Table Of Contents

Key Takeaways

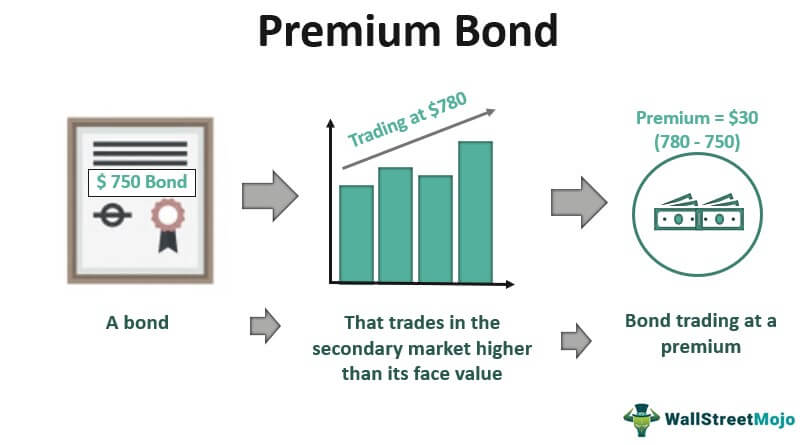

- A premium bond is a debt instrument exchanged in the secondary market at a price above its par or face value.

- When new bonds provide lower interest rates, the older bonds of the same category with higher interest rates attract investors. As a result, they start trading at a premium.

- Investors who buy these bonds pay a higher price than their cheaper alternatives in hopes that they’d eventually make more, especially if the interest continues to rise.

- If a bond's and its issuer's credit ratings are high, it helps boost the interest rates due to enhanced reliability. High credit rating and stable market performance help the security in gaining the premium badge.

- Sometimes the excess price paid by investors in premiums is relatively higher than the returns, making them an overvalued debt instrument.

Trading Peculiarities of Bonds

When bonds trade at a premium, it requires adjustments to compute their present value in the accounting books. The present value will help one understand the current issue price of the bond. Moreover, to compare the profitability of similar category bonds, they must be brought at the same level.

The adjustments require computation of yield to maturity (YTM), which helps in comparing bonds. YTM depicts the annual return one makes on the bond and eventually till maturity. Interestingly, if the coupon rate is lesser than YTM, the bond price will be less than its face value.

If the coupon rate is higher than YTM, the bond's price will be higher than its face value, reflecting that it is trading at a premium. Conversely, when YTM is equal to the coupon rate, the bond trading will be at its face value. This suggests an inverse relationship between YTM and bond prices.

| Face Value | Coupon Rate | YTM | Bond Price | Trading At |

|---|---|---|---|---|

| 1000 | 6% | 4% | 1043.3 | Premium |

| 1000 | 5% | 7% | 918 | Discount |

| 1000 | 5% | 5% | 1000 | Par |

Example with Calculations

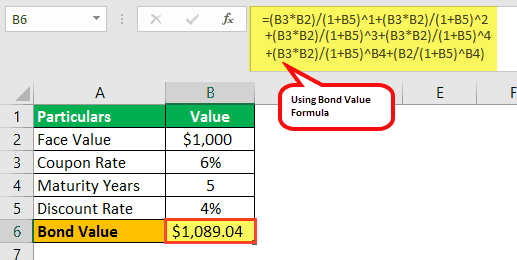

Let us take an example to understand the bond price formula better.

Suppose that IBM Corporation has issued a bond with a face value of $1,000, a coupon rate of 6%, and a maturity of 5 years. The coupon payments on the bond are made annually. If the discount rate or yield to maturity is 4%, what should be the bond’s price?

Solved Solution

Present value of the bond

![]()

= 821.9

![]()

Since the total time period or n is 5 years, we need to separately calculate the present values of the interest earned at the end of each year and add them all. We have converted both the interest rates into decimals at 0.06 and 0.04 for ease in calculations. The present value of the interest =

= 57.7+55.47+53.34+51.28+49.31

BV or Bond Price = 821.9 + 57.7+55.47+53.34+51.28+49.31

= $ 1089.04

In this example, the IBM bond is trading at a premium of $89 (1089 - 1000).

MS - Excel Solution

Additionally, with huge numbers, it becomes easier to find the bond price using MS Excel. Using the same example and formula, the bond price calculation on MS Excel is explained below.

This is the traditional way of calculating the bond value. This can also be calculated in MS Excel by using the PV (present value function).

Limitations

Credit rating, market conditions and financial performance of the bond issuing company can influence a bond’s interest rate. If interest rates fall in the long run, the bond’s price will be affected. The longer the maturity, the more sensitive it is to fluctuations. As such, premium bonds could at times seem overvalued if their returns struggle to match the price paid.