Table Of Contents

What is Prepayment Risk?

Prepayment Risks refers to the risk of losing all the interest payments due on a mortgage loan or fixed income security due to early repayment of principal by the Borrower. Prepayment Risk results in loss of potential Interest payment and loan obligations are discharged by the Borrower prematurely. This Risk is most relevant in Mortgage Borrowing, which is normally obtained for longer periods of 15-30 years, and from a borrower perspective, it makes sense to repay early to avoid large interest payments due to the long period of such loans.

From a Lender’s perspective, this risk possesses a relevant challenge as it results in excess funds deployment issues whenever repayment takes place and also the loss of prefixed interest payments, which may not be possible to deploy at the same rate in case of early repayment. In short Prepayment, Risk is the risk that borrowers prepay as Interest Rates decline.

Key Takeaways

- Prepayment risk refers to the risk that borrowers may pay off their loans earlier than expected, reducing the expected cash flows and returns for lenders or investors holding those loans or mortgage-backed securities (MBS).

- Prepayment risk is particularly relevant in fixed-income investments such as bonds and MBS, where borrowers can refinance or repay their debt before its scheduled maturity.

- Factors that can increase prepayment risk include declining interest rates, which incentivize borrowers to refinance at lower speeds, and changes in the borrower's financial circumstances or the overall economic environment.

- Investors can manage prepayment risk by analyzing the prepayment behavior of the underlying loans or MBS, considering investment strategies such as using securities with prepayment protection or adjusting their portfolio duration.

How Prepayment Risk Affects Investments?

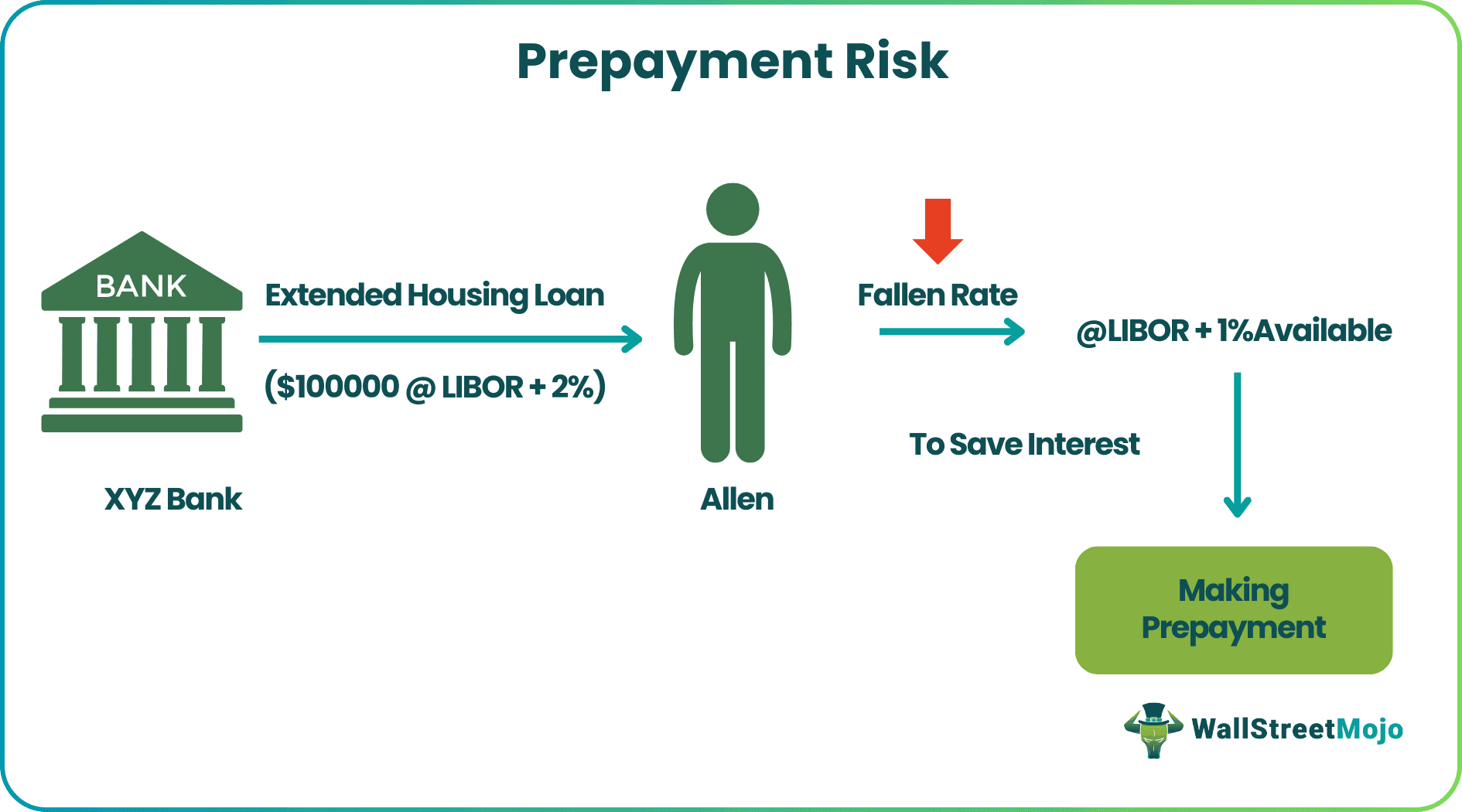

A simple example to elucidate this point is shared below:

