience of having such facilities in close vicinity and paying only a limited amount for using them compared to getting membership of a club that provides such facilities.

- Lack of privacy: Rented places are available in a community format, and people who desire privacy and quiet cannot get it.

- No tax benefits: Owning a home brings tax benefits and reduces tax liabilities, and therefore renter may lose out on the same.

Lease vs Rent - Explained in Video

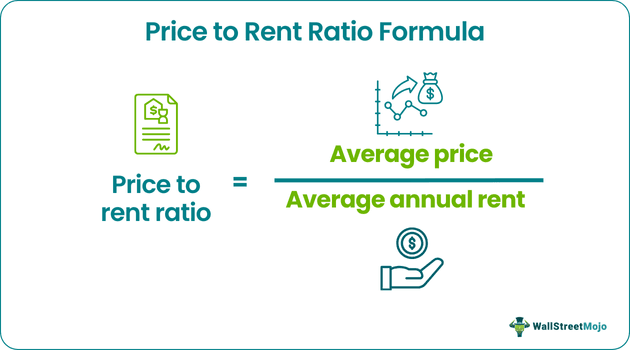

Formula

The formula that the price to rent ratio calculator works on:

Price to Rent Ratio formula = Average Price / Average Annual Rent

- However, as the figures vary quite a lot when we move from suburbs to metros within a country, using an average is not highly advisable statistically as the average metric can be affected by the effect of the outliers.

- So, at times we replace average figures with median figures; however, this switch is not always possible due to lack of data availability, so usage of average is still quite prevalent.

Examples

Let us consider the following instances to understand the price to rent ratio meaning in detail:

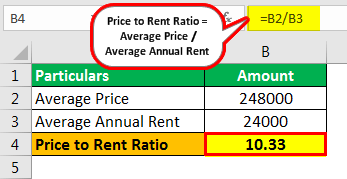

Example 1

According to a study published by “The State of the Nation's Housing 2018" by the Joint Center for Housing Studies (JCHS) of Harvard University, The median sales price of a newly constructed house in the US was $323,100. The average price was $248,800, and according to the same study, the average monthly rent varied between $1500 and $2000 depending upon the areas surveyed. Therefore an annual rent would be somewhere near $24,000.

Solution

Calculation of Price to Rent Ratio

- = 248000/24000

- Price to Rent Ratio = 10.33

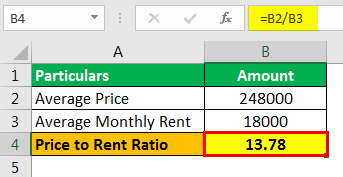

If we use the average monthly rent of 1800, then the ratio would be calculated as:

- = 248000/18000

- Price to Rent Ratio =13.78

It is a convention that when this figure is below 15, it is better to buy the house, while if it is above 15, we should rent the house.

Even the outcome of the study, as mentioned earlier, which analyzed the current trends in the Housing market, conveyed that the population was edging towards homeownership and a bump in the home renting trend.

This result was arrived at after surveys and data collected by the US Census Bureau and analyzing the actual numbers instead of calculating the above ratio; therefore, we can say that the study, in a way, verifies what the ratio implies.

It is a known fact that right before the housing market crash in 2007, the Price to rent ratio had become very high and had crossed the mark of 20. It was due to the bubble that was created around the housing market that over-inflated the market prices of the houses.

Example 2

In May 2023, an analytical report presented by Clever claimed San Jose to be one of the cheapest options when it comes to renting out properties than buying them. When dividing the median home price by the median annual rent, the report found out the price to rent ratio to be 21 and more, thereby indicating a market favorable for short-term benefits, thereby making renting out properties a better and more profitable alternative.

Advantages And Disadvantages

Price to rent ratio, when obtained, not only helps investors of the real estate industry to evaluate the properties they are interested in, but also allows the players of the sector to identify the market trends and patterns of the housing market. However, along with the merits, calculating these ratios have demerits also. Let us have a look at the advantages and disadvantages below:

Benefits

- It is easy to calculate this ratio using simple division.

- Investors and real estate analysts can easily make comparisons between the residential properties by finding out their price to rent ratio separately.

- Calculation of this ratio does not require much data for analysis.

Limitations

- It is the ratio that helps analyze the whole market and not individual real estate properties.

- No matter what the ratio is, it is not useful in determining or indicating affordability of any property per locations.