The counterparty risk can be bifurcated into pre-settlement and settlement risks. Following are some of the significant differences between the two:

Table of Contents

What Is Pre-Settlement Risk?

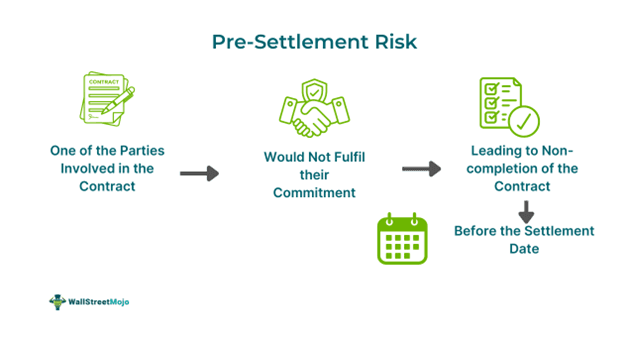

Pre-settlement risk refers to the potential default or non-fulfillment of the obligations by one of the parties to the contract prior to its settlement. Thus, in such a condition, if the other party is not secured or insured, then they would suffer a loss as the contract remains incomplete.

Such uncertainty is common in swaps and forward contracts, where there is a higher possibility of defaulting to counterparty payment. Further, it can provoke the risk of replacement costs for the party that faces loss. They would then have to incur the expenses and efforts to enter into another contract.

Key Takeaways

- A pre-settlement risk is a form of counterparty risk that arises when there is a chance that one or more parties involved in a contract will not accomplish their contractual commitment before the expiration date.

- Such a non-fulfillment could result in the termination of the contract before its settlement date and exacerbate replacement cost risk for the deceived party.

- The parties can secure these transactions by including a risk premium while pricing such contracts or determining the underlying fees.

- It differs from settlement risk, which propounds when any of the parties back off from the contract on the expiration date.

Pre-Settlement Risk Explained

Pre-settlement risk, also known as counterparty pre-settlement risk, is the likelihood that one or more parties who have entered into a contract may step back from meeting the contractual terms and conditions before the settlement period. This is particularly relevant in the context of pre-settlement risk in banking. The defaulting party may disagree to accomplish their part of contractual responsibilities or deliver the goods or services before the settlement date. This type of uncertainty arises when the counterparty becomes insolvent or bankrupt, finds that the deal will no longer benefit them, or witnesses a market fluctuation. Moreover, such risk is higher in derivatives contracts like swaps and forward contracts, while it is less common in equities and bond transactions.

Indeed, if a contract involves a high risk of non-completion due to the default of one party, then it may incur a significant cost to the counterparty. Hence, a deceived party may have to bear the replacement cost, which arises when the old contract isn't accomplished, and they have to undertake another contract (which may not be similarly competent) in its place. Therefore, the parties aim to reduce the impact of such uncertainties by effectively considering risk premiums while pricing and determining the fees of these contracts. Some of the primary factors influencing the pre-settlement risk include:

- Unexpected market fluctuation

- Creditworthiness of the counterparty

- Recovering the cost of the potential counterparty or default risk

However, markets and exchanges often take necessary steps to discourage these uncertainties. It is also essential for the parties to properly verify the creditworthiness of their counterparties before finalizing a deal. Otherwise, they may face significant consequences like financial loss while entering into another contract in an environment of adverse price movement or falling interest rates.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Examples

Such a risk persists in almost every kind of contract until the transaction is completely secured. Let us go through these two examples to understand the concept better:

Example #1

Suppose PQR Ltd. and LMN Co. Ltd. enter into a forex forward contract on July 18, 2024. PQR Ltd. agrees to pay 1.5 million USD for 2.05 million Canadian Dollars to LMN Co. Ltd. after 3 months. However, the value of the USD increased by 7% compared to the Canadian Dollar a month before the settlement date. Hence, PQR Ltd. refuses to fulfill the contractual obligations. Therefore, the contract ends before the expiration date, which caused LMN Co. Ltd. to incur a loss of 0.2 million.

Example #2

Let us assume that Mrs. Gabriel orders a gold necklace worth $10,000 from ABC Jeweler. They commit to delivering the necklace after a month through a written contract. Mrs. Gabriel makes the full payment in advance. However, after 14 days, the price of gold surged by 5%. Thus, ABC Jeweler revises the necklace price to $10,500. Also, they informed Mrs. Gabriel of the revised price and refused to deliver the necklace at the previously agreed price, breaching the sales contract.

Example #3

The article published on October 8, 2021, on Risk Markets Technology Awards 2021, honors innovations in counterparty risk management, including pre-settlement risk. The awards highlight innovations and products that reduce the possibility of one side pulling out of a deal before it's finalized. This is indicative of the industry's emphasis on strengthening financial transaction stability and risk management procedures.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Pre-Settlement Risk Vs. Settlement Risk

| Basis | Pre-Settlement Risk | Settlement Risk |

|---|---|---|

| 1. Definition | It is the uncertainty that one party will back off from meeting their obligations to a contract before its expiration date. | It is the likelihood that one or multiple parties to the contract will not complete their responsibilities or commitments on the expiration date. Risk can be of two kinds: default risk or settlement timing risk. |

| 2. Timing | Before the expiration date of a contract. | During the settlement period or on the expiration date |

| 3. Reasons | Counterparty credit risk, bankruptcy, or market fluctuations. | Bankruptcy, operational issues, or timing difference. |

| 4. Consequences | Replacement cost risk, default risk, and legal proceedings for breach of contract. | Breach of contract or potential completion of the transaction even after missing the settlement deadline. |

| 5. Mitigation Mechanism | Dealing with recognized counterparties and getting insured against such uncertainties through proper pricing and fee determination. | Gain knowledge of technical skills, solvency, and broker's incentives; engage in deals with trustworthy, financially sound, and competent parties. |