XYZ Bank extended a Housing Loan to Allen for $100000 @ LIBOR +2% for 20 years. After 2 years, the rates have fallen, resulting in the same loan available to Allen from ABC Bank @LIBOR +1%. To save the Interest payment due to the reduction in Interest rate, Allen closes his Loan account by making a prepayment to XYZ Bank, which has crystallized into a Prepayment Risk for XYZ Bank.

Prepayment Risk is largely impacted by the changes in Interest Rate and can be classified majorly into two components:

- The decrease in Interest rates resulting in Contraction Risk where Mortgage-backed Securities will have shorter maturity than original maturity due to early closure of my borrowers resulting in the account of decline in Interest Rates.

- Increase in Interest Rate resulting in Extension Risk where prepayments will be lower than expected as Interest rate rise and borrowers continue to stay rather than making an early payment, which will lead to longer maturity than original maturity (assumptions related to prepayment will be higher than actual prepayments) on account of increase in Interest Rates.

Prepayment Risk Practical Example

Let’s take a practical example and understand the concept to gain more clarity.

Avendus has created a pool of mortgages consisting of AAA-rated Housing Loans worth 1 million dollars. The average return from this pool of assets is 12% per annum, and it comprises 100 mortgages. The average maturity of the Mortgage Pool is 10 years, and investors are expected to receive back their principal at the end of the maturity period of 10 years.

At the end of 3 years, 40 mortgages (constituting 0.4 million dollars) out of the pool of 100 mortgages prepaid their outstanding principal exposure as interest rates declined to 8%. As a result, of the same, the proceeds of 0.4 million dollars, which were repaid, were reinvested at the interest rate of 8% instead of the original 12% due to a decline in interest rates.

Thus due to the Prepayment of Proceeds during the mortgage pool cycle, the return from Avendus Mortgage Pool reduced from 2.20 million dollars to 2.09 million dollars.

- Asset Pool Size (in million $) : 1

- No of Mortgages: 100

- Maturity: 10 Years

- Average Return: 12%

Expected Payment Schedule

From Year 4 Onwards

Revised Payment Schedule due to Prepayment in Year 3

Advantages

- Risk of any nature is never advantageous for the business, which is taking it; prepayment risk creates uncertainty in future interest payments as the fear of prepayment and reinvestment of Principal Proceeds at lower rates is a daunting and challenging task.

- However, the only advantage that comes with this risk is that normally Fixed Instruments with embedded Prepayment Risk are priced, taking into consideration historical prepayment rates, and when actual Prepayment Rates turns out to be lesser than Historical ones, it results in better returns for the Investor holding the same.

Disadvantages

- It makes future interest payments uncertain, and as such, the underlying instruments created from a pool of mortgages such as a Mortgage-backed Security suffers from the risk of repayment before maturity and reinvestment at lower interest rate than what was predetermined at the beginning of such MBS (in a case when interest rates fall and prepayment increases as more borrowers refinance at lower interest rates) which led to Reinvestment Risk

- It is difficult to assess and determine the cash flows and maturity of instruments that are backed by MBS due to Prepayment Risk.

Important Points

An important point worth noting in Prepayment Risk is that it is not only affected by the changes in interest rate but also by the path taken by interest to reach there. For instance, suppose a Mortgage Pool was formed when interest rates were around 7%. Now suppose interest rates dropped to 4%, which will result in many homeowners prepaying their loan obligations by borrowing at lower rates. Thereafter interest rates again shot up to 7% and then declined again to 4%.

However, in the second instance of a drop in rates to 4%, there will be lower prepayments, and that makes predicting and modeling Prepayment Risk a challenging task as it is not just interest rate dependent but also path-dependent.

Conclusion

Prepayment Risk is here to stay, and Banks and Financial Institutions in the lending space are used to it. Mortgage Pricing is done, taking into consideration historical prepayment rates, expected interest rate movements in the future. The Prepayment option acts as a Call Option for Borrowers and should be adequately priced into by the Lending Institution to make sure that this risk is adequately captured and priced into product offerings. Some of the popular measures used by Financial Institutions to mitigate Prepayment Risk include but are not limited to, such as Prepayment Penalty, Closure Charges, and Minimum Cooling Period, etc.