Table Of Contents

What Is Price Elasticity Formula?

The price elasticity refers to the price elasticity of demand or supply that measures the response of demand and supply for a particular item to the change in its price. It is a fundamental economic concept that business owners need to track in order to strategize and optimize the resources to achieve maximum profitability.

This concept acts as a guide for price and production planning, attracting viable expansion and investment opportunities and finally making the company sustainable in the face of foreseen and unforeseen situations. Proper elasticity analysis will ensure that the business remains flexible to changes, creating a greater capacity to absorb shocks.

Key Takeaways

- Price elasticity refers to the demand's sensitivity to price changes, which is measured by the price elasticity of the market.

- It can be calculated by dividing the quantity change percentage by the price change %.

- From a business standpoint, it is critical to comprehend price elasticity because it aids in analyzing the connection between a good's price and the matching demand at that price.

- As a result, there is elastic demand, where the quantity demanded fluctuates as prices change.

Price Elasticity Formula Explained

The price elasticity formula refers to the steps and mathematical approach taken to calculate the price elasticity. It is a concept that explains how any change in prices of goods and services in the market can affect the demand and supply levels of the same. This can also be termed as sensitivity of demand or supply to price change.

In the case of demand, price is one of many factors that can influence the demand for goods in the market. If we assume all other factors to remain constant, then typically as per the formula for price elasticity of demand, a rise in price triggers a fall in demand and vice versa. For supply, in general supply will rise with rise in prices.

Now, if it is seen that this sensitivity is high, which means the rise or fall in demand with relation to the fall or rise in price, respectively, is more than one, then the sensitivity is termed as elastic. If the sensitivity is less than one, the situation is inelastic. Quite often, we also see the change is equal to one. In such a case, the term used is unit elastic.

It is to be noted that for price elasticity formula economics, if a product has close substitutes in the market, then the elasticity levels will be greater than those goods that have fewer substitutes. This is because, with slight rise in price, the customers using the former good have the option to change their preference and shift to competitors.

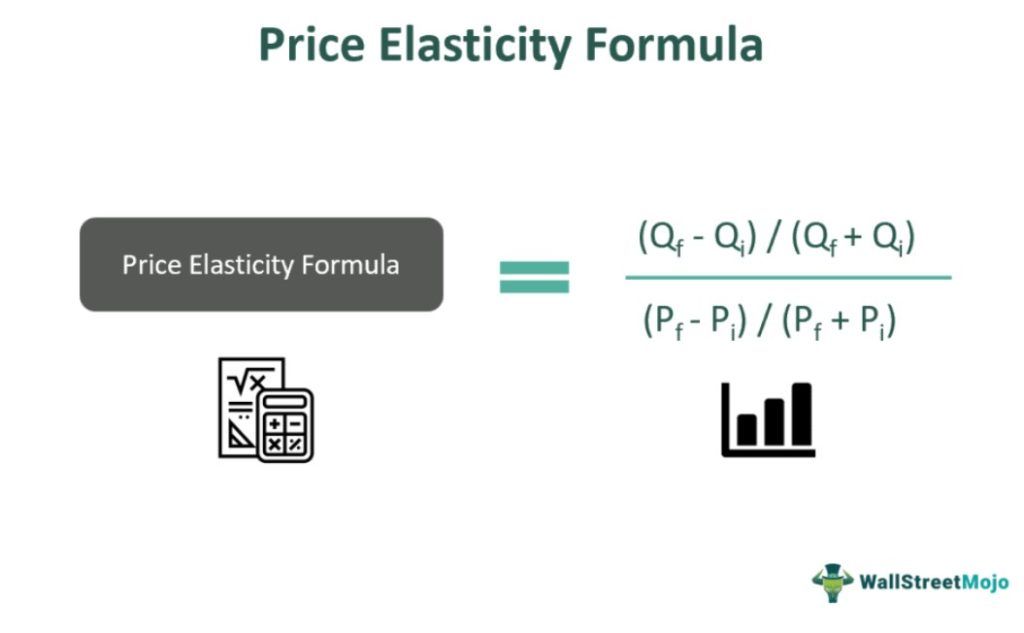

One can derive the formula for price elasticity by dividing the percentage change in quantity by the percentage change in price. Mathematically, it can be calculated as:

Price Elasticity = (Qf – Qi) / (Qf + Qi) ÷ (Pf – Pi) / (Pf + Pi)

or

Price Elasticity = (∆Q/Q) ÷ (∆P/P)

- Qi = Initial quantity

- Qf = Final quantity

- Pi = Initial price and

- Pf = Final price

How To Calculate?

Follow the below steps to calculate the formula for price elasticity of demand:

- Firstly, determine the initial price and quantity demanded of the item. Pi and Qi, respectively, denote the initial price and demand.

- Then, determine the final price and quantity demanded of the item. The final price and demand are denoted by Pf and Qf, respectively.

- Next, calculate the percentage change in quantity demanded by dividing the change in demand by the average demand. The change in quantity is the difference between final and initial demands (Qf – Qi), while the average demand is (Qf + Qi)/2. Therefore, the percentage change in demand is expressed as – 2 * (Qf – Qi) / (Qf + Qi).

- Now, regarding the formula to calculate price elasticity of demand, we calculate the percentage change in price by dividing the change in price by the average price. The percentage change in price is expressed as – 2 * (Pf – Pi) / (Pf + Pi).

