Table Of Contents

What Is Price Elasticity of Demand Formula?

The price elasticity of demand formula is a method used to measure the sensitivity of the change in the demand of goods and services due to change in the price of the same. It shows the relationship of price to the demand in the market.

It can be of different types elastic, inelastic, perfectly elastic, perfectly inelastic, and unitary elastic. It proves to be very useful to manufacturers who can use it to plan their future production and expansion projects by analyzing how any current change in price is affecting the current demand in the market.

Key Takeaways

- The formula of price elasticity of demand means the elasticity of order based on price. It is determined by dividing the percentage change in quantity, i.e., ∆Q/Q, by the percentage change in price, i.e., ∆P/P.

- A business needs to know the concept and relevance of price elasticity of demand to understand the relationship between the price of a good and the corresponding demand at that price.

- The product is elastic if the quantity demanded varies with a slight price fluctuation. It often happens with products or services having many alternatives, and the consumers are relatively price sensitive.

- The product is inelastic if the quantity demanded changes by a minimal margin though there is a lot of price change.

- It may happen due to the lack of suitable substitutes for the product or service, so consumers are willing to purchase at relatively higher prices.

Price Elasticity Of Demand Formula Explained

The absolute price elasticity of demand formula explains the effect of change in price on demand of goods and services. It shows the responsiveness of demand to changes in price of goods in the market and is very useful in production planning, resource allocation and future expansion.

The formula of Price elasticity of demand is the measure of elasticity of demand based on price, which is calculated by dividing the percentage change in quantity (∆Q/Q) by percentage change in price (∆P/P) which is represented mathematically as

Price Elasticity of Demand = Percentage Change in Quantity (∆q/q) / Percentage Change in Price (∆p/p)

Further, the equation for price elasticity of demand can be elaborated into

Price Elasticity of Demand = /

Where Q0 = Initial quantity, Q1 = Final quantity, P0 = Initial price and P1 = Final price

The result of the economics price elasticity of demand formula is a numerical value that is interpreted to understand the elasticity. If the value is greater than one, the product is said to be elastic, a value of less than one denotes inelastic, and a value of one indicates that the elasticity is unitary, in which the percentage change in demand is same as the percentage change in the price.

If the quantity demanded fluctuates a lot when prices vary a little, then the product is said to be elastic. It often happens in the case of products or services with many alternatives, and, as such, the consumers are relatively price sensitive. In such a scenario, the business will be careful in setting the price or target a different market with low fluctuation.

If the quantity demanded changes by a very small margin despite a significant change in prices, then the product is inelastic. It happens when there is a lack of good substitutes for the product or service, and as such, the consumers are willing to buy at relatively higher prices. A business will price the product much more comfortably in such a market condition.

How To Calculate?

The economics price elasticity of demand formula can be determined in the following four steps:

- Identify P0 and Q0, which are the initial price and quantity respectively, and then decide on the target quantity and, based on that, the final price point, which is termed as Q1 and P1, respectively.

- Now work out the numerator of the formula, which represents the percentage change in quantity. It is arrived at by dividing the difference of final and initial quantities (Q1 – Q0) by summation of the final and initial quantities (Q1 + Q0), i.e. (Q1 – Q0) / (Q1 + Q0).

- Now work out the denominator of the absolute price elasticity of demand formula, which represents the percentage change in price. It is arrived at by dividing the difference of final and initial prices (P1 – P0) by summation of the final and initial prices (P1 + P0), i.e. (P1 – P0) / (P1 + P0).

- Finally, the price elasticity of demand is calculated by dividing the expression in Step 2 by expression in Step 3, as shown below.

Examples

Let us go through some examples in details to understand the concept.

Example #1

Let us take the simple example of gasoline. Now let us assume that a surge of 60% in gasoline price resulted in a decline in the purchase of gasoline by 15%. Using the formula as mentioned above, the calculation of price elasticity of demand formula business can be done as:

- Price Elasticity of Demand = Percentage change in quantity / Percentage change in price

- Price Elasticity of Demand = -15% ÷ 60%

- Price Elasticity of Demand = -1/4 or -0.25

Example #2

Let us assume that there is a company that supplies vending machines. The vending machines sell soft drinks at $3.50 per bottle. Now at this price, consumers buy 4,000 bottles per week. To increase sales, it has been decided to decrease the price to $2.50, increasing sales to 5,000 bottles. Now, the calculation of price elasticity of demand can be done as below:

Given, Q0 = 4,000 bottles, Q1 = 5,000 bottles, P0 = $3.50 and P1 = $2.50

Therefore,

- Price Elasticity of Demand = (5,000 – 4,000) / (5,000 + 4,000) ÷ ($2.50 – $3.50) / ($2.50 + $3.50)

- Price Elasticity of Demand = (1 / 9) ÷ (-1 / 6)

