Table Of Contents

Price Formula

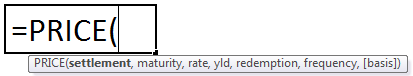

The Price formula has 7 arguments:

Explanation of Price in Excel

- Settlement: Settlement is referred to as the date on which the bond is settled. The value mentioned as the settlement is the date after the issuing date when the bond/security is traded to the security buyer.

- Maturity: The maturity date is when the security/bond expires, and the principal amount is paid back to the bondholder.

- Rate: The bond's annual interest rate at which coupon payments are made.

- Yld: The security's annual yield, which is the annual market interest rate representative of the risk of the bond.

- Redemption: The bond value per $100 face value that is paid back on the redemption date.

- Frequency: The number of times coupon payments are done per year.

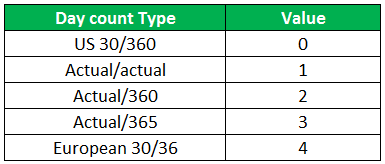

- Basis: This is an optional integer argument that specifies the financial day counting basis

How to use the Price Function in Excel?

The PRICE Excel function is very simple and easy to use. Let us understand the working of the PRICE Excel function with examples.

Price in Excel Example #1

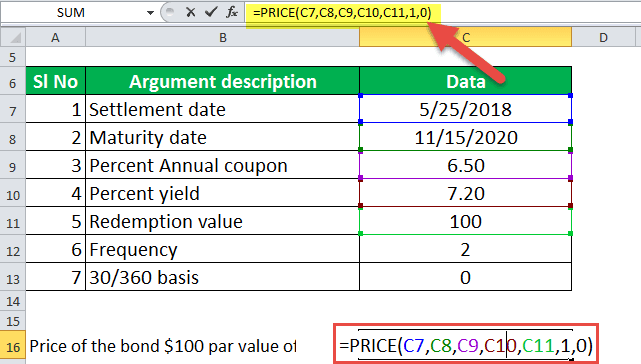

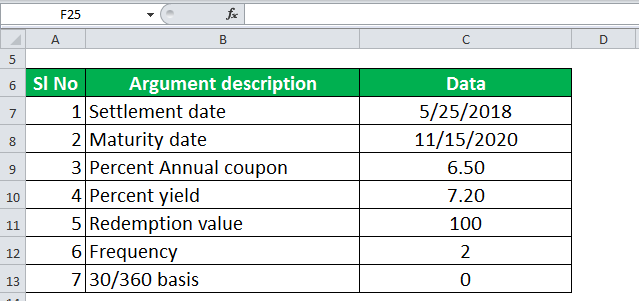

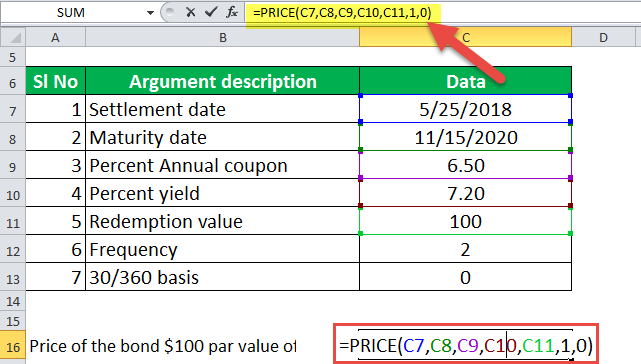

Suppose we are given the following data to calculate the price in Excel.

The following screenshot illustrates how the PRICE function Excel prices a bond.

Things to be Remember while using Excel Price Function

- For Calculation purposes, the Date format in Excel is sequential. So, by default, value 1 stands for January 1, 1900. So the next day, January 2, 1900, would be 2.

- The data parameters used as settlement, maturity, frequency, and basis value should be integers.

- If maturity or the settlement day is not a valid date, then the PRICE formula returns the #VALUE! Error value.

- If yld < 0 or if rate < 0 or redemption ≤ 0 PRICE returns the #NUM! Error value.

- If the frequency mentioned in the price formula is any other value apart from 1, 2, or 4, PRICE will return the #NUM! Error value as an answer.

- If basis < 0 or if basis > 4, PRICE returns the #NUM! Error value.

- If settlement value ≥ maturity value, then PRICE returns will return #NUM! Error value.