- Finally, the price elasticity can be derived by the percentage change in quantity demanded (step 3) by the percentage change in price (step 4), as shown below.

Price Elasticity = (Qf – Qi) / (Qf + Qi) ÷ (Pf – Pi) / (Pf + Pi)

Thus, the above steps give us a clear idea about how the formula to calculate price elasticity of demand is used to arrive at a figure that will help businesses to understand where their products and services stand in the market and strategies the operation to increase profitability. However, one should also note the situation in the case of price elasticity, that elastic goods also make consumers spend more on that product. This is because the product is beneficial and is highly in demand in the market, having the ability to provide a lot of benefits to its users. Companies should use this concept to increase their revenue by optimizing the consumer’s reaction to elastic goods.

Inelastic goods will give the opposite result and there will be fall in demand and overall revenue of the seller, due to increase in price. This will lead to excess supply in the market. Therefore sellers will always welcome products that increase demand, revenue and profits will a small reduction in prices.

Examples

Let us understand the concept with the help of some suitable examples.

Example #1

Let us take the example of chocolate ice cream to understand the concept of price elasticity. If the price of the ice cream surged 20% in the last week, that resulted in a decline in demand for the same to the tune of 30%. Calculate the price elasticity based on the given information.

Use the following information to calculate price elasticity: -

- Percentage change in demand: -30%

- Percentage change in price: 20%

Now, we can calculate the price elasticity by using the above formula: -

- Price Elasticity = Percentage change in demand / Percentage change in price

- = -30% / 20%

Price Elasticity will be -

- Price Elasticity = -1.50

Therefore, the ice cream demand exhibited a price elasticity of -1.5.

Example #2

Let us take the example of a company in soft drinks production. Currently, the company sells its soft drinks at $4.00 per bottle, drawing weekly demand of 3,000 bottles. Today, the company’s management has decided to cut the price by $0.50 per bottle, which is expected to increase the weekly demand by up to 4,000 bottles. Calculate the price elasticity based on the given information.

Use the following information to calculate price elasticity: -

- Initial demand of bottles (Qi): 3,000

- Final demand of bottles (Qf): 4,000

- Initial price per bottle (Pi): $4.00

- Final price per bottle (Pf): $3.50

Now, we can calculate the price elasticity as follows: -

- Price Elasticity = (Qf – Qi) / (Qf + Qi) ÷ (Pf – Pi) / (Pf + Pi)

- = (4,000 – 3,000) / (4,000 + 3,000) ÷ (3.50 – 4.00) / (3.50 + 4.00)

- = (1,000 / 7,000) ÷ (-0.5 / 7.5)

Price Elasticity of weekly demand will be -

- Price Elasticity = -2.14

Therefore, the price elasticity of the weekly demand for soft drinks is -2.14.

Example #3

Let us take the example of the beef sale in the U.S. in 2014 to illustrate how price elasticity works in the real world. In the ongoing food shortage, cattle prices surged from $3.47/lb to $4.45/lb in 10 months. As a result of the price surge, the regular consumption of a family of four was reduced from 10.0 lbs to 8.5 lbs. Calculate the price elasticity of beef demand.

Use the following information to calculate price elasticity: -

- Initial Demand (Qi): 10.0

- Final Demand (Qf): 8.5

- Initial Price: (Pi): $3.47

- Final Price (Pf): $4.45

Now, the price elasticity can be calculated as,

- Price Elasticity = (Qf – Qi) / (Qf + Qi) ÷ (Pf – Pi) / (Pf + Pi)

- = (8.5 – 10.0) / (8.5 + 10.0) ÷ (4.45 – 3.47) / (4.45 + 3.47)

- = (-1.5 / 18.5) ÷ (0.98 / 7.92)

Price elasticity of the beef demand will be -

- Price Elasticity = -0.66

Therefore, the price elasticity of beef demand was -0.66 during the food crisis of 2014.

Relevance and Uses

Let us look at the uses of this concept both from the point of view of sellers and buyers.

- The seller can use this idea of of price elasticity formula excel and formula for production planning. If the management notices that the products exibit an elastic demand, it can optimize this opportunity to increase its revenue and profits and grow the business.

- The seller can use the price elasticity formula to plan for pricing strategies, which is very important for survival of the company for long term. Correct pricing ideas can take a company towards greater heights, ensuring it is able to cover its cost of running the business and at the same time earning profits for growth.

- Price elasticity formula economics can also help the business of seller to use innovative techniques to improve of its goods so that with little fall in price the demand rises to a large extent. This will lead to increase in production and bring economies of scale within the business.

- The consumers can stick to their own preferred brand with a small fall in price in case of goods with elastic demand. Their purchasing power increases in such cases too.

- In case the opposite happens, that is the price rises for elastic goods, the consumers will be able to test other better brands that may offer same type of products with lesser price.

Thus, From the perspective of any business, understanding price elasticity is significant as it helps assess the relationship between the price of a good and the corresponding demand at that price. That is because the products whose quantity demanded changes significantly with the price change have elastic demand. Moreover, if we calculate the price elasticity formula in excel, then we see that this characteristic is exhibited in by-products or services that have readily available alternatives; as such, the consumers relatively price sensitive.

On the other hand, goods for which quantity demanded do not change much, although a significant price change is known to have inelastic demand. This characteristic is exhibited when there is a lack of substitutes for the product or service, and consumers are willing to buy at relatively higher prices.