- Price Elasticity of Demand = -2/3 or -0.667

Example #3

Now let us take the case of a beef sale in the US in 2014. Due to certain food shortages, the prices of cattle surged. In January 2014, a family of four consumed around 10.0 lbs of beef at a price point of $3.47/lb. Due to the price surge, the price went up to $4.45/lb by the end of October 2014, bringing the consumption down to 8.5 lbs. Now, the calculation of the price elasticity of demand formula business can be done as below:

Given, Q0 = 10.0 lbs, Q1 = 8.5 lbs, P0 = $3.47 and P1 = $4.45

Therefore,

- Price Elasticity of Demand = (8.5 – 10.0) / (8.5 + 10.0) ÷ ($4.45 – $3.47) / ($4.45 + $3.47)

- Price Elasticity of Demand = (-0.081) ÷ (0.124)

- Price Elasticity of Demand = -0.653

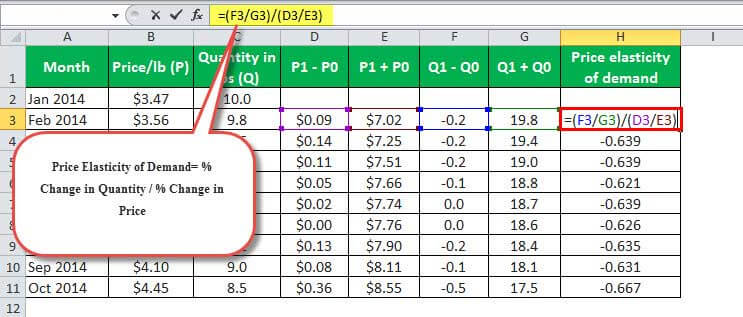

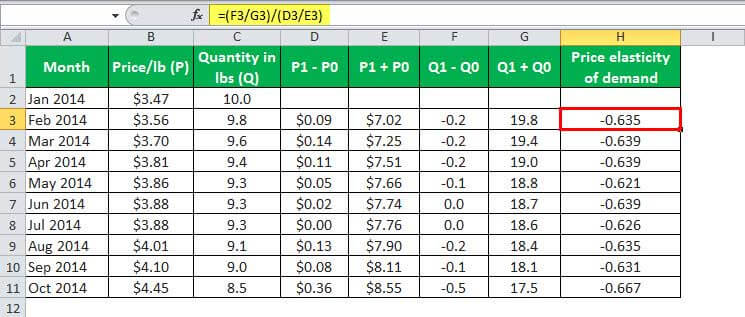

Price Elasticity of Demand in Excel (with excel template)

Now let us take the case mentioned in price elasticity of demand example #3 to illustrate the same in the excel template below. The table gives a snapshot of the monthly variation in price and consumption of a family of four for January 2014 to October 2014 and calculates the monthly price elasticity of demand.

In the below given excel template, we have used the price elasticity of demand formula to find the Monthly Price Elasticity of Demand.

So the Calculation of Monthly Price Elasticity of Demand will be-

Importance

It is of paramount importance for a business to understand the concept and relevance of price elasticity of demand to understand the relationship between the price of a good and the corresponding demand at that price.

- Price elasticity of demand can decide the pricing policy for different markets and various products or services. The business wants such a price which will bring the maximum revenue from the market but at the same time it will make the products competitive and create a good image for itself, which will help in retaining customers and boosting revenue. This formula helps in calculating that level of price which will help in revenue maximization along with having a competitive edge.

- The formula acts as a guide for analysing the market condition, competition level, availability of substitute products, etc. If the formula shows inelastic demand, it signifies less competition, more possibility of customer retention and better future prospects. A highly elastic demand show the opposite situation.

- Manufacturers calculate price elasticity of demand formula because it helps in making price related decision that affects all aspects of the business, like finance, marketing, advertising an so on. It is extremely important to be able to decide the correct price of goods and services, so that it affects the organization positively.

- The taxation policy of the government also uses this formula to plan tax rates on goods. For products having inelastic demand, tax imposed can be higher since they are necessities that will not face much change in demand, thus generating a good revenue through higher taxes. The opposite is the case with goods having elastic demand.

Limitations

Let us look at some limitations of the formula.

- It assumes a linear relation between price and demand. But this may not always be the case. The demand curve may exhibit non-linear elasticity and at the same time various other external factors may also influence demand.

- The formula does not clarify the time frame if the study. For the same level of price, the demand may be inelastic in short run but become elastic in the long run when customers adjust to the price change and switch to substitutes.

- It does not provide any precise numerical value. It takes one as a common value to calculate price elasticity of demand formula.

- It gives an analysis of the total quantity of a particular product in the market, but does not segregate it as per the market of geographic conditions, or consumer segments, etc.

Thus, even though it is an important tool for manufactures to make informed decisions about their business, all pros and cons should be analysed so as to get the best results form the method.